Lance Wiggs for National Business Review & LanceWiggs.com writes: I’ve been asked too many times what I think of Xero’s valuation – whether it’s in the last few months, or in the years gone by. I don’t have much time, so decided to set myself a time and information limit and give it a go. So let’s walk through how to do a valuation:

Comments and questions

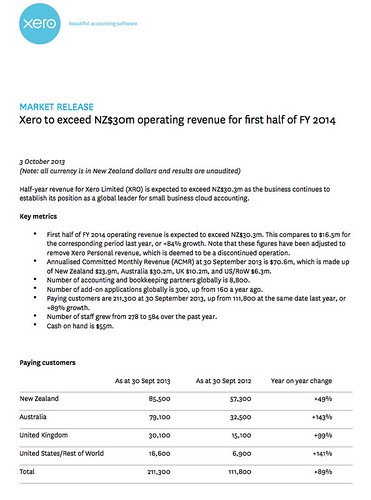

1: based on very limited information – specifically, just one piece of information – this earnings release from yesterday:

2: And I will try to do it in an hour. I really don’t have that much time.

Constructing the financial forecast

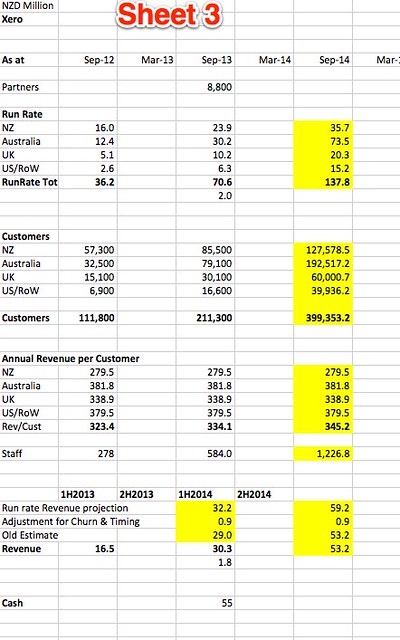

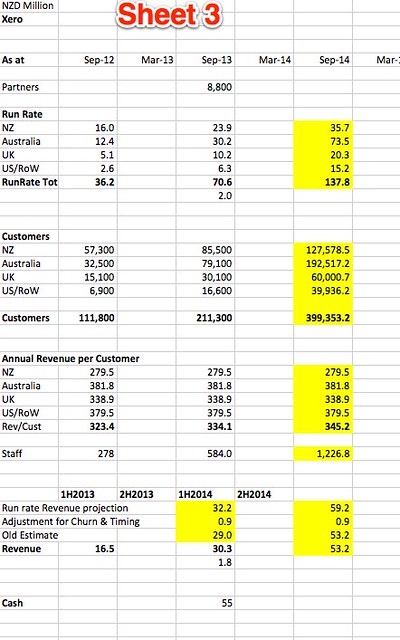

We start by putting down what we know from the earnings release into a spreadsheet.

We start by putting down what we know from the earnings release into a spreadsheet.

There is not much there, but it should, however, be enough.

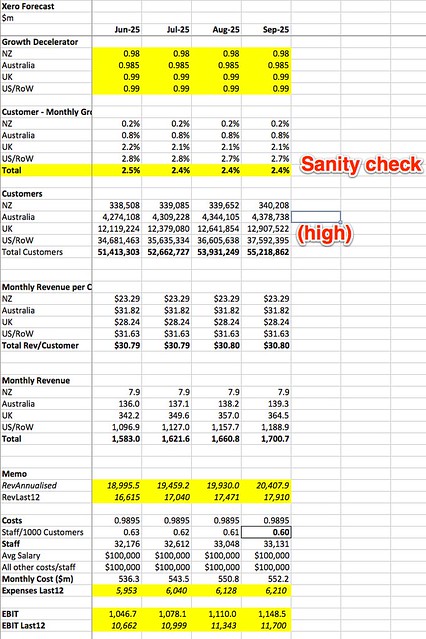

We next work out some ratios, and back-fill the run-rate numbers for September 2012. From now on we are starting to make assumptions, but we are using the known data to make sure they are roughly reasonable.

Now know that the average revenue per customer was $379.50 per year in the USA, and $279.50 in New Zealand. We could check by looking at Xero’s pricing page, or even their annual report, but that’s out of scope – I’m only using the information given.

Next up – let’s forecast forward a year, based on the same growth ratios.

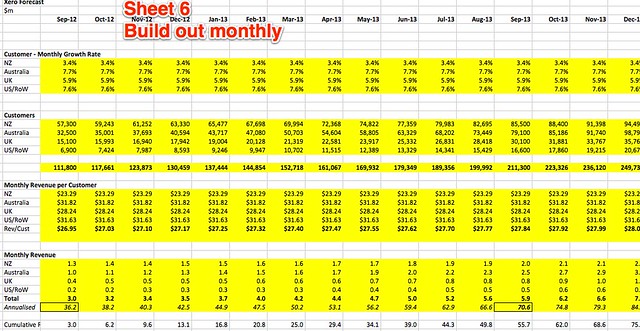

I put an adjustment in for churn and so on, but really didn’t like the thought of doing a model based on six-monthly numbers. So I stepped back and decided to convert to monthly numbers. The first thing to do was to derive the correct monthly growth rates. This is a core part of any forecast, and it’s worth a look at how to turn yearly growth rates into monthly growth rates, double checking to make sure we get the formula right:

At this stage I was recovering from the wasted time on doing the model the wrong way. But it’s normal to re-jiggle things a few times when building a model, as it’s the manipulating of the numbers that lets you understand how it will work.

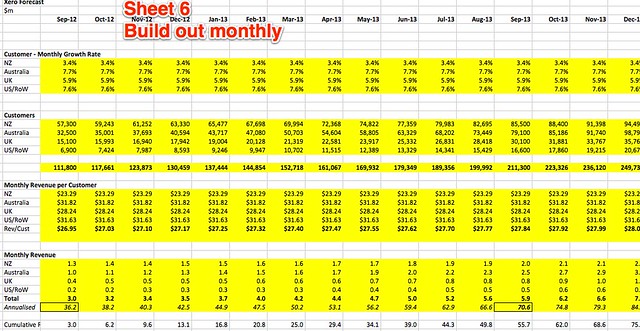

I next put the months across the top of the page and got the initial growth rates sorted. I also changed the order of data on the page to be logical, starting with customer numbers, then revenue per customer and then revenue.

All this is very quick and I could now stretch out the table

The model uses the customer growth rate per country as the main driver. US 7.6% per month, NZ 3.4% per month. These numbers feel low for folks in the early stage game, but Xero is 7 years old after all.

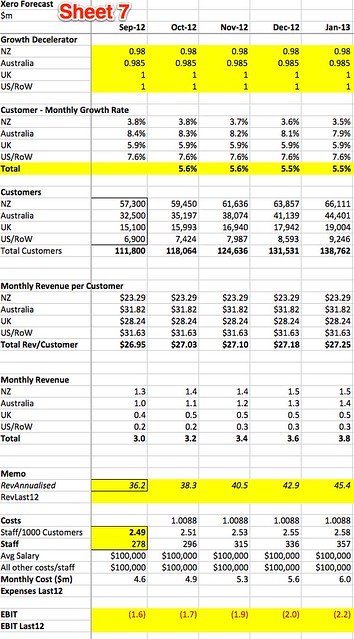

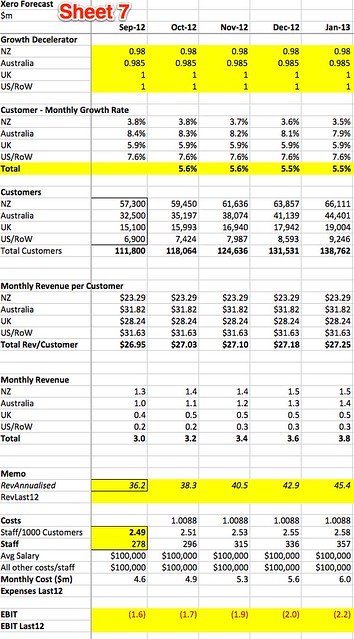

But it’s still not good enough as nothing grows forever, and growth rates fall over time.

So I put in a decelerate on the growth rates, so that the monthly growth rate would decline over time. I varied the numbers by market, so that the US and UK growth rates would not decline for a few years, and the NZ one declined at a faster rate than the Australian one.

I also put in some cost assumptions – very simply assuming that each staff member was worth $200,000 in total salary and overhead. Staff numbers were the only piece of cost information I had to go on (not even profit/loss) and so that’s the best I could do.

I used a ratio of the number of staff per 1000 customers to drive the increase in staff numbers over time, which would rise as the customer numbers rise.

From there we can derive the EBIT (Earnings before interest and tax), which unsurprisingly was negative for the first few years.

I like extending models out a long way, so I did. For something like Xero the hyper-growth is going to continue for a while, so long curves are needed to get a good grasp of the value.

I then tweaked the assumptions to make sure that the numbers were as rational as possible.

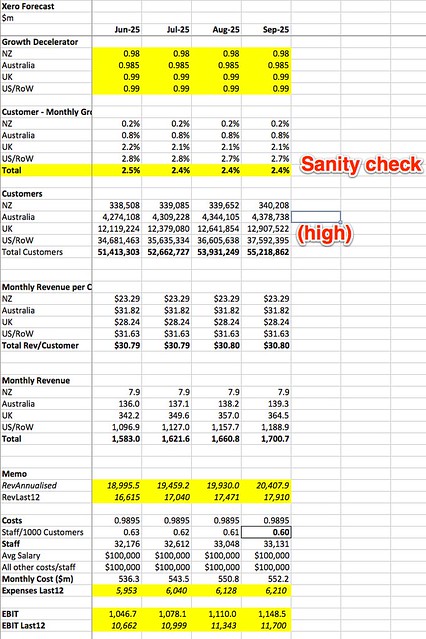

The key cost driver of the ratio of staff numbers to customer numbers was making the model lose money forever, so I cheated. I looked up Intuit’s numbers of staff and revenue, found and estimated the same for its Quickbooks division and then gave Xero a discount on that due to their better efficiency using the SaaS-only model. I then set that number to September 2025 and put a gradual decline in the staff/customer ratio from now until then. Whatever the mechanism, It is important to show that as Xero gets bigger it will have an increasingly better ratio of revenue to costs.

I then looked at the 2025 numbers to check that the end numbers were not outrageously high. They were a little for the UK and USA, but the model does not take any other countries into account, so, running out of time, I left it as it is.

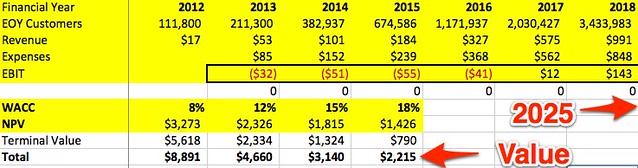

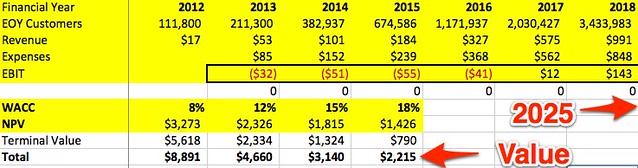

I then gathered up the annual figures into one place, largely for presentation purposes. I did the Net present Value calculation on these yearly figures rather than the monthly ones. No big reason for that, and ideally I would do it on the monthly ones.

Net Present Value

The net present value (what it is worth today) varies depending upon the WACC, (weighted average cost of capital or discount rate) that we use. Think of the WACC as the amount of interest you would want a bank to pay you if the investment was as risky as Xero.

The net present value (what it is worth today) varies depending upon the WACC, (weighted average cost of capital or discount rate) that we use. Think of the WACC as the amount of interest you would want a bank to pay you if the investment was as risky as Xero.

At 12%, which is often quoted as a long term stock market return, Xero’s cash flows to 2025 are valued at $2.3 billion. At 18%, which is more suitable for a fast growing company like this, Xero’s EBIT flows are summed to $1.4 billion.

However after 2025 Xero is still a going concern, and so we now need to add something which is the cause of a lot of errors and angst in valuation models – the terminal value. The terminal value takes the last years earnings and assumes that these will be constant from then on. What that’s worth depends on the WACC used, so it varies in each case. In general I advise to use this with care, and if it is too material, as it is here, then the model needs to be stretched further. The WACC used makes the value fluctuate wildly, and there is a certain amount of finding the right WACC to fit the value you want to create going on.

Results

In this case the sum of the NPV of the EBIT to 2025 and terminal value is $2.2 billion when using the 18% discount rate. (Current market cap is $2.22 billion.)

In this case the sum of the NPV of the EBIT to 2025 and terminal value is $2.2 billion when using the 18% discount rate. (Current market cap is $2.22 billion.)

At 15% it’s $3.1 billion. I’ll ignore the lower rates as they are used for “safe” investments like electricity companies and banks. (Which I don’t believe are that safe).

So overall this very dirty and quick analysis shows that there is value there in Xero. But don’t forget that this analysis is primitive, wrong and I am not a, or your, financial advisor.

Next Steps

The next steps would be to build a proper model based on the much wider range of inputs available from Xero, both through their NZX releases and from other sources.

The next steps would be to build a proper model based on the much wider range of inputs available from Xero, both through their NZX releases and from other sources.

I would also want to test the key assumptions, in particular the USA growth rates and potential. For example, Intuit is large and ponderous, but they are trying very hard to redesign how they do business using design thinking techniques. I’d want to spend a lot of time looking at their redesigned products, and would stay in touch with them (by using them) as I followed Xero. I’d also use Xero products.

I’d probably extend the model for more years, tweaking the growth rates and other assumptions a lot harder for different stages of maturity by market.

Overall

This was all done in a very quick period of time, and from very limited information. But the purpose was to demonstrate that it is remarkably simple to get to a set of numbers that can provide useful information. Already I feel I know a little more about Xero, and some better questions to ponder as I look at their business.

This was all done in a very quick period of time, and from very limited information. But the purpose was to demonstrate that it is remarkably simple to get to a set of numbers that can provide useful information. Already I feel I know a little more about Xero, and some better questions to ponder as I look at their business.

There is so so much wrong with the spreadsheet, and probably several major bugs that will change things a lot, probably cancelling each other our. There is also so much to add – a model like this should have over 100 lines. But here it is.

In the end the spreadsheet took around 75-90 minutes and was a fun exercise. If you like this sort of thing then make one for your own company. Actually you should do that anyway, but use real data, a lot more lines and assumptions built up based on facts, not whimsy.

Disclaimer: Intended for educational use only. See a financial advisor before making any investment decisions.

-

Comments and questions

30

by Lance Wiggs (verified) 11 hours ago in reply to anon

I realise it's a bit geeky. But investors into companies should really understand these models and how they work. Else rely on a financial advisor who does have access to this level of advice.

Sadly there are very few investors who do create these models.

#2 by This is fantastic. 14 hours ago

Many thanks for contributing this to the readers.

I can't help but think when Xero announces their actual loss that this sheet will change dramatically once again.

But they are having a crack which is more than a lot of people out there.

by Lance Wiggs (verified) 11 hours ago in reply to This is fantastic.

The short term loss (up to tens of millions say) is relatively tiny versus the long term net present value (billions) in the model.

Sophisticated investors who are comfortable with the space see the long term potential value in billions, and can accept short term losses as a company grows. The questions to ask are around whether and wen access to new funds will be required. But the more important question in Xero's case is a deep dive into key driver of the net present value - the US market.

(I am not a financial advisor)

(I am not a financial advisor)

#3 by The Doctor 14 hours ago

One big question

How sure are you that the Xero customer base can grow from 211,000 in 2013 to 3.4M in 2018 and whatever number is predicted for 2025 when growth has been nowhere near those numbers to date

That means the customers have to increase 16,500% from the current base and that the company will survive that period with the huge ongoing cost to grow the business and raise enough capital to achieve that growth. That is a huge ask and a huge call by you Lance.

Hopefully your projections for the Punakaiki Fund are more realistic than what you are portraying here with Xero.

by Lance Wiggs (verified) 11 hours ago in reply to The Doctor

The answer is that organic growth is always surprising. The key is to look at percentage growth rates, not absolute growth rates.

It can be done. e.g. When I projected Trade Me's numbers back in May 2004 the revenue per month increased by about 3500% per month between then and FY2012.

And it was correct to within 9%.

That model was a lot more sophisticated than this one, mind.

The model, basic as it is, shows that Xero will conquer costs and be profitable for much if its journey. Ultimately they are always making a trade off between short term losses and long term value.

But yes - there are some huge assumptions in the model. We assume that Xero can hold themselves together, can conquer markets, keep costs under control, raise money and so on and on. This is an exercise, not a proper model.

#4 by Anonymous 13 hours ago

I'm surprised you didn't do a sanity check on the average revenue per customer. $280 per NZ customer seems high, for example.

by Jochen Daum 11 hours ago in reply to Anonymous

based on a price of $32 per customer per month (typical price an accountant gets you for it), I think its low. How do you think you would go below $348 per year?

I have met tons of Xero users, but not a single one had the small plan.

I have met tons of Xero users, but not a single one had the small plan.

#5 by Chris Keall (verified) 13 hours ago

To justify its market cap, Xero has to make gains in the US, which in turn will set the stage for a Nasdaq listing. Conquering the US means taking on Intuit and its near-monopoly. More: http://www.nbr.co.nz/opinion/xeros-us-assault-analyst-raises-small-red-f...

#6 by Mike Porter 12 hours ago

Another method that could work. Take the combined market cap's of each of the incumbents. Realise that as their customers transfer into a cloud based model, the value of the realestate has probably doubled. Improved cost efficient delivery model + opportunity in new service delivery to extract more $ per customer. Combined with an improved product that encourages a greater number of SME's to be on a platform. Then project reasonable final market share achievement for Xero in each space. Intuit 22.68, future market cap available say $40bn US - Xero share 10% (final position leading challenger brand) - say $6bn NZD. SAGE UK, 7.8bn NZD, future cap 14bn, Xero share 20%, 2.8bn.... MYOB $1bn, Xero share 60%, 0.6bn... rest of the world... whatever... that comes to about $10bn.. if you squint. Would take a while though.

by Lance Wiggs (verified) 11 hours ago in reply to Mike Porter

It's good to cross-check models with methods such as this. I don't agree with your assumptions, but that's the point - we can now have a conversation about assumptions rather than throwing around numbers based on even even less.

For the original Trade Me valuation I did in 2004 I had over 120 valuation methods. There is no one true way.

#7 by PJK 12 hours ago

Really Mr Wiggs?

You really attempted to project numbers 12 years into the future of a high-tech company that will need to re-invent itself several times over in order to keep pace with change that will inevitably occur in cloud computing?

Go back to 2001, and compare the state of computing, internet access and mobile platforms then until now - and tell me that ANY financial modeling using raw growth rates is a serious attempt at value projection.

This article simply displays very poor thinking - almost no situational awareness of the industry - and seems little more than a PR puff piece to promote a personal profile.

A very dubious exercise ... and an unwise attempt considering your high reputation and current ventures to push a Punakaiki Fund on retail investors that will specialise in early high tech opportunities.

The quality of thinking shown here is simply alarming.

by Lance Wiggs (verified) 11 hours ago in reply to PJK

Yes I did project forward 12 years. The model assumes that Xero, which is 7 years old, now has a sustainable advantage. The next steps would be about exploring that question.

>Go back to 2001, and compare the state of computing, internet access and mobile platforms then until now - and tell me that ANY financial modeling using raw growth rates is a serious attempt at value projection.

See comment above about Trade Me. Yes it is very possible and the results were very close. But a tremendous amount of thought goes into the growth rates, and for the Trade Me model that meant digging into demographics. For Xero it means digging into how thy sell, country by country and sector by sector penetration and so on. In an hour and a half this is what you get.

This basic model which has a ridiculously simple level of inputs and assumptions is obviously not enough to build confidence for an investor. Its there as an example of the sort of work you should be doing if you are investing in a company. If not, then invest in what you know.

#8 by Matt 11 hours ago

Interesting. But I wonder if there have been adjustments made for inflation. They would probably need to double their revenue per customer every 10 years to keep up with inflation. eg $27 in 2012, is not going to have the same buying power sa $30 in 2022. So will they raise fees, and is it the sort of business that can raise fees very easily?

by Lance Wiggs (verified) 11 hours ago in reply to Matt

Inflation essentially washes out as if the costs, revenues and investor returns all inflate by the same amount then it's all still worth the same in today's money. And I only had 90 minutes.

The model does not account for changes in inflation or currency rates between countries, for Xero's ability change prices as they grow dominant in each market. And the answer is yes - they can change fees very easily by increasing the wholesale price to accountants, adding more compelling higher priced plans to push migration upwards and simply putting the price up as we are all locked in now.

#9 by anon 11 hours ago

An alarming piece of thinking, am now glad I didn't invest in your Fund. You are going to pay away investors money for patently ridiculous valuations by the looks.

Every sophisticated investor in NZ is expecting Xero to bomb in the next few years.

by Kevin Mann 9 hours ago in reply to anon

Interesting comment. I assume you weren't an investor of Amazon or Facebook either based on that view?

by Kevin Mann 9 hours ago in reply to Kevin Mann

Sorry Lance, I was in fact responding to the comment #9 (anonymous). I am a total supporter of your fund and what you are doing to assist the high tech high growth (export) sector in NZ. So much so I have already invested. However, this confusion has pleasingly extracted a further response (as if I had been critical) and supports the lack of insight some analysts have to the new world of cloud technology and the valuation of such firms. Peter Theale is just one well know person who has made some astute investments in the sector and these are based on the same thinking you have.

by Lance Wiggs (verified) 9 hours ago in reply to anon

If this is your perspective then you are always going to struggle with investing in any long term high growth company. That's ok - invest in what you are comfortable with, and there are some fine offers available right now.

However if you feel strongly that Xero is going to fall then you cal always test that belief and short them, but that's a short term trading strategy in the face of long term fundamentals.

However if you feel strongly that Xero is going to fall then you cal always test that belief and short them, but that's a short term trading strategy in the face of long term fundamentals.

As I explained above this model is insufficient to make a valuation call.

L

L

Four things I recommend reading:

1: Common Stocks and Uncommon profits, by Philip A Fisher. Written in 1958 it is still highly insightful reading. e.g.

"Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years? A company seeking a sustained period of spectacular growth must have products that address large and expanding markets."

"Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years? A company seeking a sustained period of spectacular growth must have products that address large and expanding markets."

2: Ten things learned from the start-up ecosystem (sorry - another one of my posts). (1). It has some basics that people in this space take essentially for granted.

3: This cartoon from 2001 (2), which asked of Amazon CEO Jeff Bezos "when will we see, in the annual report, bottom line: profitability?

Not at the moment, but a 16% cumulative annual return to shareholders since 2001 is the ultimate answer - and yet still no profitability. Amazon, and Xero and others like them are building long term value. Even Apple only just start paying dividends recently, but they are enormous ones.

Not at the moment, but a 16% cumulative annual return to shareholders since 2001 is the ultimate answer - and yet still no profitability. Amazon, and Xero and others like them are building long term value. Even Apple only just start paying dividends recently, but they are enormous ones.

4: And finally the timeless classic Reminiscences of a Stock Operator by Edwin Levere, based on Jesse Livermore's life. It's a pearler for people who like short term trading into and out of stocks, and a great read regardless.

(1) http://lwcm.co.nz/perspectives/ten-things-learned-from-the-internet-start-up-ecosystem/

(2): http://lwcm.co.nz/wp-content/uploads/2013/05/BEZOS.png

(2): http://lwcm.co.nz/wp-content/uploads/2013/05/BEZOS.png

#11 by Anonymous 9 hours ago

55 million customers by year end 2025 is very high.

It appears as if Sheet 7 from 2021 to 2025 which valuations have been driven off seems to be linking incorrectly back to incorrect cells.

#12 by Steve 9 hours ago

I pay $55/month for xero to run a few rental properties. In hindsight sounds like a lot but when I pay it monthly I never think twice and now that I'm on it, do I really want to go through the hastle of changing to save a few bucks a month?? It really is a simple system to use.

#13 by MadamX 9 hours ago

It's pretty simple. You can't value XRO using tired old carthorse metric fundamentals that work for property companies, so don't bother. Here's another idea: Rod lives and continues to be the Steve Jobs of the Antipodes - stock will go to $40, $50, $100, $200, Etc. Rod dies in a snowboarding accident - stock goes to 50c. Stock is pricing on expectations alone, nothing more. Big ones. Realistic? It's the tech game, people...

#14 by financial modeller 9 hours ago

obviously you didn't have time for this, but I always like to do monte carlo analysis rather than taking a single projection for growth that assumes the business is successful.

i.e. 10% chance of growth rate [a], 20% chance of growth rate [b] etc etc.

Helps to show the potential downsides as well as upsides. or you might have a scenario with x% chance that quickbooks/MYOB gets its act together and competes hard and see what happens there.

Helps to show the potential downsides as well as upsides. or you might have a scenario with x% chance that quickbooks/MYOB gets its act together and competes hard and see what happens there.

In the case of Xero the valuation has an upper limit based on the number of businesses that exist, but the lower limit is Zero (of course), so based on our estimates of the probabilities of different growth rates, what is the expected value, rather than just the value of Xero if it does well, which it might not.

#15 by looking at that model 8 hours ago

I realise you only spent a short time on this, but there are some alarming problems with some of your key assumptions around cost

1) average salary constant at $100k/year all the way up to 2025! no pay rises for poor old Xero staff for then next 11 years.

2) non-staff costs at $100k per staff member all the way up to 2025. What is the basis for that?

3) no CAPEX ever.

4) your NPV does not take into account any tax at all. I know a lot of tech cos avoid tax, but is this realistic? It should reduce the cashflow by ~30% at current tax rates.

2) non-staff costs at $100k per staff member all the way up to 2025. What is the basis for that?

3) no CAPEX ever.

4) your NPV does not take into account any tax at all. I know a lot of tech cos avoid tax, but is this realistic? It should reduce the cashflow by ~30% at current tax rates.

#16 by Anon 8 hours ago

I would suggest a WACC of 18% significantly underestimates the risk. This remains a venture capital play and I would suggest a WACc closer to 25% would be justified, especially for investors with limited exposure to high risk transactions. Lance what is the NPV at this rate. The major investors are playing high risk, high payoff - but they are backing 20+ companies across a number of different industries - normal portfolio theory.

I read a recent analysis of high risk investing and it bascially said the expected returns for an investor increases sigifcantly as they move from 5 to 25 investments or something. This is the major risk for investors in Punakiki Fund at $5m there is not enough capital to get a portfolio and 5 - 10 companies is just not enough.

One Response to Valuing Xero – in 1 hour From Lance Wigg's website:

Jesus Bless You