Lance Wiggs for The National Business Review writes: The currency fall has a wonderful effect for exporters, especially those who have most of their costs back here in New Zealand.

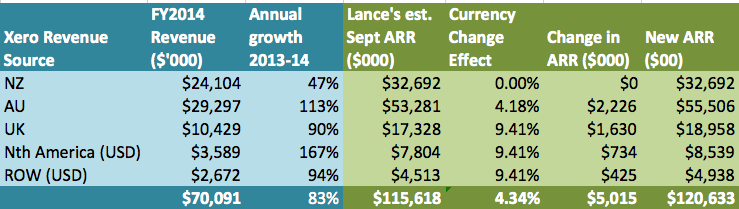

As I write this, the NZD versus the USD has fallen about 10% since earlier this year. As an exampled of what this means I’ve made a simple spreadsheet estimating the impact on Xero [NZX: XRO].

My take is that the fall from the end of May to today would increase their estimated monthly revenue by about 4.3%.

Obviously this is only for revenue received after the exchange rate changes, so don’t expect any surprises when Xero announces their September revenue, although their Annualised Run Rate might have a boost.

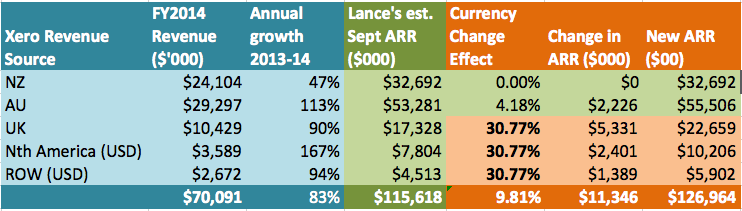

But we’ve also heard talk of a desired optimum level of a rate of $.65 US dollars per NZD. If that happened tomorrow (and I am never a fan of fast movements), and if the AUDNZD cross rate stayed the same, then the Xero table would look like this:

That’s would show almost 10% increase in revenue, a lovely bonus for Xero and Xero’s shareholders. Xero does have a lot of staff offshore, but the bulk of their costs would be in NZD, so overall they should see a net increase in profitability, which in their case means little, as they are very well funded and constrained by things other than monthly profitability.

Every other exporter will be facing a similar scenario, but SaaS providers are luckiest because their costs are often largely in NZD, and so they will maximise the benefit.

0 comments:

Post a Comment