Steve Nicastro for Seeking Alpha writes: This article continues my series on the best investments for a Roth IRA account. In my search, I have stumbled across a number of intriguing investments - both stocks and ETFs - which I feel present a compelling long-term investment opportunity.

To recap briefly, my criteria is as follows:

- My picks are geared towards investors with at least 30-35 years until retirement, so I am focused on buying very long-term investments - both stocks and ETFs - which I believe will outperform the market over that time period.

- I love the idea of re-investing dividends in a Roth every chance you get through a dividend reinvestment plan (DRIP). A DRIP allows you to purchase more shares without having to buy more shares in the open market and allows you to benefit from the powers of compound interest.

- A DRIP also allows you to dollar-cost average your position over time, another powerful, long-term investing strategy.

Here are the previous stories in this series:

Why a Roth IRA?

I personally like a Roth IRA over a 401k for a number of reasons.

- With a Roth IRA, you are investing post-tax money, but you are getting tax-free returns at retirement, unlike a 401K, which invests pre-tax money, but is taxed at retirement. Therefore, I believe a smart strategy would be to start a Roth IRA account as soon as possible, invest in dividend paying stocks or ETFs with a low expense ratio and enroll them in a DRIP and watch your money grow tax-free over a number of years.

I am not completely against a 401K if your employer matches your contributions. You just need to know what fund you are invested in and how much the expense ratio is.

- I like the freedom of choice when investing in a Roth IRA: you can invest in stocks, ETFs, bonds, etc. Plus, you can specifically choose ETFs which carry super-low expense ratios - unlike many mutual funds which carry expense ratios over 1%.

- The freedom of choice in a Roth IRA allows you to choose between a number of blue-chip dividend paying stocks such as Altria Group (MO), McDonald's (MCD) and as I mentioned in my previous article, Realty Income Corp (O).

- Another great feature of a Roth IRA is that you can take out yourcontributions when you want (but not your gains), without any penalty.

- For 2013 and 2014, the IRS website says the maximum you can contribute to all of your traditional and Roth IRAs is the smaller of: $5,500 ($6,500 if you're age 50 or older), or your taxable compensation for the year.

For full information and rules on a Roth IRA account, visit the IRSwebsite.

Why Monthly Dividends?

Compound interest is a powerful force. The more you compound your money over time, you more you will end up with at the end. So, it makes sense to invest in a stock or ETF which pays out its dividend monthly, as opposed to another investment which pays quarterly, semi-annually or annually.

For example, let's use two people who both start with $20,000 in a Roth IRA, and invest just $50 a month for the next 30 years. Both investors earn a rate of 6% annually on their investment (which is the approximate average annual return in the stock market over time) but investor A receives his dividends monthly, while investor B receives its dividends quarterly.

- Investor A ends up with $169,310.97 after 30 years, a total return of 345.56%.

- Investor B ends up with $167,975.46 after 30 years, a total return of 342.04%.

As you can see, the difference is nearly $2,000 favoring investor A. Not a tremendous difference, but still extra cash in investor A's pockets.

Please note that I don't think this means investors should choose one stock or ETF over another just because one pays dividends monthly and the other pays quarterly. It is just another thing to keep into consideration when performing your due diligence.

Top 3 Monthly Dividend ETFs for a Roth IRA

Here are three monthly dividend ETFs which I feel stand out above the rest:

*Wisdom Tree Small Cap Dividend Fund (DES)

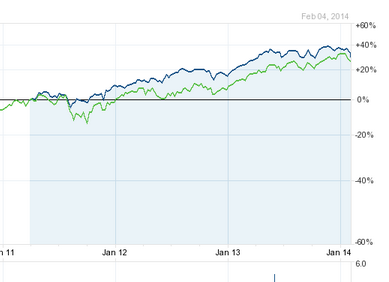

(click to enlarge)

(Credit: Yahoo! Finance)

The WisdomTree SmallCap Dividend Fund seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree SmallCap Dividend Index, which is a fundamentally weighted index measuring the performance of the small-capitalization segment of the US dividend-paying market.

This fund carries an expense ratio of just .38% and currently yields 2.28%. Over the past five years, the fund has returned average annual gains of 19.83% and average annual gains of 8.12% since inception. You will see above that DES has outperformed the Dow Jones index over the past five years.

The sector breakdown is as follows: Information technology (9.7%), consumer discretionary (12.2%), utilities (13.04%), industrials (17.6%) and financials (25.37%).

The top 5 holdings in the fund are: Covanta Holding Corp. (CVA), which makes up .87%, PDL BioPharma Inc. (PDLI) with .89%, Compuware Corp. (CPWR) with .95%, UIL Holdings Corp. (UIL) with .99%, and Vector Group Ltd. (VGR), with 1.53%.

I like DES for the yield but also for its long-term appreciation potential. I think it could be a great long-term pick for a small-cap fund in a Roth IRA account.

*The Global X SuperDividend ETF (SDIV)

The Global X SuperDividend fund seeks investment results that correspond to the price and yield of the Solactive Global SuperDividend Index. The Underlying Index tracks the performance of 100 equally weighted companies that rank among the highest dividend yielding equity securities in the world, as defined by Structured Solutions AG (Source: 2013 prospectus).

The fund carries a management fee of .58% and has a current yield of about 6.54%.

The top 5 holdings in the SDIV are: Fisher & Paykel Healthcare (OTCPK:FSPKF) with 1.56% of net assets, Suez Environnement Co. (OTCPK:SZEVF) with 1.60%, Northstar Realty Finance Corp. (NRF) with 1.71%, RR Donnelley & Sons (RRD) with 1.79%, and Electricite De France (OTC:ECIFF) with 1.81%.

The industry breakdown is as follows: 18.73% in financials, 15.46 % in utilities, 12.10% in REITS, 11.29% in telecommunication services, 8.65% in industrials, 7.65% in energy, 7.21% in Mortgage REITs, etc.

I believe that investors looking for an attractive yield and global diversification should check out the SDIV. The fund holds 23.62% of its assets in the USA, but 19.59% in Australia, 10.54% in the United Kingdom, 6.93% in Canada, 4.28% in Singapore, etc.

My biggest concern with the SDIV is that the fund has too much exposure to the real estate market, with 12.10% in REITS and 7.21% in mortgage REITs. Therefore I would strongly recommend that investors consider diversifying into different funds if you are considering investing in the SDIV.

*iShares High Dividend ETF (HDV)

The iShares High Dividend ETF is exposed to high-quality U.S. companies with a focus on high dividends. The ETF carries an expense ratio of just .40% and contains 74 holdings in total. Since inception in March of 2011, the fund has returned 16.39% annually, and currently yields 3.17%.

You will see below that the HDV is beating the Dow Jones industrial average since its inception:

(Credit: Yahoo! Finance)

The sector breakdown for the HDV is as follows: 26.52% in consumer goods, 18.25% in healthcare, 14.58% in utilities, 11.06% in oil and gas, 9.9% in telecommunications, 7.62% in technology, etc.

I like the HDV because the ETF mainly because I feel it contains a number of very high-quality dividend paying stocks. For example, the largest holding in the ETF is AT&T (T), making up 9.9% of the ETF. AT&T is one of my top picks among US large caps and the stock currently yields 5.7% with a P/E of just 9.6.

Other top holdings in the HDV include:

- Chevron Corp. (CVX), 7.66%.

- Johnson & Johnson (JNJ), 7.5%.

- Proctor & Gamble (PG), 6.52%.

- Merck & Co. (MRK), 6.01%.

- Philip Morris International (PM), 5.95%.

- Intel Corp. (INTC), 4.78%.

In total, the top 10 holding of HDV make up a little over 62% of the portfolio.

HDV looks like a very solid long-term investment for a Roth IRA because of the low expense ratio and exposure to high quality dividend paying stocks.

Conclusion - A Mix of These Three Good Be the Right Move

No matter what your investment choice, you should begin investing for retirement as soon as possible because of the powers of compound interest: the longer you invest, the more your investments will compound and dollar cost average themselves, leading to much bigger gains over the long haul.

This post is meant for informational purposes only; please do your own due diligence before investing.

-

COMMENTS