BitPay is an electronic payment processing system for the bitcoin currency. We enable online merchants to accept bitcoins, as a form of payment, just as they accept payments from Visa, Mastercard, or Paypal. Jason @ Bitpay writes: Bitcoin sales can be exported from BitPay and imported into Quickbooks. We recommend the setup described below.

Home Currencies supported: USD, EUR, CAD

In Quickbooks, you do not need multi-currency enabled if your home currency is USD, EUR, or CAD, and you are taking 100% settlement from BitPay in that same home currency.

Preparing Quickbooks

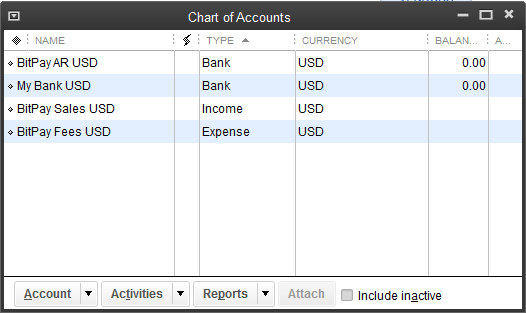

First, create 3 new Accounts in your Chart of Accounts. Income and Expense accounts can only be denominated in your home currency. (Below, replace USD with your home currency.)

Account 1

| Type | Income |

| Account Name | BitPay Sales USD |

| Tax-line Mapping | Income: Gross Receipts or Sales |

Account 2

| Type | Expense |

| Account Name | BitPay Fees USD |

| Tax-line Mapping | COGS: Other Costs |

Account 3

| Type | Bank |

| Account Name | BitPay AR USD |

| Tax-line Mapping | B/S Assets: Accts Rec |

Your bank account should already be in Quickbooks. BitPay’s ACH/EFT transfer will be transferred toMy Bank which you can change in the General Ledger transaction after import. Your QuickbooksChart of Accounts should have these entries:

Importing Bitcoin Sales

To confirm that your Quickbooks is properly configured, a sample file is provided at the bottom of this article.

From the menu in Quickbooks, select: File > Utilities > Import > IIF files and import the sample file.

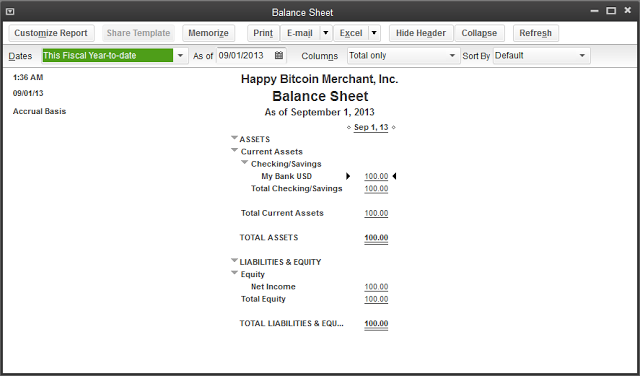

You can confirm that the file was imported correctly by noting that My Bank USD shows a balance of $100.00. You can review the G/L to verify Sales Receipts. Edit the transfer to replace My Bank USD with the Bank account in your chart of accounts that received the direct deposit from BitPay.

Your BitPay sales are now fully integrated with your financial reports in Quickbooks!

Note that if you keep any % of your sales in Bitcoin, this will not be noted in the download. It will prorate the gross sale to only the % of the gross sale which you settle in your local currency. Read the next section “Keeping Partial or All Settlement in Bitcoin” to learn more.

Visualizing your Bitcoin Sales

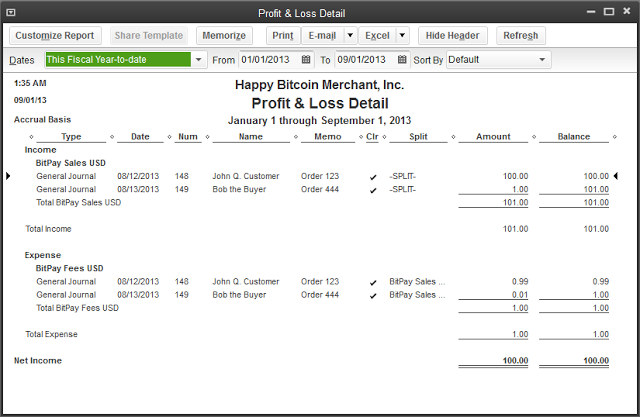

Income Statement

Balance Sheet

To download your BitPay transactions, login to your merchant account at

https://bitpay.com. From your dashboard, click on Account Ledger and select your home currency to download.

You will need to specify the date range to download, and then choose:

Quickbooks IIF file.

We should note that Quickbooks does not support multi-currency very well, even in the 2013 edition. Nonetheless, we have used the capabilities of Quickbooks to their current maximum potential.

If you take 100% settlement from BitPay in your home currency, you are done!

If you keep a % of your BitPay Sales in Bitcoin, follow the next section to import those from your BitPay BTC ledger.

Keeping Partial or All Settlement in Bitcoin

The Gross, Net, and Fees are % prorated from the total amount of the sale. Meaning if you keep 10% bitcoin and settle 90% in EUR, your EUR ledger will have an entry representing 90% of the total gross sale, and your BTC ledger will have an entry representing 10% of the total gross sale, with the same Order Number so you can match them up in Quickbooks.

Create 2 more accounts in your Quickbooks Chart of Accounts:

Account 4

| Type | Bank |

| Account Name | BitPay AR BTCUSD |

| Tax-line Mapping | B/S Assets: Accts Rec |

Account 5

| Type | Bank |

| Account Name | My Wallet BTCUSD |

| Tax-line Mapping | B/S Assets: Cash |

These accounts represent the USD value of your bitcoin, at BitPay and also when pushed to your bitcoin wallet.

How to Reconcile your Company’s Bitcoin holdings in Quickbooks

While Intuit’s support for multi-currency doesn’t give all the income/expense reporting needed for bitcoin transactions, it is possible to add your bitcoin wallet into Quickbooks, and mark your digital assets to market price every day or every month.

As of the 2013 edition, Quickbooks cannot:

- have an income account in any currency other than your home currency

- have an expense account in any currency other than your home currency

- allow you to set your home currency to a currency you add (e.g. Bitcoin)

- resolve any currency balance to more than 2 decimal place precision

- allow you to specify an exchange rate for each sale

- allow you to specify a data source for exchange rates for a currency

- allow you to upload a history of exchange rates for a currency

- allow an exchange rate with a date & time (only 1 rate per calendar day permitted)

We encourage Quickbooks users to contact Intuit directly and encourage development in the above 8 areas to improve their multicurrency support.

You cannot enter Income or Expenses in BTC, mBTC. But you can setup a Bank account in bitcoin to declare and value your bitcoin holdings. You will first need to enable multicurrency support in your Quickbooks. Then, you can add a new currency. From the menu in Quickbooks, select: Company > Manage Currency > Currency (New)

| Name | millibitcoin (mBTC) |

| Symbol | mBTC |

Next, create a new account in your chart of accounts for each bitcoin wallet you want to account for in Quickbooks.

| Type | Bank |

| Account Name | My Wallet mBTC |

| Currency | millibitcoin (mBTC) |

| Tax-line Mapping | B/S Assets: Cash |

Because Quickbooks precision cannot go past 2 decimal places for the quantity, if you want to account for your bitcoin holdings you will need to use millibitcoins (mBTC). The exchange rate for mBTC is the rate for BTC divided by 1,000. Quickbooks does have 8 decimal precision when calculating the rate, but only 2 decimal precision on the quantity.

| USD for 1 bitcoin (BTC) | $123.4567 |

| USD for 1 milibitcoin (mBTC) | $0.1234567 |

To transfer the balance from the USD representation of your bitcoin wallet to the mBTC account for your bitcoin wallet:

Every day, you will manually need to enter the exchange rate under Company - Manage Currency. The exchange rate is the USD amount pushed to My Wallet BTCUSD divided by the actual number of bitcoins delivered to your wallet, as viewed directly on your bitpay.com BTC account ledger page.

Then, manually enter a TRANSFER every day to clear out the deposit from the My Wallet BTCUSDand transfer into My Wallet mBTC. Your wallet should now show the latest deposit in the correct number of mBTC, and on your balance sheet the entire wallet balance will be marked to the current market price.

What is BitPay?

BitPay is an electronic payment processing system for the bitcoin currency. We enable online merchants to accept bitcoins, as a form of payment, just as they accept payments from Visa, Mastercard, or Paypal.

In which countries is BitPay available?

BitPay is available in every country, and you can set your prices in over 150 different currencies.

How do I get paid?

Merchants choosing to keep the bitcoins can be anywhere in the world. Merchants in some countries can choose to receive a direct deposit into their bank account.

When do I get paid?

We prefer to send one payment to every merchant each day, which clears out their balance with BitPay. This prevents balances from accumulating and discourages hackers. Payments to bank accounts are made per business day. Payments in bitcoins are sent to the bitcoin address of your choice, at least once per calendar day.