Claire Georghiades FCA, Co-Founder of Accounts Resource writes: Many small businesses start life with their income and expenses on a

spreadsheet. As your business grows or if you register for VAT you will

have to consider using a software package for your accounts. We are

often asked which cloud accounting software packages we recommend. Here

are our top three cloud accounting software products.

Online means no software to install and business owners can log in anywhere with an internet connection. Software updates are carried out automatically and data is safely stored and backed up.

We think that it lives up to its claim as the world’s easiest accounting software without compromising on functionality, and this is why are registered as a Certified Partner for Xero.

Features: Easy to use cloud accounting software connects you with your accountant.

Accreditation: Institute of Chartered Accountants in England and Wales; Institute of Certified Bookkeepers

Price: Micro business – £9+VAT per month; Small business – £20+VAT per month Free 30 day trial: no payment details required.

What we love:

Features: Easy to use cloud accounting software connects you with your accountant via IrisOpenBooks.

Price: Sole Trader £15+VAT per month; Partnership £20+VAT per month; Limited Company £25+VAT per month

What we love:

Accreditation: Institute of Certified Bookkeepers

Price: £18+VAT per month Free 14 day trial: no payment details required.

What we love:

However, it is Xero’s superb management reporting tools which are transforming the way we can work with our clients. It makes it easy and cost effective to manage compliance and frees us up to offer you high value services. For more information on which cloud accounting software package would be best for your business, please contact us on info@accountsresource.co.uk or on twitter @accountsresourc

By Claire Georghiades FCA, Co-Founder of Accounts Resource.

Accounts Resource is a pro-active accountancy practice based in South West London. Accounts Resource are specialists in providing Accounting and Tax solutions to small and startup businesses and won The Best New Startup Award at the Richmond Business Awards 2012.

Online means no software to install and business owners can log in anywhere with an internet connection. Software updates are carried out automatically and data is safely stored and backed up.

1. Xero Cloud Accounting Software – Ideal For Larger Business

We have made no secret of the fact that we love Xero.

We think that it lives up to its claim as the world’s easiest accounting software without compromising on functionality, and this is why are registered as a Certified Partner for Xero.

Features: Easy to use cloud accounting software connects you with your accountant.

Accreditation: Institute of Chartered Accountants in England and Wales; Institute of Certified Bookkeepers

Price: Micro business – £9+VAT per month; Small business – £20+VAT per month Free 30 day trial: no payment details required.

What we love:

- Automated bank feeds and bank rules mean one-click bank reconciliations

- Fantastic iPhone app Xero Touch gives you bank information on the go and allows you to do your invoicing and expense claims (and then throw away all those messy receipts)

- Easy to use and integrates with many excellent add-ons eg Paypal

- Dashboard giving a snapshot of important financial information

- Comprehensive help – as well as the Support Team, the new Xero community means that if you post a support question it will be answered by any of the Xero Partners

- Directors’ current accounts and drawings accounts for sole traders can be treated as a bank account so no untidy journals needed when doing expense claims.

- The VAT return can be filed on-line with HMRC directly from the software.

2. FreeAgent Cloud Accounting Software – Ideal For Freelancers And Contractors

Despite our love affair with Xero, we are proud to say that we are ‘FreeAgent Friendly’ and if you are a small-business owner or sole trader who lacks accounting experience, you’re the target market for FreeAgent.Features: Easy to use cloud accounting software connects you with your accountant via IrisOpenBooks.

Price: Sole Trader £15+VAT per month; Partnership £20+VAT per month; Limited Company £25+VAT per month

What we love:

- Project management – You can organise expenses or income by project, and establish a budget for each to measure their profitability

- Time tracking feature where each user can log in and manage their own timesheets, while the project manager retains an overview of the entire project

- Dashboard giving a snapshot of important financial information

- A simple interface and everyday language throughout, transactions are gathered under headings such as Work and Expenses

- Unique tax time-line showing upcoming deadlines to take away the stress of dealing with the taxman

- VAT return can be filed online directly from FreeAgent to the Inland Revenue.

- A one-click report that creates a self-assessment summary for income tax purposes, the details of which you can copy to your tax return

- iPhone App – Mobile Agent, although not as useful as Xero as bank feeds are not carried out automatically

- FreeAgent does not offer automatic bank feeds but it makes a good job of tracking previously matched transactions and attempts to match similar transactions as they’re imported

- FreeAgent’s range of reports isn’t as extensive as Xero’s or KashFlow’s, but the main ones – trial balance, VAT, profit and loss, and journal entries – are here

3. Kashflow Cloud Accounting Software – Ideal For Stock Based Small Business With No Accounting Knowledge

Features: Easy to use cloud accounting software connects you with your accountant in the cloud via Orbit AccountsAccreditation: Institute of Certified Bookkeepers

Price: £18+VAT per month Free 14 day trial: no payment details required.

What we love:

- Kashflow integrates with a variety of payment card processors, including SagePay, Barclaycard and Paypal. These allow you to update your accounts with payment information automatically.

- Dashboard may not be as polished as Xero’s, but its information is presented clearly, with historical balances, sales charts and quick links.

- An impressive invoicing tool. You can quickly create quotes and turn them into invoices through a single button link.

- A huge list of reports and tools, some of which are displayed in the browser, while others open in a spreadsheet, including one that produces the figures needed to complete a self-assessment form, and another that generates a business “health check” score, with suggestions on how to improve.

- Like FreeAgent, direct VAT filing. You run the VAT report, enter your HMRC online filing credentials and submit. Given how much of a chore many small businesses find submitting returns, the ability to do so without leaving KashFlow is a major strength.

- A unique stock management feature. It’s basic, but functional: you enter the number of items in stock, and that decreases when you issue an invoice containing that item. You can also set a value at which you’d like to be warned about low stock.

However, it is Xero’s superb management reporting tools which are transforming the way we can work with our clients. It makes it easy and cost effective to manage compliance and frees us up to offer you high value services. For more information on which cloud accounting software package would be best for your business, please contact us on info@accountsresource.co.uk or on twitter @accountsresourc

By Claire Georghiades FCA, Co-Founder of Accounts Resource.

Accounts Resource is a pro-active accountancy practice based in South West London. Accounts Resource are specialists in providing Accounting and Tax solutions to small and startup businesses and won The Best New Startup Award at the Richmond Business Awards 2012.

;

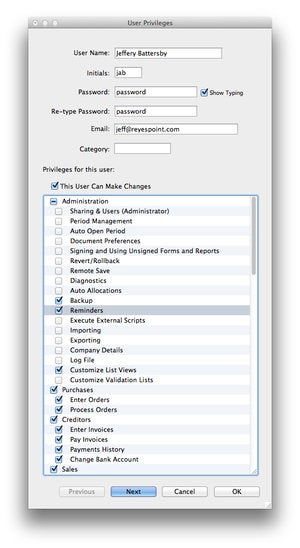

$99 per seat license). MoneyWorks Gold is a solid, full-featured

business accounting application that is networkable, supports multiple

users, and works on both Macs and PCs.

;

$99 per seat license). MoneyWorks Gold is a solid, full-featured

business accounting application that is networkable, supports multiple

users, and works on both Macs and PCs.