Basia Hellwig for Investopedia writes: After April 15, most of us are happy to ban all thoughts of income tax until next April’s deadline looms. But taking a little time to do a midyear check-in and tuneup can really be worth it – saving you last-minute panic and big bucks. “Summer is a good time to make sure you’re on track, because for a lot of people, the pace is a little slower,” says Barbara Weltman, attorney and author of “J.K. Lasser’s 1001 Deductions & Tax Breaks 2014.” “If you wait until year-end to check on your tax status, you’ll be right in the middle of holiday season. And summer is your tax advisor’s slow time, too.” Here are some points Weltman and other experts recommend you cover in a mid-year checkup.

1. If you have an extension to file your 2013 tax return, do it now. Why wait until Oct. 15, when the return is due? If you’re expecting a refund, the money should be earning interest for you, not the government. And if by some chance you’ve miscalculated (and underpaid) the tax you owe, the sooner you pay up the better. Penalties and interest start to accrue on April 16, even if you have filed for an extension. And if the reason you’ve been procrastinating about filing is because you can’t pay what you owe, “don’t let that stop you,” urges Weltman. “File the return – you can always ask for an installment plan to pay.”

1. If you have an extension to file your 2013 tax return, do it now. Why wait until Oct. 15, when the return is due? If you’re expecting a refund, the money should be earning interest for you, not the government. And if by some chance you’ve miscalculated (and underpaid) the tax you owe, the sooner you pay up the better. Penalties and interest start to accrue on April 16, even if you have filed for an extension. And if the reason you’ve been procrastinating about filing is because you can’t pay what you owe, “don’t let that stop you,” urges Weltman. “File the return – you can always ask for an installment plan to pay.”

2. Are you on track with tax payments so far? If you’ve had, or expect to have, any life-changing events during the year – marriage, divorce, having a child, buying a house, a spouse taking or leaving a job – you may need to adjust the amount of tax that’s being withheld from your paycheck. You don’t want to give Uncle Sam a big interest-free loan, but you don’t want any underpayment penalties, either (although they’re only 3% right now). The IRS has a withholding calculator, so you can get it right. If you need to make any adjustments, file a new W-4 form with your employer.

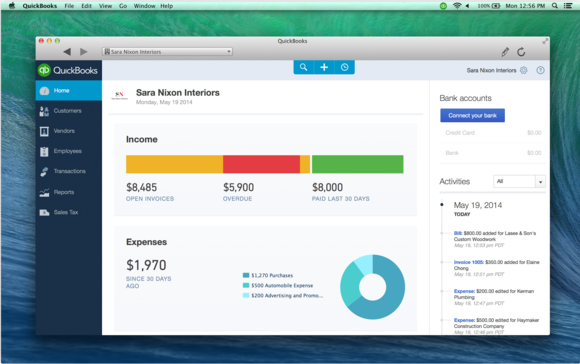

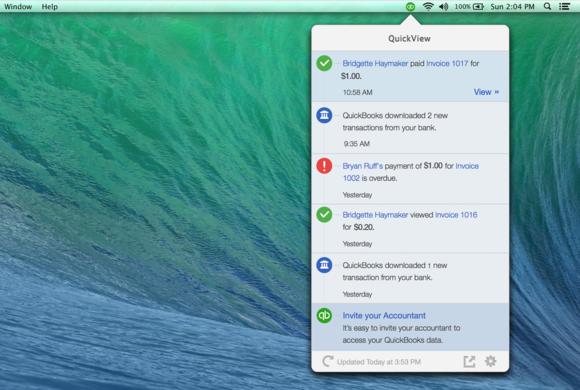

If you’re self-employed and make estimated tax payments, it’s helpful to closely monitor your income and expenses throughout the year, so that you know what you owe and set aside enough money to make the quarterly installments. There’s a “safe harbor” with no underpayment penalties if you pay at least 100% of the tax you owed last year (110% if your adjusted gross income last year was more than $150,000) or 90% of the current year’s tax.

But “there may be surprises in store for high-income taxpayers, especially if you’re landing in that category for the first time,” says Weltman. It’s not so hard for a married couple to find themselves hitting the $250,000 threshold. When that happens, new tax issues come up, such as additional Medicare taxes and the phaseout of personal exemptions and itemized deductions, which you’ll need to account for in your estimated taxes and withholding.

3. Eyeball your retirement accounts. Could you afford to bump up your contributions or even max them out? “Some companies are limiting and cutting back on their 401(k) contributions,” says Weltman, “but that doesn’t mean you should.” Check on your investments and asset allocation.

4. Are you close to the itemize/don’t-itemize decision point for deductions? If so, you may want to use a strategy called bunching, in which you push discretionary write-offsinto a year when you’re going to itemize, rather than one when you take the standard deduction. Think of scenarios such as the following, suggests Weltman: At midyear, it looks like you’re almost at the point where you could itemize. You usually give $1,000 to a particular charity each year. You’re close to retirement, so next year you won’t need the deductions to offset as much income. So this year you double up on your contribution to take advantage of itemization when you need it.

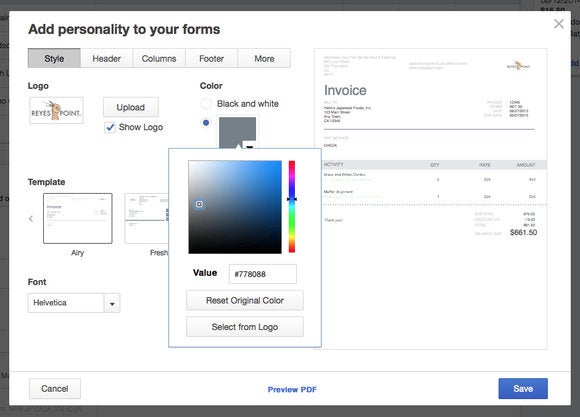

5. Get organized – there’s an app for that. Who hasn’t vowed on April 16, “next year I’m going to stay on top of my tax receipts.” If you still haven’t acted on that vow, avoid another marathon session of receipt logging next April by enlisting the help of an app. For instance, Shoeboxed Receipt and Mileage Tracker lets you scan receipts (valid for IRS documentation) with your iPhone, iPad or Android mobile device, making it easy to track your expenses and deductions as you go along. The DIY program is free, or you can choose a paid plan (starting at $9.95/month after a free trial) that lets you mail in your receipts. Keeping up-to-date with expenses and maximizing your tax deductions is particularly important if you have business travel and entertainment expenses, or need to track business use of your personal car.

6. Are you staying within the tax guidelines for renting out your vacation home? If you rent out your vacation home when you’re not using it, you can generally deduct expenses such as mortgage interest, real estate taxes, casualty losses, maintenance, utilities, insurance and depreciation against your rental income. But you won’t be able to take a loss if you make personal use of the home for more than 14 days a year, or 10% of the days it is rented to others at a fair rental price (whichever is greater). If you spend the day at your home making repairs, it’s not considered personal use, even if your family is there for other reasons. But if you rent the home to a close family member, even at market rate, it is.

7. Could you be taking advantage of the 25D energy credit? The 25C energy credit expired at the end of 2013, but the 25D credit is still available through Dec. 31, 2016. It covers 30% of the cost of solar water heaters, solar panels that generate electricity directly for your home, small wind turbines and geothermal heat pumps. It can be used for a primary residence or a vacation home that you own.

The Bottom Line

Take advantage of summer to lock in tax breaks and catch up with any payments you owe. It’s the slow period in the world of tax advising, and, therefore, a good time to plan ahead before the year speeds up in December.

If you’re self-employed and make estimated tax payments, it’s helpful to closely monitor your income and expenses throughout the year, so that you know what you owe and set aside enough money to make the quarterly installments. There’s a “safe harbor” with no underpayment penalties if you pay at least 100% of the tax you owed last year (110% if your adjusted gross income last year was more than $150,000) or 90% of the current year’s tax.

But “there may be surprises in store for high-income taxpayers, especially if you’re landing in that category for the first time,” says Weltman. It’s not so hard for a married couple to find themselves hitting the $250,000 threshold. When that happens, new tax issues come up, such as additional Medicare taxes and the phaseout of personal exemptions and itemized deductions, which you’ll need to account for in your estimated taxes and withholding.

3. Eyeball your retirement accounts. Could you afford to bump up your contributions or even max them out? “Some companies are limiting and cutting back on their 401(k) contributions,” says Weltman, “but that doesn’t mean you should.” Check on your investments and asset allocation.

4. Are you close to the itemize/don’t-itemize decision point for deductions? If so, you may want to use a strategy called bunching, in which you push discretionary write-offsinto a year when you’re going to itemize, rather than one when you take the standard deduction. Think of scenarios such as the following, suggests Weltman: At midyear, it looks like you’re almost at the point where you could itemize. You usually give $1,000 to a particular charity each year. You’re close to retirement, so next year you won’t need the deductions to offset as much income. So this year you double up on your contribution to take advantage of itemization when you need it.

6. Are you staying within the tax guidelines for renting out your vacation home? If you rent out your vacation home when you’re not using it, you can generally deduct expenses such as mortgage interest, real estate taxes, casualty losses, maintenance, utilities, insurance and depreciation against your rental income. But you won’t be able to take a loss if you make personal use of the home for more than 14 days a year, or 10% of the days it is rented to others at a fair rental price (whichever is greater). If you spend the day at your home making repairs, it’s not considered personal use, even if your family is there for other reasons. But if you rent the home to a close family member, even at market rate, it is.

7. Could you be taking advantage of the 25D energy credit? The 25C energy credit expired at the end of 2013, but the 25D credit is still available through Dec. 31, 2016. It covers 30% of the cost of solar water heaters, solar panels that generate electricity directly for your home, small wind turbines and geothermal heat pumps. It can be used for a primary residence or a vacation home that you own.

The Bottom Line

Take advantage of summer to lock in tax breaks and catch up with any payments you owe. It’s the slow period in the world of tax advising, and, therefore, a good time to plan ahead before the year speeds up in December.