John J. Bowen Jr. for Financial-Planning.com writes: Building strategic alliances with CPAs is one the most effective ways to generate a steady stream of referrals and capture millions of dollars in new assets under management. Yet even advisors who understand such alliances say they need help connecting with accountants.

I think many of these frustrated advisors are making one big mistake: They don’t take the time and effort to understand accountants’ challenges, concerns and culture. Consequently, they lack empathy toward CPAs — and that’s a key factor in forming a lucrative alliance with an accounting firm.

Empathy means directly identifying with and understanding someone else’s situation, feelings and motives. Here’s why it’s so important to have that empathy as you work to build alliances with CPAs: Like it or not, many accountants have a somewhat unfavorable opinion of advisors; many view advisors with some distrust.

Many CPAs are fiscally conservative by nature; they want to minimize risk for their clients and for themselves. Referring their high-value clients to someone outside of their firms carries big perceived risks: the risk of damaging the CPAs’ relationships with their clients and the risk of losing control over the relationship.

And they believe those risks are even bigger when it comes to financial advisors, who seek to navigate clients through the often volatile financial markets. Empathy goes a long way in breaking through those barriers of suspicion and creating the trust that CPAs need to have to form alliances with advisors.

GET SCHOOLED

How do you build and demonstrate empathy? Your first step is to learn all you can about accounting firms offering financial services, taking into consideration the current challenges these firms face.

Developments in the 1980s and ’90s made it possible for CPAs and financial services providers to work together. During that time, some states changed their laws to allow CPAs to offer insurance and financial investment products. The AICPA established its personal financial specialist designation, and also clarified the ethical rules and regulations on CPAs and financial services providers working together.

Yet things did not work out very well between the two groups, leading CPA firms to seek out providers more in alignment with comprehensive financial planning.

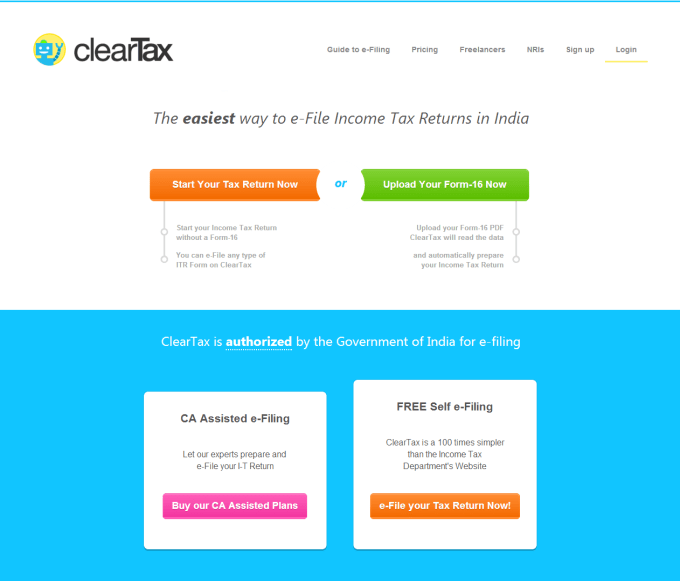

To ally with a CPA firm, you must understand the wide variety of issues that such firms contend with. These include the commoditization of fees and increasing competition from other CPA firms, leading to confusion about the best strategies for future growth. What’s more, tax-preparation software and websites continue to tempt clients and potential clients away from working directly with CPAs.

In addition, accountants don’t get nearly as much face time with clients as they used to, as in-person meetings have been replaced with emails. That’s hurting CPAs’ ability to foster client loyalty. And yet, because of these forces, CPAs need to bring value to their clients beyond just tax preparation and planning.

Additionally, the industry is finding it tougher and tougher to attract talented, charismatic young people, who often see CPA work as a grind. Hiring also remains a challenge, making long-term growth and succession planning difficult. Indeed, valuations of accounting firms are often only 85% to 100% of annual revenues. (For wealth management firms, by comparison, the rule of thumb is that firms are valued at more than two times revenues.)

One excellent way to understand the state of the CPA business in your area is to reach out to your state CPA society. You may be allowed to attend meetings and continuing education sessions as a guest — giving you the opportunity to better understand the issues in your area as well as to meet accountants who might end up being ideal partners. Reviewing the Journal of Accountancy regularly, especially the practice management articles, is another smart move.

By understanding the industry’s challenges, you can offer an approach that will address them. Emphasize that the CPA firm’s clients would remain its clients, and that they would receive the type of elite wealth management services that they are already seeking and that would most benefit them. This helps show accountants that an alliance is a winning proposition for clients.

ANTICIPATE CONCERNS

Another way to demonstrate empathy: Use your knowledge of the challenges facing CPAs to anticipate the concerns they may express — ethical, financial, legal or structural — when discussing the idea of an alliance. Prepare responses that will show you understand their worries and can address them.

Have detailed answers prepared for the many questions the CPAs will have, and be able to demonstrate that you are a very different kind of financial advisor from the type they imagine (and mistrust).

You have to be keenly aware of both the risks and the benefits that will come up in their minds. (A few are on the chart below.) Imagine yourself going through your meetings with potential CPA alliance partners with responses at the ready for nearly any question that they might raise. For example, take reputation risks: Are you sufficiently dedicated to world-class service to allay any fears? If a CPA is worried about losing control of client relationships, be able to explain the procedures you’ll put in place to make sure this doesn’t happen.

What about the CPA firm’s need to form an appropriate legal entity such as an LLC to avoid professional liability and protect the partners’ interests? Will you have some suggestions, or be able to point to another CPA firm that has done something similar? Maybe you know an attorney who is experienced in this area.

And what about the need for each CPA partner who will share any revenue to obtain the necessary licenses? Are you prepared to offer help along these lines? Can your firm provide administrative support or tutoring, and would it be proper to do so? If one of the CPA firm’s partners fails to receive his or her license in a timely manner, you should have contingency plans in place.

For each of an accountant’s concerns, being able to respond immediately will make it much easier for a potential ally to say “yes.”

The more you think things through, and the more you put yourself in the shoes of the CPAs you’ll be talking to, the better the chances that they’ll consider working with you. So before you initiate an introductory meeting, take a step back and think about the underlying relationship and cultural dynamics at play.

Essentially, you are attempting to change your own thinking about CPAs. Then you can approach individual partners in CPA firms and work on changing their thinking — so that they can change their partners’ thinking. And with their thinking changed, they’ll be able to present to their clients a brand-new and highly desirable option: working with a wealth manager.

John J. Bowen Jr., a Financial Planning columnist, is founder and CEO of CEG Worldwide, a global training, research and consulting firm for advisors in San Martin, Calif.