Time & Model @ SeekingAlpha writes: What Is Intuit Worth? Summary

- 10 years of ROEs over 18%+.

- Strong moat and established brand transitioning to a cloud-only model.

- Fantastic franchise we hope to become a partner in -- there may be upside today, but one is betting without a margin of safety.

It is said there are only two certainties in life: death and taxes. The author John Brooks paints an intriguing picture of the latter situation in chapter 3 ofBusiness Adventures.

We can bet demand for tax-related services is perennial. And we can bet that accounting services are also perennial. Accounting is, after all, explicitly mentioned in the 3800-year old Hammurabi code. And we can bet that the established firms have an advantage due to their age -- after all, tax laws build on tax laws.

Under our microscope today is Intuit, Inc. (NASDAQ:INTU) the maker of QuickBooks, TurboTax, Lacerte, ProSeries and Quicken (among others). Intuit has an enormous customer base of some 45 million, with 30 million using web and mobile products.

Intuit is a fantastic business. We like most everything about it. Whether it is an inexpensive purchase in today's markets is a whole different matter. We can hardly hold our nose and like anything at all in these markets. Prices are simply too high for any degree of confidence in common stock commitments (excluding, I suppose, some of the mega-cap corporations). Therefore, we will abstain from saying whether it is too high or too low -- which is pretty much another way of saying "fairly valued." But the business is laudable, and we hope to be shareholders at some unknown date. Let us, therefore, laud.

Historical Performance

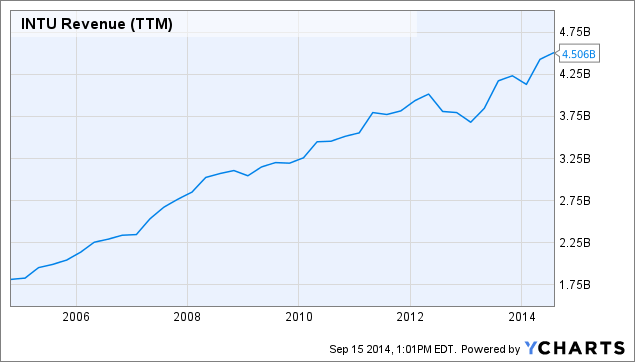

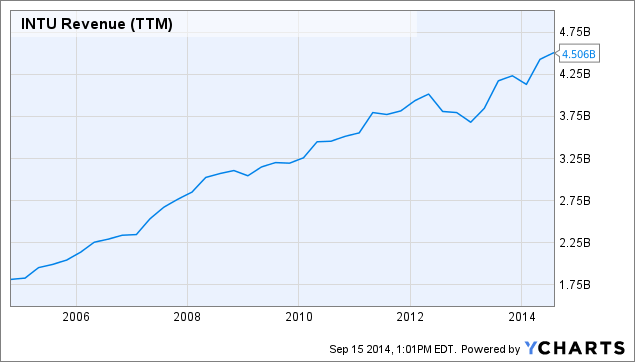

Check out the revenue growth:

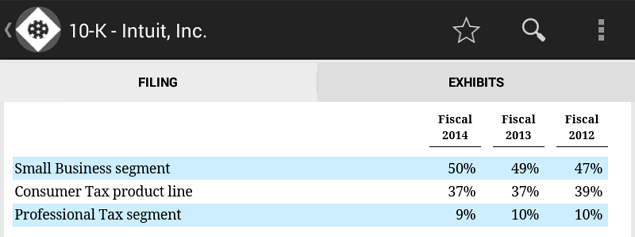

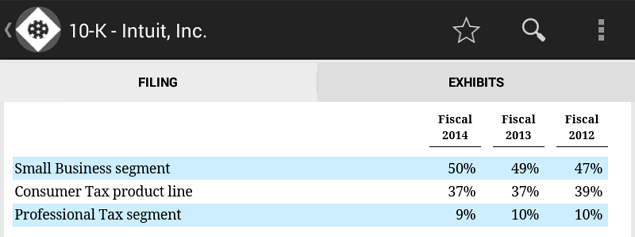

The company increased revenues by 250% in the last ten years, or about 9.5% per annum. Here is the corporation's revenue breakdown by segment (please try our Filings Reader for Android!):

(2013 10-K, p. 5; source: Time & Model's Filings Reader)

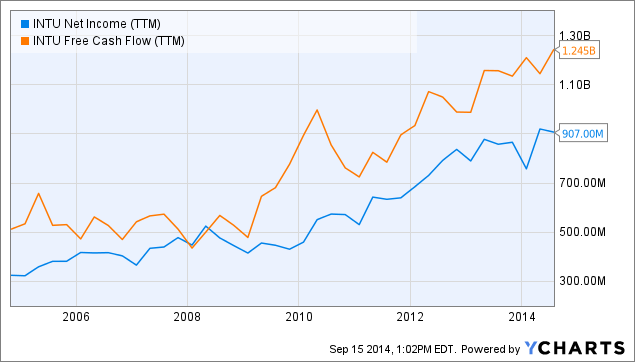

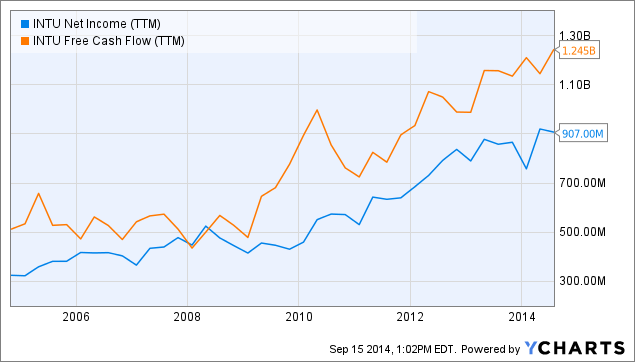

They are about half in accounting and half in tax. Take a look at the profits and free cash flow:

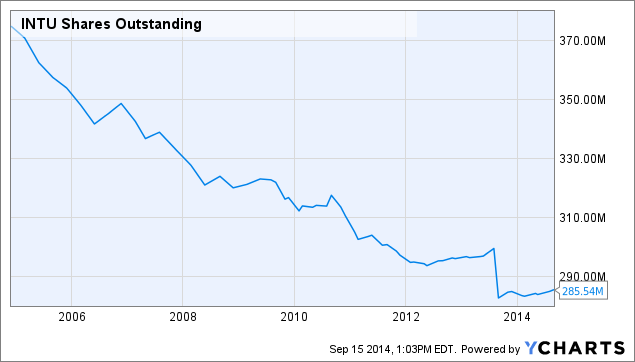

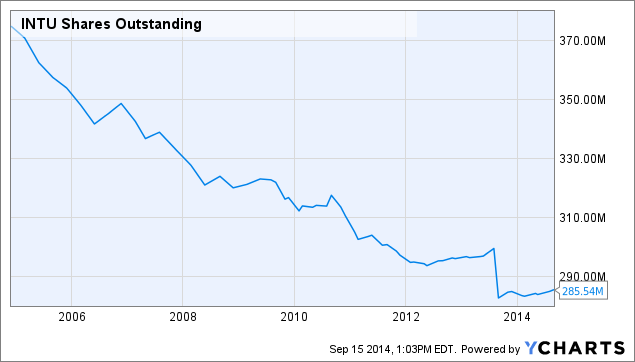

Very pretty. Take a look at shares outstanding:

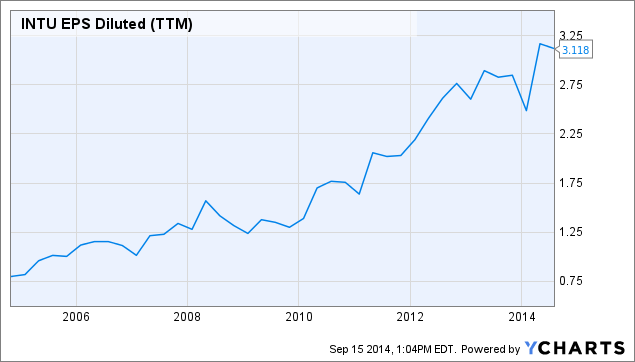

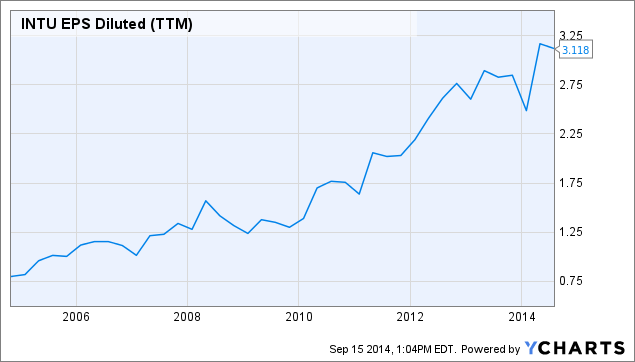

These two trends cause a beautiful effect in EPS when combined -- just check it out:

Whereas revenue grew 9.5% per annum and net income grew 11.5% per annum, EPS grew 14.6% per annum over the last ten years. Thank you buybacks.

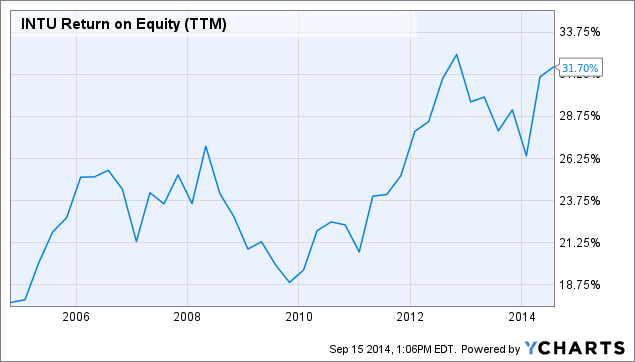

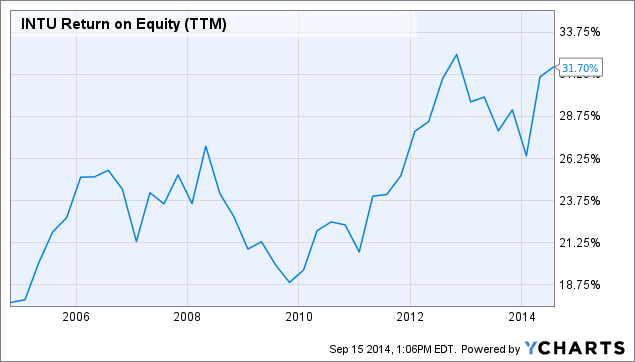

Most importantly, however, we have our ROE:

That is basically ten years of ROEs above 18.75% -- and much of the time, the ROE was higher than that. TTM ROE is 31%.

All these things suggest we are dealing with a first-class business. Furthermore, we know its market is nearly perpetual -- our current system wouldn't work without the income tax. Further, our entire system is itself shaped by the tax (as John Brooks explains so well).

So we know that (1) demand is constant and not going away, (2) the return on capital is excellent, (3) the company has been piggy-backing on technological trends (such as the marketing and technical phenomenon known as "cloud") and (4) the company's historical exhibit is excellent.

So let's address a few questions. First, the business would be attractive today if the growth of the past could be assured -- and hence, we need to evaluate forward-looking prospects. Next, what would a fair price for Intuit be?

Let's keep in mind that we don't want to "explain" the current share price when we address that question. We want to come up with a price which allows for future growth, but puts us in the conservative position of not falling for the most classic of investment errors: paying for growth ahead of time. In the worst cases, people pay for growth which never even happens, and they, of course, end up with losses. We would argue this latter mistake is presently going on at scale today. The stock market is remarkable in its ability to act as if it lacks a history.

Future Growth

"QuickBooks Online is opening new stores [sic] with 75% of new QuickBooks Online customers being first-time customers to the Intuit franchise." - Q4 2013 conference call (emphasis added)

The conference call goes on to say:

"Using ending QuickBooks Online subscribers of 683,000, we generated more than $800 in annual revenue per customer. On the desktop side we generated less than $500 per customer."

In other words, not only does the cloud offering have a theoretically better gross margin than desktop, it also seems to offer a better revenue picture. This will be an interesting trend to watch, and it could create some serious whiz-bang upside.

Growth will likely be driven by new customer adoption of Intuit's cloud offerings. This offering, by the way, further begs the question why Intuit is so "cheap" compared to other cloud providers? Surely, Intuit has a more credible business model. The word "cheap," of course, is a relative term given the extreme overvaluation of the sector. Workday (NYSE:WDAY), for example, is selling for $16 billion, or 71% of INTU's price, but WDAY has only 15% of INTU's sales and exactly 0% of INTU's profits. But we will leave this digression for someone else.

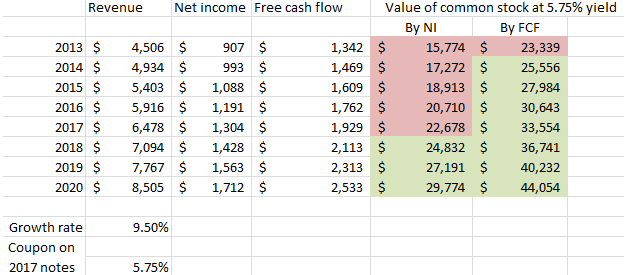

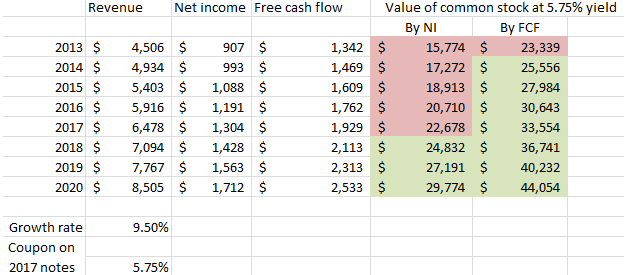

If we projected 9.5% revenue growth (and corresponding net income growth), we would have a security which is likely undervalued. E.g., this would be its future exhibit:

Assuming that the stock sold at its bond coupon long-term -- which implies a PE of 17.3 -- the corporation would be worth more than today's prices within a year, valuing the corporation from free cash flow.

If we used GAAP net income, the stock looks a little ahead of itself. However, we believe, some hybrid of the two profitability measures might be appropriate in this specific case. FCF is overstated due to stock-based compensation and due to "usually low" (management's words) capital expenditures; net income is understated due to amortization of intangibles and working capital improvements. Assuming some hybrid of those two measures, and assuming a PE of 17.3 is correct long-term, the corporation would easily grow into its valuation in a few years.

But of course, anyone looking at this can clearly see that if the corporation is able to continue to grow long-term, an investment will likely work out quite well in due course -- especially since EPS will be helped along by operating leverage and share repurchases.

However, for us, we want the odds to be better than this. An investment in Intuit would likely fare better over the next 5 years than many other available investments. But this is due to the quality of the underlying business. On the whole, Intuit is valued similarly as many other firms in the market. Many other firms valued at Intuit's level, however, don't deserve the premium. That is, on a relative basis -- a basis we at Time & Model do not use -- Intuit is attractive. But Intuit is only good from this point of view because the market is not being very discriminating. On an absolute value basis, there is little margin of safety for the conservative investor.

Margin of Safety

One way of thinking of the margin of safety is to compare the earnings yield with the market yield on the bonds. The "margin of safety" in this definition, borrowed from an essay of Graham's, is the yield of the common divided by the yield on the bonds.

Currently, we have a free cash flow yield of 5.16% and an earnings yield of 3.73%. Compare this with the 2017 bonds' current yield of 5.2%, and one can see that the common is clearly viewed as more attractive than the bonds. This might be fair given the growth rate and the rate of inflation -- i.e., the real coupon rate on the bonds is only 3.2%, assuming 2% inflation. But what is clear is that it is at the high end of the value spectrum.

There are some other fancy formulas we could apply. For instance, Graham once created a formula for growth stocks which takes into account the current bond yields. Here is the definition, with earnings being the mid-point between net income and free cash flow:

Earnings * ((37.5 + 8.8 * growth rate)/ bond yields)Or:$1124 * (37.5 + 8.8*9.5)/5.2 = $26.1 billion

Don't ask me how Graham came up with the "8.8" or the "37.5" above -- I believe he just selected figures which gave reasonably answers given his historical experience.

From this point of view the common equity is undervalued by 10%, and we personally would not be surprised to see the security selling at that level.

However, we should again recall the "margin of safety" concept. The concept is to ensure good long-term results over many market cycles. The whole point is to introduce additional selectivity to enhance the probabilities of investment success. In our opinion, we should look to purchase Intuit at about 66% of the formula figure above -- or about $17.2 billion.

At 66% of the "fair value," we would be able to secure an upside of approximately 50% and a current yield of 6%+. For a business as good as Intuit, purchasing at higher valuations will probably still work out if the security is held long enough.

Positioning and Marketing

Intuit beat its own predictions when it came to sales on the individual tax side. This is due to an improved product approach. Have a read of this exchange from an Q&A on September 3rd, 2014:

"We designed our product specifically around the type of customer you are. Whether you do investments, whether you have a home. By doing that you had to pick a product that was right for you. And that delivered a far better experience for our customers; and in essence a large portion of our customers actually paid more than they did the year before."

And hence, it achieved better revenue than it expected, since it got better pricing. The higher pricing achieved could be a one-off -- unless there is a broader trend towards specific product specifications which could serve to improve revenues by diversifying the product line into areas where pricing power is yet untapped. Very good move, if this proves to be the case.

For some basic filers, TurboTax recently offered a mobile product calledSnapTax, where customers could simply take a photo of their W-2 and about 80% of their taxes were finished. Products like this proved the mobile channel as a possible means of addressing taxes. Both of these are indications that Intuit's management is watering their garden and nurturing young innovation, which may drive revenue in the future -- or at the very least, improve their moat.

Priorities on the tax side are, in order: (1) customer growth, (2) revenue growth and (3) operating income growth.

In many respects, it seems that market share becomes more important over time in the software field. Just as people lack time for two newspapers a daily, people lack the time to learn multiple software systems. Therefore, people can get trapped in a software ecosystem whose incremental improvements are tolerable. This is an enormous barrier to exit and, further, really cements the franchise in the customers' mind. Software franchises, like other brands, are very valuable if taken care of.

The company also owns Mint.com. Long-term, Mint may connect our entire financial lives and do our taxes. Pretty fabulous future vision. Mint must protect its information and be the most secure platform. Its long-term reputation is important, and a security failure would negatively affect the value of this brand.

Important Trends & Accounting Changes

We may get an opportunity to purchase the shares in the near-term, since the corporation expects to report lower revenues in the near term. In reality, its revenues will likely grow a bit slower than last year but slow growth is very different from a revenue decline.

If speculators react superficially -- as they frequently do -- we could see better pricing in the shares. So why are they changing the company's accounting?

"For the first time more new customers choose QuickBooks Online over QuickBooks Desktop." - Q4 2013 Press Release

The actual labor within old desktop releases was before they shipped. Hence, revenue was recognized up-front. With cloud software, the coding is located on remote servers, and therefore, the company can update the code whenever it wants. It is entirely under its control. Furthermore, apps on the iOS or Android ecosystem update automatically, which also creates the effect of "ongoing development."

This "software updating" trend is now affecting desktop software too, specifically QuickBooks, Pro-Tax and Quicken. Due to the fact that revenues under a continually updating system are tied to ongoing expenses, it makes sense to recognize revenue over time, rather than all at once. Hence, revenue will no longer be recognized immediately after the sale of desktop systems, but over three years. This obviously creates the effect of a decline in near-term revenue (although, just to stress the point, the cash flowing through the door is the same as it was before).

Due to these ongoing expenses, it also makes sense in general to distribute software on a SaaS basis so that software can fund its continual improvement. (This is also, I might add, what Time & Model would like to do with its current and future products.)

This change in accounting will mostly affect GAAP revenue and GAAP net income. Revenue, therefore, is expected to decline 3% to a range of $4.275 billion to $4.375 billion for FY 2014. Net income will also decline, but cash flows will likely remain very similar to today -- the disconnect between net income and cash flows will be able to be seen in the "deferred revenue" line item on future cash flow statements.

Long-Term Targets

The company has some corporate targets for 2017:

- Revenue of $5.8 billion (9% annualized revenue growth)

- Adjusted EPS of $5 (recall the $5 a share comment...)

- GAAP EPS of $4.25

Conclusion

Intuit is a fabulous business with a fabulous return on capital. We would expect purchases, except those done at extremely high valuations, to work out favorably for the purchaser if they plan to hold the security long enough. In the long run, Intuit is very attractive. But we want to purchase at advantageous levels, wherein a margin of safety can be mathematically demonstrated in one way or the other. We believe this is possible with "growth securities," provided they have some describable moat.

We advocate very conservative buying. Despite the quality of the business, today's prices do not offer a margin of safety which assures investment success. Perhaps the accounting change mentioned above will lower the valuation of the shares, thereby offering an opportunity for intelligent investors.

Good luck. The corporation's investor day is on September 30th, 2014.