Tweepler.com writes: Tweepler: How did LedgerDocs get started, and in a few sentences how does it work?

Wayne Zielke: Having been in the accounting industry for almost a decade, we understood the challenges involved to provide exceptional bookkeeping and accounting services to clients. One of those challenges is document collection and management, and wanted to create an application that helped other firms to improve their business workflow and processes.

After years of doing bookkeeping for clients, we decided there must be a way of using the web to better connect with our clients and make things easier. This is why LedgerDocs exists today. It’s a small business software tool designed specifically to make collaboration around bookkeeping easier.

Our goal is to find ways to better manage, share, and collaborate on accounting documents to make the process more efficient. We believe the collection and management of client documents should be a seamless process that makes your life easier, saves you time, and grows your business. Whether you are a business owner, bookkeeper, or accountant, LedgerDocs offers a unique online tool that is able to give you a step-up from your competition.

Tweepler: What makes the QuickBooks Online integration important?

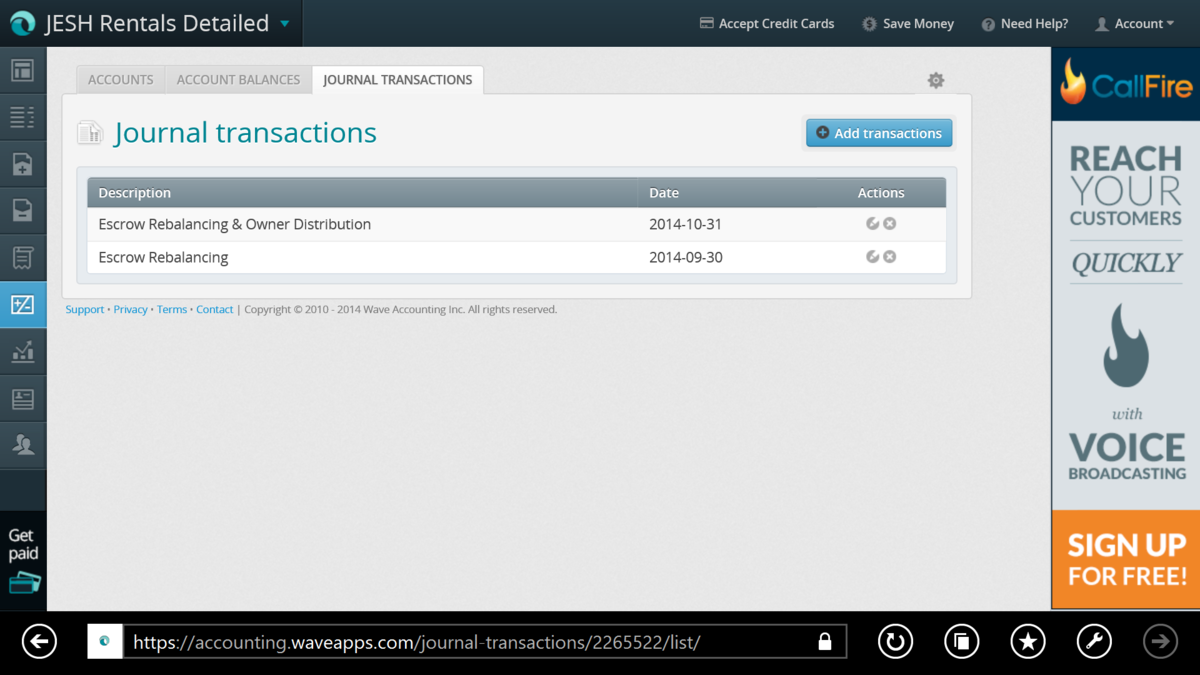

Wayne Zielke: The latest integration with QuickBooks Online [See press release] allows for LedgerDocs users to quickly enter transaction information directly from LedgerDocs into QuickBooks Online, the leader in small business accounting software. This is an important step in bridging the gap between document management and accounting application. Having access to the original document from your accounting app completes the loop. And it’s all done in the cloud.

Tweepler: Online document storage seems to have business applications beyond accounting. Is LedgerDocs focused mainly on accounting uses?

Wayne Zielke: LedgerDocs was created with bookkeepers and accountants in mind. After all, it was created for the sole purpose of creating a tool to help bookkeepers, accountants, and their clients to collaborate on important accounting information. Although the application can be used for a variety of industries and uses, focusing our design and development on this niche audience allows us to provide the best user experience possible.

Tweepler: It seems security would be a big issue for cloud-based storage of financial documents. How do you secure your client’s materials?

Wayne Zielke: Yes, we take security seriously, and uses the most up-to-date tools available to ensure user’s information remains safe. Not only do we provide 256-bit SSL encryption, we also perform daily backups of the information within LedgerDocs to multiple locations. As accountants and bookkeepers have multiple clients, the application is multi-user friendly and protects data so it’s only accessible by users who have been granted access.

Tweepler: What is next for LedgerDocs?

Wayne Zielke: We would like to be the champions in getting more and more accounting and bookkeeping firms using and embracing the cloud. There are huge strategic advantages to this. On the product side, we’re continuing to look at integrations and partnering with other apps to provide users with a streamlined and efficient workflow.

_______________

LedgerDocs’ QuickBooks Online Integration Completes The Accounting Loop

Provides a perfectly integrated document management solution for US and Canadian QuickBooks Online users

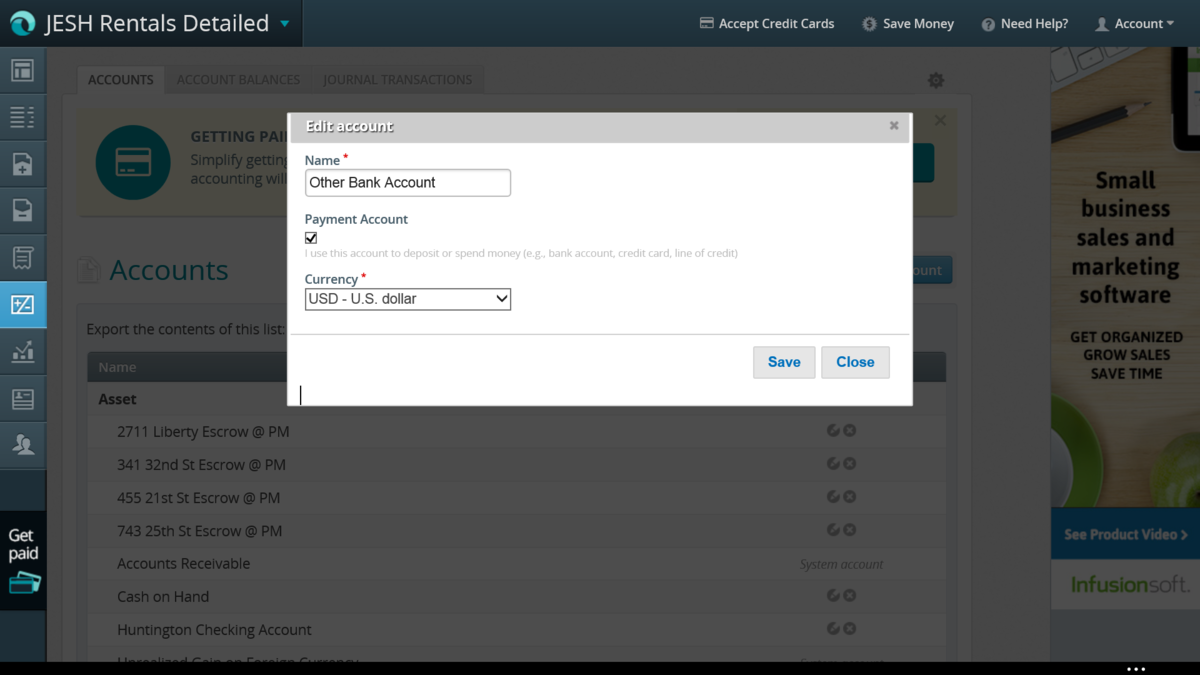

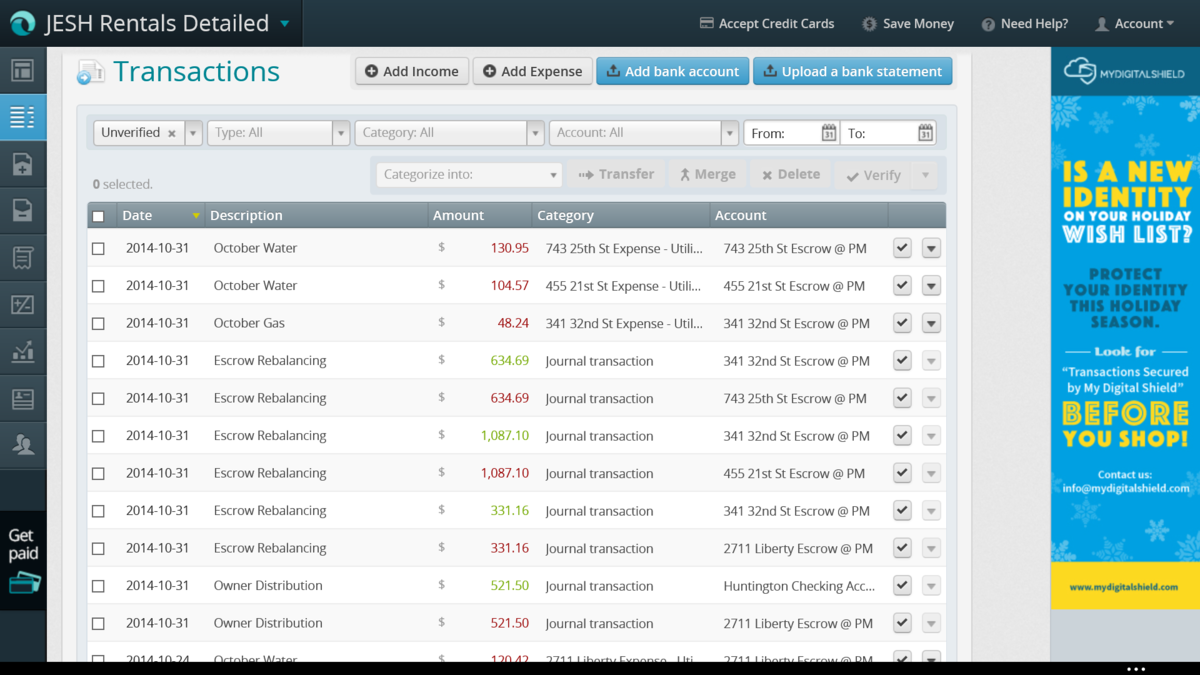

The newly launched QuickBooks Online integration from cloud-based document management start-upLedgerDocs is a time saving and user friendly feature that allows individuals to create transactions from documents which post directly to, QuickBooks Online (QBO), the leader in small business accounting software.

Using LedgerDocs, small business owners and entrepreneurs can continue to scan, email, or take photos of their documents such as receipts, invoices, and statements to send directly to their bookkeeper or accountant.

With the QuickBooks Online integration, bookkeepers and accountants can now create transactions such as bills and invoices to post directly to QBO. This is done using a very simple and intuitive user interface that works right out of the box.

It also creates the opportunity for bookkeepers or accountants to share these tasks with their clients to help reduce time spent and lower service fees when applicable. Clients with the most limited knowledge of bookkeeping can create these simple transactions without working within QuickBooks Online.

Most importantly, the document in question is linked to the transaction in QBO. This is particularly useful for audit purposes or for looking up source transactions — and it’s all done in the cloud.

LedgerDocs CEO Wayne Zielke is excited by this new addition:

“We’re positioning LedgerDocs to sit between the small business owner, their accountant or bookkeeper, and their accounting software [QuickBooks Online, for example].

Think about a building contractor who is onsite, and a cement truck shows up. They get the bill right at the job site. So he takes a picture of it with his iPhone and uploads it to LedgerDocs. The accountant receives it in real-time. There’s no phoning and asking, ‘Did you send that stuff?’

The result is LedgerDocs closes the loop on the whole communication issue around exchanging accounting documents, saving time and money.”

LedgerDocs for QuickBooks Online is available now. For more information visit www.ledgerdocs.com/qbo