Chris O'Donnell for SeekingAlpha writes:

Summary

- Intuit benefits from a product ecosystem that commands customer loyalty and satisfaction.

- The company is looking to expand globally through QuickBooks Online, which has shown early signs of success.

- Intuit's implementation of a dividend in 2011 shows the fruits of its strong cash position and consistent business model.

"Nothing is certain except death and taxes." - Benjamin Franklin

We've all heard (and sighed at) the quote above. We've all dealt with the headache and stress of surviving tax season in the United States, where 150 million people file their returns and receive more than $300 billion in refunds. But maybe not all of us have heard of Intuit (NASDAQ:INTU), a company that aims to help people accurately and efficiently manage their finances and their tax filing through one of life's certainties. As investors and the market move into 2015, Intuit's business will come into focus as tax season rears its ugly head. The company is expanding on a global scale, and is investing heavily in R&D to keep pace with customers on a range of online and mobile platforms. In an economy filled with dense regulation and continued uncertainty, more and more small businesses, tax professionals and general consumers are turning to Intuit to keep their finances simple and flexible. Investors should take this opportunity to own a high-quality company that is well positioned to capitalize on a recovering economy and its effect on the consumer finance industry.

Overview

Intuit is a technology company focused on creating financial management solutions that help consumers, small businesses and accounting professionals simplify their research and their decisions. The company manages a portfolio of products that are tailored to this pursuit, which includes:

- QuickBooks - Small businesses turn to QuickBooks for a product that allows them to manage their operations from one centralized tool. With QuickBooks, users can keep track of money entering and leaving their accounts, connect to over 2,000 financial institutions to get a full view of their business, and keep their information backed up and secure.

- TurboTax - With TurboTax, consumers can keep track of and file their taxes with accuracy and ease. TurboTax helps users collect more in refunds and comply with complex regulations, which has earned it the title of the No. 1 best-selling tax software for over 25 years.

- Quicken - Quicken is a personal finance application that helps customers keep track of their budget and view all their financial information in one place. Quicken products cover real estate, investments, home and business finance, and comes with features like free credit scores, budget projections, and alerts to users when bills are due.

These products complement each other to provide customers with a complete financial tool to tackle their personal, business and taxation needs. Intuit takes advantage of the impact these products provide to create an ecosystem with its current customer base. This ecosystem is what drives consistent business for the company - customers who try an Intuit product get used to the interface and the quality of service and can't imagine using anything different. This leads to an implementation of other company products in customer routine and creates full use and reliance on INTU's services to enhance financial life.

At its core, Intuit's ecosystem strategy is what's made the company so successful. INTU drives customer growth by sticking to three main factors:

- High-quality products - Intuit's high-quality and result-driven products attract consumers to the brand and keep them loyal to new updates and releases from the company over competition.

- 3rd party contributions - Intuit's 3rd party apps downloaded through its products help meet specific customer demands and keep Intuit ahead of competitors.

- Product cycles - Customers of Intuit have become used to steady updates to their products as well as the release of new ones into the market. These product cycles drive company sales and keep both old and new customers satisfied. Because of these cycles, INTU usually exhibits concentrated sales for the periods ending January 31 and July 31, and light sales for the periods ending October 31 and April 30.

Moving forward, Intuit plans to leverage its growing ecosystem to engage with more consumers domestically and abroad and stay ahead of new technologies and government regulation.

Q1 2015 Earnings

When Intuit reported earnings on November 20th, management gave an update to the company's point in the product cycle as well as its plans for the upcoming tax season, where TurboTax will move into the spotlight with customers. The company beat expectations on both the top and bottom line and saw momentum building in its online ecosystem. QuickBooks Online, a product designed to give small businesses functionality anywhere they can find an Internet connection, grew subscribers by 43% in the first quarter. This brings total online subscriber numbers to 739,000 globally, with 103,000 coming from businesses overseas. Intuit sees global expansion of QuickBooks Online as a primary growth driver going forward, with some signs of this already being seen - non-U.S subscribers grew by 170% in Q1 alone.

On its earnings call, Intuit also talked about the Affordable Care Act and how implementation of this policy affects business. Overall, increased government regulation can be seen as a net positive for Intuit's business model. As filing taxes and doing business in the United States becomes more cumbersome, more consumers and companies will look to Intuit to cut through the mess and provide the ease and security they need. With regard to the ACA, management cited confidence in being able to navigate situations involving the law and helping customers do business in spite of increased red tape and paperwork.

On the other hand, if Congress does decide to simplify the tax code, wouldn't that mean less reliance on Intuit's service? Not as much as people may believe. In a situation where Congress overhauls the tax system for the benefit of American citizens (highly unlikely), regulation will still exist in the tax code that will require a helping hand in sorting it out. Intuit invests heavily in staying flexible when reacting to government and technology changes and will respond accordingly to any simplification in the tax code. A simpler way to file taxes might even mean cost savings for INTU, which could translate to the bottom line. Intuit's ecosystem also would show its strength in this situation, where customers already satisfied with company products might choose to stick with their current routine rather than spend time and money figuring a simpler tax code out themselves. Either way, a bet on Intuit is a bet on a complex regulatory environment in the United States and a Congress that won't do anything drastic to change it.

Valuation

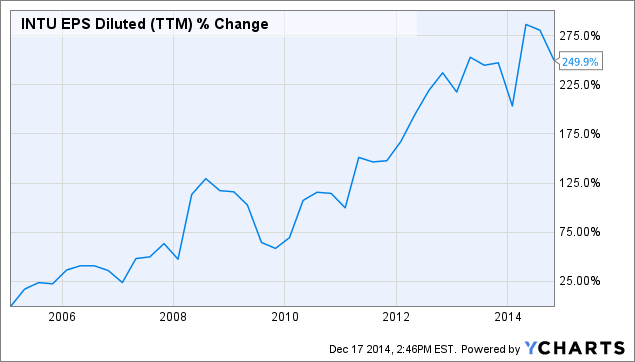

When looking at shares of INTU, investors can see how the performance of the business can be reflected in the stock price and valuation. Intuit currently trades at a multiple of around 32, which shows how investors are pricing in success of the company in the near and medium term. A multiple this lofty can be justified by the company's EPS growth in the past, and how that translates to future growth:

INTU EPS Diluted (TTM) data by YCharts

With 25% annual earnings growth over the past 10 years, it doesn't seem out of the ordinary for a stock with this kind of track record to be valued with a 30+ multiple, especially for a company in the technology sector with so much R&D investment. Investors are banking on INTU growing earnings at a similar or even faster clip to its 10-year average, and 2015 should be able to prove them right as global growth sends earnings higher.

Another positive pillar that should factor into investor's analysis is INTU's implementation of a dividend and its capability to pay and raise that dividend for years to come. Intuit started paying a dividend in late 2011, and has consistently raised it from $.15 per share to $.25 by 2014. Intuit's cash position supports this kind of dividend growth, with a payout ratio of only 35. This payout ratio means that only 35% of Intuit's earnings are paid out in the form of dividends, which leaves a lot of room for growth despite INTU's need to spend heavily on R&D. As earnings rise with fundamental business growth, look for future dividend raises to send shares higher as income minded and dividend growth investors give INTU a look.

Conclusion

As the economy picks up, consumer and small business confidence is sure to rise with GDP steadily increasing and equities near all-time highs. Intuit should benefit from this economic growth down the road, with high-quality products that help businesses perform at their best. Intuit's strong ecosystem, global growth initiatives and strong regulatory knowledge should drive customers to its products and money into its coffers. Investors should take advantage of an opportunity to own Intuit as a 2015 growth story and as an economic recovery beneficiary for many tax seasons to come.