Background

Under new IRS regulations issued in 2007 (the "New Regulations") and subsequent IRS announcements, 403(b) retirement plans were required, no later than December 31, 2009, to have a written plan document in place that reflected the New Regulations. For many non-profits who sponsored such 403(b) retirement plans, this was a new and complex compliance requirement that required time intensive work by the non-profit and its retirement plan providers and other vendors. Some non-profits never before maintained formalized written plan documentation regarding their 403(b) retirement plans (and such documentation was generally not previously required by the IRS), while others had old documents that were not necessarily reflective of current law or current administration pertaining to the 403(b) retirement plan.

Subsequent to the December 31, 2009 written plan document requirement for 403(b) retirement plans, 403(b) plans, like many other defined contribution retirement plans (e.g., 401(k) plans), were required to be formally amended for certain legally required provisions by certain IRS-imposed deadlines. For example, for calendar year plans, amendments with respect to the Heroes Earnings and Assistance Relief Tax Act of 2008 ("HEART") were required to be adopted on or before December 31, 2010, and amendments relating to certain provisions of the Worker, Retiree and Employer Recovery Act of 2008 ("WRERA") were required to be adopted on or before December 31, 2011.1 Additional legally required amendments are likely to be required in subsequent years.

Help for 403(b) Retirement Plans

Given the new requirements for 403(b) retirement plans in the last several years—i.e., to have had a formal written legally compliant plan document in place as of December 31, 2009 and to timely adopt post-2009 legally required amendments—the IRS has announced assistance for those plans that may not have met (or will fail to meet) such legal requirements.

1. Failure to Adopt a Compliant Written 403(b) Plan Document by December 31, 2009

The IRS has opened up its voluntary correction program (the "VCP")2 to enable non-profit organizations that sponsor 403(b) retirement plans and that did not have a written plan document in place as of December 31, 2009 (or, if later, the date on which the 403(b) retirement plan became effective) that complied with the New Regulations to "fix" their noncompliance before the IRS otherwise becomes aware of such noncompliance. The VCP involves the plan sponsor completing and submitting an application to the IRS and paying a fee, which fee is likely to be significantly less than the penalties that could apply if the IRS were to otherwise find out about such noncompliance.

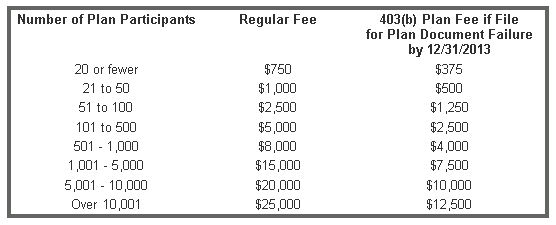

The IRS has given further relief for 403(b) retirement plans to incentivize prompt compliance by providing that if a plan sponsor files under the VCP on or before December 31, 2013 for failure to adopt a written plan document that complies with the New Regulations, then the fees for such VCP are reduced by 50%. The chart below shows the fees that would apply for this type of VCP filing:

The IRS has given further relief for 403(b) retirement plans to incentivize prompt compliance by providing that if a plan sponsor files under the VCP on or before December 31, 2013 for failure to adopt a written plan document that complies with the New Regulations, then the fees for such VCP are reduced by 50%. The chart below shows the fees that would apply for this type of VCP filing:

2. Failure to Timely Adopt Legally Required Amendments After 2009

As mentioned above, 403(b) retirement plans were required to adopt certain legally required amendments since January 1, 2010 and may be required to adopt additional amendments in the near future. For 403(b) plans that either have not yet adopted such amendments or adopt them after the IRS-imposed deadline, the plan document can be considered compliant for these purposes if the following criteria is met:

a. A formal written plan document was in place as of December 31, 2009 that was intended to satisfy the requirements of the New Regulations or the employer failed to timely adopt such a plan document but corrects the failure under the VCP described above;

b. The post-2009 legally required amendments, when adopted, are made retroactive to the relevant legally required effective date;

c. The plan sponsor—when the IRS formally makes such options available—either:

i. Adopts a 403(b) retirement plan prototype document (i.e., a standardized plan document with an adoption agreement provided by a vendor) that has been pre-approved by the IRS. The availability of this option would seem to be at least another year away; or

ii. Applies for an individual determination letter from the IRS to document that its 403(b) retirement plan is in good order. The availability of this application process is anticipated to be several years away.

ii. Applies for an individual determination letter from the IRS to document that its 403(b) retirement plan is in good order. The availability of this application process is anticipated to be several years away.

The date by which either (i) or (ii) must be done is technically referred to as the end of the plan's "remedial amendment period"; and

d. The post-2009 legally required amendments are adopted on or before the plan's remedial amendment period (described in (c) above), which, again, may be several years away.

With this relief, the IRS has made it relatively easy and accessible for plan sponsors to bring their 403(b) retirement plans into compliance and has given ample time to do so.3

3. Operational Noncompliance

While 403(b) retirement plans have been able to use IRS's correction programs for several years when failures arise from not following the plan's provisions (referred to as an "operational failure"), the new guidance gives expanded correction opportunities for 403(b) retirement plans and provides more specific methodologies for 403(b) retirement plans to correct these operational mistakes.

The IRS relief guidance is a welcomed event for 403(b) retirement plans that may be defective. 403(b) retirement plan sponsors are encouraged to consider whether corrections to their plans are advisable. If an updated formal written plan document was not in place by December 31, 2009, a plan sponsor should consider whether the 2013 reduced fee program can be used to correct this particular failure; if so, action will be needed by December 31, 2013 to take advantage of the reduced fee program.

Please contact one of the Patterson Belknap attorneys listed below if you would like more information on the IRS's relief program for 403(b) retirement plans.

Footnotes

1 The amendments pursuant to HEART pertain to changes in retirement plan rules for military personnel and their families. The amendments pursuant to WRERA referenced above pertain, among other things, to relief from 2009 required minimum distributions and the operation of a 403(b) plan with respect thereto.

2 The IRS has also made its Audit Closing Agreement Program ("Audit CAP") available to correct this type of compliance problem. Under that program, if the failure is identified during an audit, the plan sponsor can correct the failure and pay a sanction.

3 If all of the criteria for the special relief are not met, then it seems that a plan sponsor may still be able to fully correct for a failure to timely adopt amendments by submitting to the IRS's VCP (assuming it is otherwise eligible for the VCP) and paying a fee for a formal statement from the IRS that the plan has been appropriately corrected.

0 comments:

Post a Comment