The tax increases are scheduled to come primarily from the individual side of the tax code, with new Medicare taxes and the expiration of the 2001 and 2003 tax cuts. Partners and shareholders in pass-through businesses will be affected directly, and the tax increases will also affect executives and owners of other privately held businesses and even public companies.

Many businesses have begun considering whether 2012 is the year to reverse tax strategy and accelerate income and defer deductions. This should be approached very cautiously. First, you need to understand exactly which taxes are scheduled to increase and by how much, and how those increases would actually affect your business, its owners and its employees. You also need to understand the likelihood that these tax increases will actually occur. That's why it is prudent to prepare now but wait to act until the legislative outlook becomes clearer. This Tax Insights will help by:

- explaining exactly which taxes are scheduled to increase and the outlook for legislation to prevent it,

- discussing the factors you need to consider when deciding whether to defer or accelerate tax, and

- discussing the specific tax issues and planning ideas that need to be addressed.

What's really coming?

Tax increases under current law

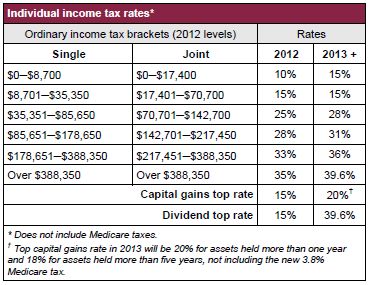

Both payroll and income taxes are scheduled to increase starting on Jan. 1, 2013 (see Tax Insights 2012-09 for a discussion of estate and gift taxes). Without legislative action, the 2001 and 2003 tax cuts will expire and new Medicare taxes enacted as part of the health care reform legislation in 2010 will take effect. The expiration of the 2001 and 2003 tax cuts would erase scores of benefits, including:- rate cuts across all income brackets,

- the full repeal of the personal exemption phaseout (PEP) and "Pease" phaseout of itemized deductions,

- the top rate of 15% for capital gains and dividends,

- the zero rate for capital gains and dividends in the bottom brackets,

- marriage penalty relief,

- the $1,000 refundable child tax credit and increased dependent care credit,

- the $12,650 adoption credit and $12,650 exclusion for employer adoption assistance,

- the employer credit for child care facilities, and

- several education-related incentives.

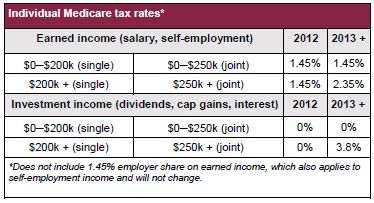

These tax increases will be compounded by additional Medicare taxes. First, the rate of the individual share of Medicare tax will increase from 1.45% to 2.35% on earned income above $200,000 for single and $250,000 for joint filers. The 1.45% employer share will not change, creating a top rate of 3.8% on self-employment income. In addition, investment income such as capital gains, dividends and interest will be subject for the first time to a new 3.8% Medicare tax to the extent AGI exceeds $200,000 (single) or $250,000 (joint).

The new tax on investment income will not apply to distributions from qualified retirement plans or active trade or business income. Active S corporation income not paid as salary will still not incur Medicare tax, as it is not earned income.

A two year partial payroll tax holiday, which cut the individual share of Social Security tax from 6.2 percent to 4.2 percent, is also scheduled to expire at the end of the year, but Social Security taxes are already capped annually ($110,100 in 2012).

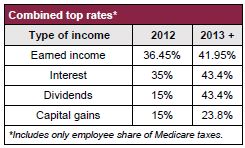

The combined tax increases would severely affect top rates on all types of income. The top rates on dividends, interest and earned income would apply when income reached the top tax bracket ($388,350 in 2012), though the Medicare portion would apply at the $200,000 or $250,000 thresholds. The top rate of 23.8% on capital gains would be reached at the $200,000 or $250,000 thresholds.

Potential for legislation

Congress has so far made little progress. Both parties held votes on separate plans to extend the 2001 and 2003 tax cuts before adjourning for the August recess, but these votes were largely vehicles to stake out campaign positions. No legislation is expected until after the elections, when lawmakers are likely to return in November to work on a lame duck compromise. In a similar process in 2010, the president agreed to extend the 2001 and 2003 tax cuts for two years, but an agreement may be more difficult this year.The bills voted on by Democrats and Republicans would both extend the tax cuts for one year, except the Democratic bill would allow the tax cuts to expire for income above certain thresholds ($200,000 minus the standard deduction and a personal exemption for singles and $250,000 minus the standard deduction and two personal exemptions for joint filers). Capital gains and dividends above these thresholds would be subject to a top rate of 20%, and PEP and Pease would be reinstated with phase-ins beginning at these thresholds.

Despite the political nature of the votes, they do offer insight into the outlook for eventual legislation. For one, lawmakers appear to have settled on an extension for just one year. A one-year extension is meant to give lawmakers time and leverage for a potential tax reform effort in 2013.

The votes also reveal that congressional Democrats are committed to campaigning on a promise to roll back the tax cuts above the $200,000 and $250,000 thresholds, although there may be room for negotiation in a lame duck session. Several Democratic lawmakers had previously floated the idea of extending the 2001 and 2003 tax cuts on income up to $1 million.

It may be significant that Republicans did not attempt to repeal the new Medicare taxes in their bill to extend the 2001 and 2003 tax cuts. Even though Republicans have already voted to repeal the Medicare tax in separate legislation, the failure to link repeal of the Medicare tax with an extension of the 2001 and 2003 tax cuts may make it more difficult to address the Medicare tax in a lame duck compromise on the other expiring tax cuts.

It is difficult to predict a final outcome. The results of the election will have an impact, but a bipartisan compromise will still be needed. If President Obama is re-elected, he will need to negotiate with Republicans in Congress. If Republicans take both chambers and the White House, they will still need to negotiate with Democrats in the Senate to overcome procedural hurdles. President Obama agreed to an extension of all the tax cuts in 2010, but he is now facing a more dire debt situation and has been more rigid in his calls for additional revenue. The extension of most of the 2001 and 2003 tax cuts remains likely, but the outcome for the tax cuts at high income levels is uncertain. The repeal of the Medicare tax may be an uphill battle given the current condition of the Medicare trust fund and the political sensitivity of the issue.

Considerations for determining whether to accelerate or defer

With the clear potential for tax increases, taxpayers may be tempted to accelerate tax into 2012 by deferring deductions and recognizing income. But a careful analysis of several factors should come first, and there are many reasons why accelerating tax is a bad idea.First, determine whether the tax increases will apply to your business. No tax increases are scheduled at the entity level — they will instead affect the income of your business's owners and executives at the individual level. Tax increases are also unlikely to affect any income below the income thresholds of $200,000 (single) or $250,000 (joint). And it's possible taxes won't increase at all. Accelerating tax in 2010 provided little or no benefit when the tax cuts were eventually extended. That's why it will be prudent to prepare now but act only when the legislative outlook becomes clearer.

Because the tax increases will apply at the individual level, it will be important to understand the tax situations of individual shareholders and partners. Taxpayers subject to the alternative minimum tax may not benefit from any acceleration in tax. In addition, when comparing current and future tax rates, it is important to remember that many taxpayers will be in a lower tax bracket at retirement. Finally, taxpayers with significant estates need to consider transfer tax consequences. Triggering gain can backfire if an asset otherwise would have received a step-up in basis at death.

You also need to consider the actual rate change versus the time value of money. The tax increases would affect many types of income in different ways. When thinking about accelerating tax, it is important to understand exactly how much tax would be paid in the future and how long you otherwise could have deferred this tax. Even at today's low interest rates, the time value of money will still make deferral the best strategy in many situations. You probably do not want to trigger gain on property you would otherwise have held onto for years just to avoid a capital gain rate increase from 15% to 20%. Economic considerations should always come before any tax-motivated sale.

Specific issues and planning ideas that need to be considered

Once you understand how the tax increases would affect the business, there are several specific issues and planning opportunities to consider before the end of the year. Even if it appears unwise to accelerate tax, you want to carefully evaluate your typical year-end decisions. Your business controls the timing of many income and deduction items for both owners and employees. Regardless of your strategy, it's important to recognize how these decisions will affect the timing of tax.Compensation

Businesses may have competing interests with employees. High-income employees may want to recognize income before tax increases take effect, while the owners of the business that employs them may want to save compensation deductions for the following year.Year-end bonuses will be important. Frequently, accrual method employers will declare bonuses before the end of the year and then pay them during the first 2½ months of the following year. This allows the employer to deduct the bonuses in the year they are earned, while allowing the employee to defer including the bonus in income until the following year. Either side of this strategy can be reversed. If a deduction will be more meaningful in 2013 for the owners of a business, accrual method taxpayers may consider purposely postponing when they will satisfy the "all events" test in Section 461, which determines when a liability is taken into account. Accrual method taxpayers can also postpone the deduction to 2013 by paying the bonus more than 2½ months after the end of the year. Alternatively, employees concerned about increased tax rates may benefit if the bonus is both declared and paid in 2012.

Employers seeking to offer employees a chance to avoid tax increases should be careful not to give employees a choice on the timing of bonuses and other pay because this will likely cause taxation on the first date the compensation is available under the constructive receipt doctrine, regardless of the employee's choice.

Employers can also consider accelerating the vesting dates of restricted stock grants and nonqualified deferred compensation (NQDC). Employees recognize income from restricted stock on the vesting date and Medicare taxes are due on NQDC at the time of vesting. In addition, employers can point out several individual tax acceleration strategies to employees, including:

- Exercising NSOs— The spread between the exercise price and the fair market value of nonqualified stock options (NSOs) is ordinary income when exercised. Exercising them early also starts the holding period for long-term capital gain treatment.

- Exercising ISOs— Taxpayers who will not hold incentive stock options (ISOs) long enough to qualify for capital gain treatment can exercise them and sell them before rates increase.

- Converting to a Roth account—Tax is due on the amount converted in the year of a conversion from a traditional IRA to a Roth IRA in exchange for no tax on future distributions.

- Accelerating Medicare taxes on NQDC— Payroll taxes (including Medicare taxes) are generally due on defined benefit NQDC plans upon vesting. Employers are allowed to postpone the payment of these payroll taxes when the value of the future benefit payments cannot be ascertained. Employers could reverse this approach in 2012 and pay payroll taxes on accrued benefits by using assumptions to calculate an estimate of the value of future benefit payments. Employees with earned income above $200,000 (single filers) and $250,000 (joint filers) would then avoid the increase in Medicare taxes from 1.45% to 2.35%.

Business-level deductions and income for pass-throughs

S corporation shareholders and partners in a partnership are taxed on business income at the individual level, so recognizing business income and deferring business deductions could accelerate taxes for owners.Many businesses have the power to control the timing of deductions and income based on the regulatory tests that determine when income is recognized or liabilities are taken into account. But be careful. Accounting method changes and other depreciation decisions can delay deductions, and decisions on advanced payments can accelerate income — but these decisions will continue to delay deductions and accelerate income incrementally in future years. It is NOT likely that there are many situations where these decisions will help.

Pass-through businesses, however, can easily control when to recognize capital gain. You can trigger gain and pay tax on stock and other securities without changing position. There is no wash sale rule on capital gains, so stock can be sold and bought back immediately to recognize the gain. If much of the net worth of your business is tied up in one asset because you're deferring the tax bill on a large gain, this might be a good time to reallocate that equity. Turning over assets besides securities will likely involve higher costs and more complications. Strategies that seek to recognize gain but allow a taxpayer to retain some control or use of the assets must satisfy rules that determine whether ownership has indeed been transferred effectively.

Taxpayers can also consider electing out of the deferral of gain recognition available for an installment sale. Deferred income on most installment sales can be accelerated by pledging the installment note for a loan.

Special opportunities exist for converted S corporations. Normally, distributions from a profitable S corporation are considered to come first from the income passed through to shareholders and taxed at their level. To prevent double taxation, these distributions are considered nontaxable to the extent they do not exceed the amount in the S corporation's accumulated adjustment account. However, an S corporation may elect to treat the distribution as first coming out of accumulated earnings and profits, and thus as being taxable. If insufficient cash is on hand, an election to make a "deemed" distribution is available under the S corporation regulations.

Special considerations for Medicare tax

The new Medicare tax on investment income includes an exception for active trade or business income and gain on the sale of trade or business assets or S corporation shares. Owners in pass-through businesses should start thinking of strategies to deal with the Medicare tax before it takes effect in 2013. If it is possible to reorganize business interests and activities so that they meet the test for active rather than passive income (without causing it to be considered self-employment income) this may save taxes in the future.Corporation shareholder strategies

C corporations will not face any tax increases at the entity level, but shareholders will be concerned with the tax on distributions and the capital gains rate on their ownership interests. While publicly held C corporations cannot realistically tailor action to suit thousands of shareholders in different positions, privately held corporations should have opportunities.The easiest way to allow shareholders to recognize income while the dividend rate is 15 percent is simply to pay dividends to them now. But many corporations will not be ready to distribute earnings. Instead, consider distributing dividends to shareholders with shareholders immediately recontributing the dividend back to the corporation — or issuing a note to shareholders. Mere bookkeeping entries may not be sufficient to accomplish the actual distribution and trigger the tax. Care should be exercised to ensure the dividend will be respected for tax purposes. It is also important to remember that distributions in excess of earnings of profit will reduce basis, which may be more valuable in the future if capital gains rates increase.

There are also corporate restructuring transactions that can be used to increase basis or trigger gains and dividends for shareholders. Transferring assets to a corporation in a transaction designed to fail tax treatment under Section 351 can trigger gains in assets and provide a step up to full market value in tax basis that the corporation then amortizes or depreciates. A transaction qualifying as a "cash D reorganization" under Section 368(a)(1)(D) can be used to trigger taxable income as a dividend or capital gain to shareholders. In addition to taking advantage of currently lower capital gain and dividend rates, in certain circumstances, these transactions can be structured with no income or dividend recognition pursuant to the Section 356 "boot within the gain" limitation.

0 comments:

Post a Comment