Many investors believe their aim should be to save a given amount -- a magic number. Rather than aiming to save a particular total, it's vital to consider how that total is going to be part of your retirement plan. There are two schools of thought: 1) Acquire enough principal to live on its interest at 6 percent, or, 2) Spend down annually.

Don't underestimate the importance of advance planning -- it can save headaches down the road. The first strategy of living off 6 percent principal works as long as it's enough to cover spending. Inflation, stagflation (the occurrence of a recession and high inflation due to the government infusing the money supply with extra cash), taxes, fluctuations in portfolio investments and other variables taken into account mean this isn't guaranteed. Diluting the money supply may be a macroeconomic band-aid; however, it can be a whopper for the retiree and may affect the classic "spending down" model.

Investors easily forget that the moment they begin spending down their principal that not only is their nest egg diminishing, but the earned interest is significantly less. Inflation and stagflation usually equate to spending more for the retiree -- so it's important to allow for variables as much as possible in your retirement plan.

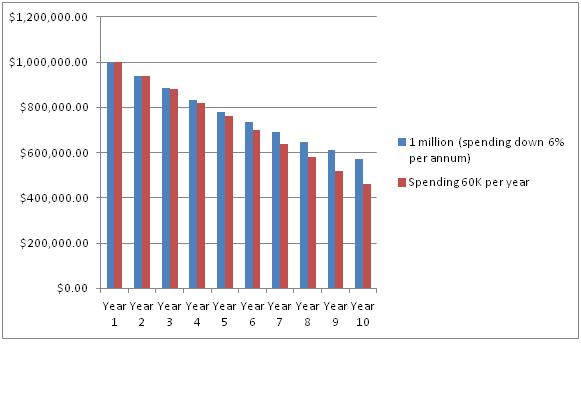

Here is a basic example of what can be achieved when planning starts early. Begin with $1 million dollars earning 6 percent interest, which is $60,000 ($5,000 per month for living expenses). However, many investors forget that once $60K is spent, there is no longer $1 million dollars, and, that amount is lessened each year. Not to mention that if the investor is used to spending $60K, it's likely that will continue. While the first few years may not show a noticeable difference, after 10 years, the investor is left with $460,000. At 6 percent that money will generate only $27,600 -- less than half of the initial $60K.

General wisdom encourages investors to save: maximize 401K plans (especially if they're matched) and take advantage of pre-tax plans such as a Roth IRA. As investors age, generally risk is not encouraged. But, is there such a thing as "too conservative?" Low interest rates will bring in lower returns and may diminish an investor's purchasing power. According to the U.S. Labor Department, there was a 39 percent loss in purchasing power between 1991 and 2011. If this trend continues, it is likely to reduce the standard of living for retirees and affect even those who have amassed millions.

So what are the alternatives?

• Know what you actually need from year-to-year -- retirement is no time to be in a guessing game about what will work and what won't.

• Consider alternative investment mixes. Experienced, competent, professional wealth managers have the know-how to create an integrated mix of assets and funds. Speak to a fiduciary to learn about what options are available.

• Manage your taxes! One of the mistakes investors make is to think that just because a paycheck isn't coming in anymore, taxes will be both easier and greatly reduced. Wrong! Taxable assets continue to need proper asset protection -- including the money an investor plans to live on in retirement.

0 comments:

Post a Comment