When it comes to the world of exchange-traded funds investors must be savvy about selecting the right investment to meet their goals while keeping in mind expenses, strategy, underlying holdings, tax ramifications, and other factors. Rarely are two ETFs created that are exactly alike, which is why it's important to thoroughly research and vet each ETF before you purchase it to make sure you understand what you are buying.

Expenses Matter

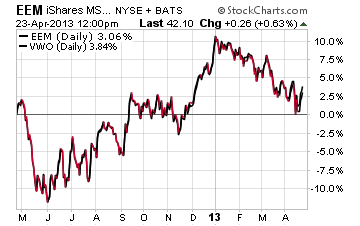

ETFs are touted for their low internal expense ratios which typically range anywhere between 0.04% to over 2.00% annually. But often times you will find ETFs with similar strategies charging vastly different fees. One of the most widely publicized examples of this is the expense comparison between the iShares MSCI Emerging Markets ETF (EEM) and the Vanguard FTSE Emerging Markets ETF (VWO). EEM has an expense ratio of 0.66%, while VWO charges just 0.18%. Put simply, EEM is over 3.5x more expensive than VWO.

As you can see on the overlay chart above, the performance of VWO vs. EEM is very similar over the last year with the Vanguard fund having a slight edge in total return. This may be attributable to its lower expenses, but the underlying holdings also play a part as well. While these two funds both invest in a diversified mix of emerging market stocks, their underlying indexes are slightly different - EEM tracks the MSCI index while VWO tracks the FTSE index. This may be one reason an investor would choose EEM over VWO when looking at these international regions.

In addition, many brokers such as Fidelity and TD Ameritrade are now offering commission free trading on a select group of ETFs which may provide you with some additional incentive to pick one fund over another. At the end of the day it's important to research and understand all of the expenses that you will incur with the purchase of an ETF so that you get the best bang for your buck.

Taxes Matter

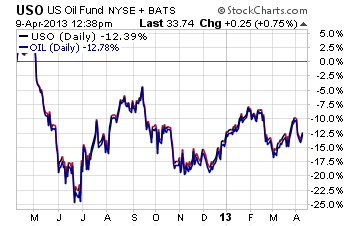

One of the hidden pitfalls of investing in certain commodity related ETFs is the tax ramifications of their legal structure. What I am talking about here is the difference between an ETF that is structured as a trust that generates a 1099 vs. being structured as a partnership that generates a K-1. One of the largest ETFs in the commodity space that is structured as a partnership is the United States Oil Fund (USO) which has nearly $1 billion in total assets. This fund is designed to track the daily price movement of West Texas Intermediate Crude Oil.

First time investors in USO, who haven't done their homework, will be surprised when they receive a K-1 in the first quarter of the new year for partnership income that doesn't correlate to their dividends or capital gains. The reason for this is that the fund must be structured as a partnership in order to participate in buying commodity futures contracts. When you purchase USO you are considered to be participating in the gains or losses of the partnership and thus receive a K-1 statement that must be dealt with on your tax return. This creates a tax headache for retail investors that can be easily avoided by purchasing the iPath S&P GSCI Crude Oil Total Return ETN (OIL).

OIL is structured as an exchange-traded note which means that it is an unsubordinated debt instrument that tracks the return of a specified index. While there are pluses and minuses of investing in ETFs vs. ETNs, the advantage in this case of purchasing OIL is that you do not receive the K-1 that you would with USO. In addition, as you can see by the chart below the two funds' performance (overlaid) is nearly identical. So you are receiving the same total return over time in OIL without the additional tax burden.

First time investors in ETNs should note that the performance and assets backing these notes are only as good as the financial stability of the issuer (in this case Barclays PLC).

Be Careful With Leverage

If there is one thing I have seen time and again devastate individual investors' portfolios, it is the use of leveraged exchange-traded funds. These sophisticated trading tools magnify the performance effect of the price movement of the underlying index, usually 2 or 3 times. Leveraged ETFs can be either long or short and in my opinion are best served in the portfolios of hedge funds, high frequency traders, and investment banks. These institutions have sophisticated trading patterns, disciplined risk management strategies, and investment mandates that allow them to utilize leveraged funds in a way that very few retail investors can duplicate. They can trade in and out of these vehicles with millions of dollars at lightning speed.

Another side effect of leverage is how its compounding effect over time erodes the tracking efficiency of the underlying index. Leveraged ETFs are only designed to track the DAILY price movement of an underlying index. Thus, investors should not expect that a 10% move in an index for a 2x leveraged ETF over a three month time frame is going to correlate perfectly to a 20% return.

One of the most well-known leveraged funds is the ProShares Ultra S&P 500 Index (SSO). Its investment objective is to track 2x the daily price performance of the S&P 500 Index. While there is nothing structurally wrong with this fund, I find its volatility to be far more dangerous than productive for most investors.

If you are considering purchasing a 10% allocation to SSO, I would recommend that you instead allocate 20% to either the SPDR S&P 500 (SPY) or the iShares Core S&P 500 ETF (IVV). Both of these funds give you single beta exposure to the same index without the added level of volatility and risk. Obviously there are situations where that wouldn't be possible given your portfolios' makeup and allocations, but it is an example of how you can accomplish a similar objective by increasing your exposure.

The Final Word

My advice for both professional and retail investors is to always thoroughly research any new investment before you decide to add it to your portfolio so that you understands its pros and cons. With the ETF universe growing so large there are generally many different ways to accomplish the same objective using different investment vehicles or strategies.

Additional disclosure: David Fabian, Fabian Capital Management, and/or its clients may hold positions in the ETFs and mutual funds mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. Fabian states, "Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article."

0 comments:

Post a Comment