It's important to note that many distributions normally consist of return of capital. They do this to provide a tax shield for unitholders. However, there is much more to the story, and investors should understand if they are comfortable with this sort of investing.

MLPs are typically great investments for a number of reasons. They provide a nice stream of income to unitholders. However, the tax complications arise when typically selling your units. If an MLP is distributing mainly a return of capital, then your cost basis will decrease to reflect that amount.

Here is an example:

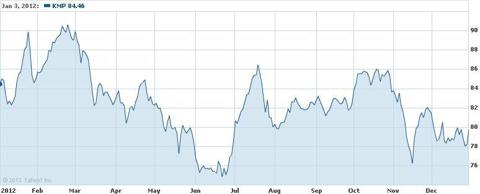

In 2012, Kinder Morgan Energy Partners (KMP) paid $4.85 in distributions to unitholders. To make our example simple, lets assume you acquired the units at the beginning of the 2012 and that the entire distribution was a return of capital.

So a unitholder initially starts with a cost basis of $84.46 per unit. This unitholder will continue to hold shares through 2012. So while doing this, the unitholder has collected $4.85 in tax-free return of capital. However, since this is a return of capital, your initial cost basis of $84.46 per unit will now be $79.61. So you will only have a tax liability when you sell your units above your new cost basis.

Distributions may not always be completely a return of capital. Often, it can be a mix of taxable income and return of capital. So knowing this, should you invest in MLPs?

I think the answer depends on the personality of the investor. In the example, if the investor chose to sell his or her units after receiving all the 2012 distributions, then they would now be on the hook for taxes. If you plan on investing and holding for a long time, then MLPs are great investments. The tax deferred treatment is really only a benefit if you hold long-term.

Think about it like time value of money. If the government gave you the option of deferring taxes for several years, wouldn't you do it? You could use the money saved from deferring taxes and reinvest it into an asset that generates a moderate return.

The type of investor qho should look into MLPs is someone that plans to hold for a long time. More importantly, it should be someone who reinvests the distributions to take advantage of their tax-free status. Eventually, you will have to pay taxes when you sell your units. Everyone has to pay taxes at some point, but by deferring it, you can use the savings to generate a higher return for your portfolio.

There are many great names out there in the MLP space with some strong yields. Breitburn Energy Partners (BBEP) has a yield over 9%. Energy Transfer Partners (ETP) yields over 7%. Boardwalk Pipeline Partners (BWP) has a yield over 7%. Enbridge Energy Partners (EEP) also has a yield over 7%.

Both Breitburn and Energy Transfer Partners recently announced secondary offerings. The offerings will help significantly clean up the balance sheet for the companies. They are likely to use remaining cash for accretive acquisitions.

Boardwalk recently formed a joint venture with Williams Companies for developing a pipeline from the Marcellus Shale to the Gulf Coast. The pipeline is eventually expected to transfer 400k barrels a day. Boardwalk has focused on pipeline projects in key industrial markets. Enbridge has also signed a three year deal with Phillips 66 to increase oil deliveries to refineries. The deal means that Enbridge will help transfer 40,000 barrels a day by end of the year. Long-term shareholders are likely to reap the benefits as oil delivery volume grows.

These are all great stocks that have strong tax-free distribution yields.

0 comments:

Post a Comment