This rundown of the major Web, mobile, and software options will help you decide which option best suits your tax situation. Users with relatively modest income and tax situations might be eligible for free Web-based tax preparation and e-filing. The small-fry websites are competent—but they’re not necessarily cheaper than the Big Three programs, let alone as polished. Of the three leading packages, TurboTax is the leader (and the most expensive), H&R Block can brag about its small army of tax pros, and TaxAct is the most affordable full-fledged option. A few mobile apps for smartphones and tablets are available, but they assume that your tax-paying requirements are pretty straightforward.

One more note: Pay special attention to what it costs to prepare your return using the software, and then what it costs to file the return electronically, as opposed to printing and mailing the return. E-filing fees can get especially high for state returns.

Who gets free Web-based prep and e-filing

Good news for many taxpayers with simpler returns: You might be able to prepare and file your federal taxes online for free. To qualify, your adjusted gross income (income after deductions) must be $57,000 or less, and you can’t have Schedule C self-employment or business income, complex investment income, or deductions beyond dependents and perhaps a home mortgage. Go through the IRS’s Free File page (you can’t get to the free options through the vendors’ webpages) to find participating vendors and their requirements—age range or military service, for example. Even if you don’t qualify for FreeFile, you can use the list as a reference guide for Web-based tax prep.

FreeFile covers only your federal return. Sites charge extra—usually around $30—for state returns. Generally, the less expensive the federal return, the more you’ll wind up paying for state tax prep and e-filing.

No matter how high your income, if you’re just looking for a way to fill out and file tax forms online using only the instructions provided by the feds, head to the Free File Fillable Formssection of the Free File site. You’ll find a list of supported forms and known issues to check out before you get started.

Taxbrain, TaxSlayer, and other Web options

Web-based services overtook desktop software in popularity several years ago, and it’s easy to see why. You don’t have to deal with installation or update hassles, and the services offer easy access from any standard browser. Most of the services on the FreeFile list support only Web-based tax prep.

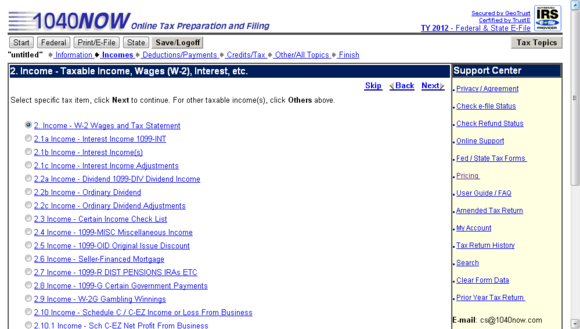

A dozen Web-based tax services, including heavily promoted ones such as eSmart Tax(formerly CompleteTax), Taxbrain, and TaxSlayer, compete with the Big Three for online filing business. All of them make it possible to file a tax return online, but they can’t match the big names in several key ways: handsome user interfaces, convenient features such as a data-import capability, and assistance from real tax pros. Some of the smaller sites are downright geeky: 1040Now, for example, presents forms in an outline format, as opposed to the Q&A, interview-style approach of more-polished services. Others provide little more than IRS form questions with basic definitions that you can get in the IRS instructions.

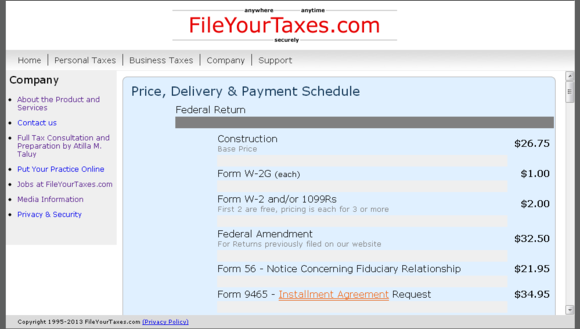

More important, the smaller players don’t necessarily cost less than the more full-featured services. TaxBrain, for instance, charges $15 to $70 for its online federal tax prep, depending on the complexity of your tax situation. State preparation and e-filing, however, add another $30 to the bill, so TaxBrain's total cost isn’t much lower than that of H&R Block at Home products.

Deciding among TurboTax, H&R Block, and TaxAct

The two 900-pound gorillas of the tax-prep game are Intuit’s TurboTax and H&R Block.TaxAct from 2nd Story Software caters to the budget crowd.

TurboTax, H&R Block at Home, and TaxAct all offer desktop software on media or as a download. Versions increase in price along with the complexity of your tax situation, and the sites explain the differences well. The most complex packages cover self-employed people or small business owners who file Schedule C for sole-proprietor businesses.

One major reason to stick with desktop software is if you want to prepare multiple returns: A Web-based service charges for creating a single return, usually with e-filing charges included. Desktop H&R Block or TurboTax software lets you create as many returns as you wish, and you may e-file up to five returns. TaxAct’s desktop software is available for $13 with electronic filing for one return and $8 for each additional e-file—or you can pay $20 up front for up to five e-files.

Things get more complicated if you also want to create and e-file state returns. Both H&R Block and TurboTax include software for a state return in all but their most basic download packages, but they charge extra for electronic filing of state returns—which is especially bad news if you have income in more than one state.

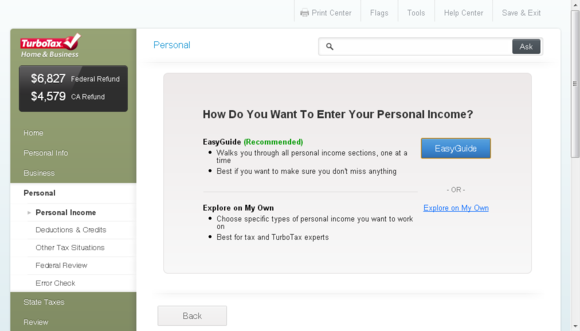

TurboTax leads in features—and expense

TurboTax costs more than the others, but it offers the best support for importing tax data from employers (W-2 forms) and financial institutions (1099 forms for investment income). Its user interface is polished, its integrated access to a huge user community is a great resource, and Intuit includes free access to tax experts if you have a thorny question. Prices range from Basic ($35 online, $40 CD or download) to Home and Business ($100 online, $110 CD or download).

The costs of preparing and e-filing a state return depend on which Intuit product you use. For any online version of TurboTax, state prep and e-filing together cost $40. If you purchase or download desktop software, the state e-filing costs $20 per state, with a maximum of three state filings per federal tax return. Buyers of a TurboTax Basic CD or download have the toughest deal: They must buy the separate TurboTax State package for $45 (it’s included in all other CD/download versions) and also pay $20 to e-file.

H&R Block offers free signoff from a tax pro

H&R Block, meanwhile, continues to use its huge network of tax professionals to chip away at TurboTax’s market leadership. Prices range from online consumer versions for $35 (Basic) to $75 (Premium), and downloadable versions from $30 (Basic) to $90 (Premium & Business). Yes, the Basic version is cheaper as a download than as an online service.

Block differentiates itself from TurboTax with its $100 Best of Both offering. Best of Both lets you prepare your taxes online using the service’s Premium software, and then submit your return to a Block tax pro. This person will review your return for deductions and credits that you may have missed and will then sign off as your tax preparer. The Best of Both package also includes audit support, an extra-cost option with TurboTax.

TaxAct is the best budget choice

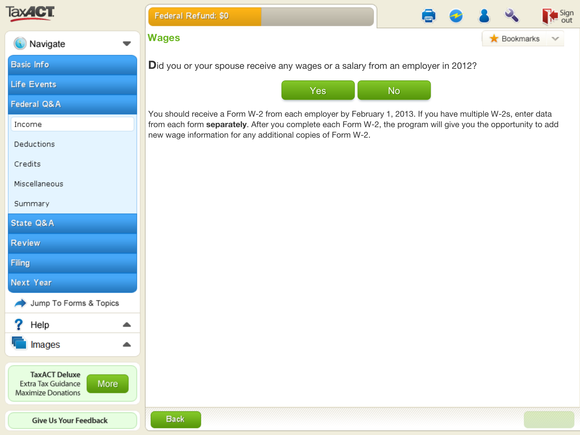

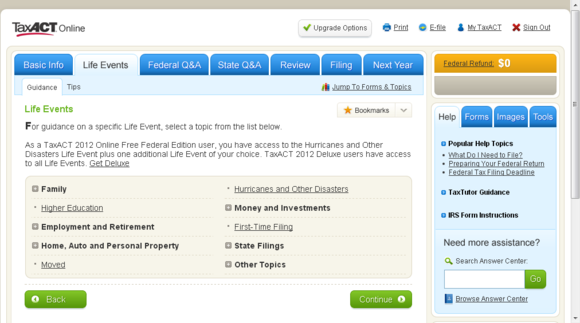

TaxAct continues to be a great deal for people who don’t need a deep dive into tax issues or access to a lot of tax-pro help. It offers a completely free federal return, e-file included. To file a state return, you must pay $18. For $2 more, you can get the same bundle with the Deluxe federal edition, which offers data import and other extras. Help with major “life events” is limited. This year, the free version covers hurricane damage and one other event.

That’s still a bargain compared to just about all of the smaller Web-based tax prep services, and TaxAct has a pleasing user interface and some useful data-import options. It can import from the investment-tracking site GainsKeeper, for example. You do have to pay extra for some services that are free with other apps—for example, storing a previous year’s data.

Tax prep via smartphone or tablet remains limited

PC-based solutions remain the best option for most users, because tax-prep apps for tablets and smartphones are still scarce and pretty limited. Intuit’s pioneering SnapTaxbegan a couple of years ago as an iPhone app and is now available for Android devices (version 2.1 or later). With SnapTax, you photograph your W-2. The app includes OCR (optical character recognition) software that fills out tax forms using data it draws from the image.

Not everyone can use SnapTax. One limitation is that you can have only W-2 forms, and interest or unemployment income not exceeding $100,000 ($120,000 if married and filing jointly). You also can’t claim a deduction for home mortgage interest. This year, for the first time, you can claim deductions for dependent children and daycare expenses. SnapTax costs $25 (covering federal and state e-filing).

H&R Block beats that with an iPhone/Android app that’s free—if you can file a 1040EZ form (meaning that you can’t claim dependents). It uses the same method as SnapTax, of camera-phone snapshots and OCR software of W-2 forms. You can e-file both federal and state returns for $10. Block does offer a few extra-cost in-app upgrades: For example, it charges a $5 smart-import fee for importing W-2 info (the OCR is for income values only).

TurboTax offers its full suite of tax software for the iPad, with the ability to store your data online for easy access. The iPad app incorporates the OCR capabilities in SnapTax so you can photograph your W-2. There’s no price advantage to using the iPad app.

H&R Block has an iPad app, too, but it just mimics the free, and very basic, Web-based version. It’s a free app with free e-filing for your federal return. State returns cost $28.

TaxAct has iPad and Android apps that integrate with its online software, so you can start your return in a desktop browser and pick it up on your tablet, or vice versa. But you can’t work on your return if your tablet isn’t connected to the Internet. The apps are free, and the online pricing applies.

The big players offer a smattering of apps tor checking on the status of a refund, too, but you can go straight to the source: The IRS has a Get Refund Status page that provides the latest information if you enter your taxpayer ID, your filing status, and the amount you’re expecting.

The better your data, the better your tax return

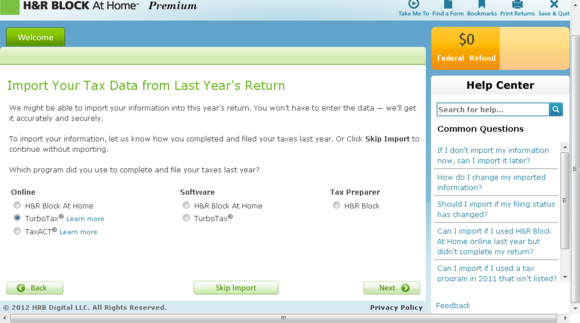

Switching tax-prep services can be tempting, but proceed with caution. You’ll want to look into a prospective new service’s support for importing last year’s return info—especially if items such as depreciation may affect your tax bill. Almost all vendors make it easy for returning customers to retrieve this information, and a growing number make switching to them easier by adding the ability to import a saved PDF.

One final piece of advice: No matter how capable your tax software or service may be, the job it does is only as good as the data you give it. Be sure to gather all of your financial records before you get started, and be prepared to spend time on data entry, especially if you’re counting on deductions to reduce your tax bill. Even if your software supports data import from personal-finance programs, you should review the results for accuracy. Tax software can do the math and bring deduction opportunities to your attention, but ultimately it’s up to you to deliver the numbers that it crunches.

0 comments:

Post a Comment