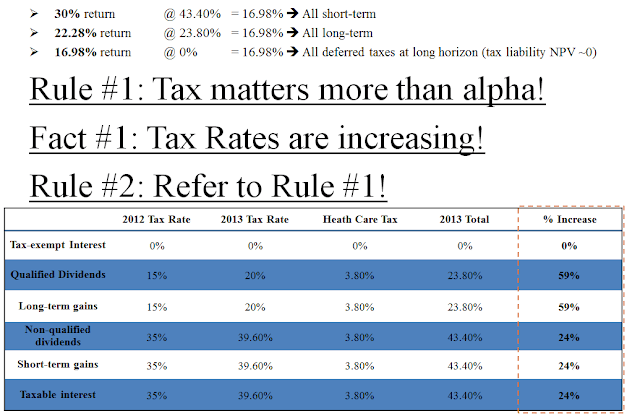

Most advisors have a lot of clients in the highest tax bracket, so this is quite applicable. It’s pretty clear that the most tax efficient way to get growth is through long-term capital gains, and the most efficient way to get an income stream is through tax-free bonds and qualified dividends.

Two things strike me about these tax rates. 1) I would rather not pay them, and 2) It makes sense to think about how to structure your investment accounts and investment strategies to be tax efficient.

Tax-deferred accounts like IRAs and 401ks are perhaps even more valuable now that rates have gone up. It might make sense to stuff in as much as you can. For taxable accounts, muni bonds are even more attractive than before. And equity strategies that cut losses and let the winners run (like relative strength) are going to be helpful due to their tax efficiency. It also occurs to me that ETFs, especially those with smart beta that aim for market-beating performance, could be very attractive because of their tax efficiency. (I’m partial to PDP, PIZ, PIE, and DWAS, but the point is generally applicable.)

0 comments:

Post a Comment