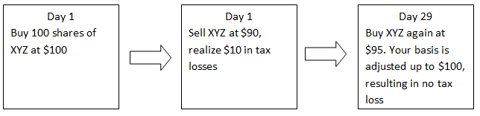

Constantinos (Dean) Pagonis for Seeking Alpha writes: Tax loss harvesting: The trick the IRS does not want you to know about. The IRS has a not so fun rule called the wash sale rule. The gist of the rule is that if you sell a security, you cannot buy back the security or a security that is materially similar for thirty days. You have to wait until the thirty-first day to repurchase the security. If you do buy back the security, the IRS will adjust your basis, or cost at which you calculate your gains on your original position, back up to the original sale price.

The Wash Sale rule

It's a very good thing that the tax code is written by and for the wealthy because the IRS has a huge loophole that allows you to take a tax loss and keep holding the same exposure to your asset class. The IRS will only consider a sale a wash sale if the security you purchased is materially similar. If the security follows a different index or is constructed using a substantially different methodology, than the IRS will likely not consider the security materially similar.

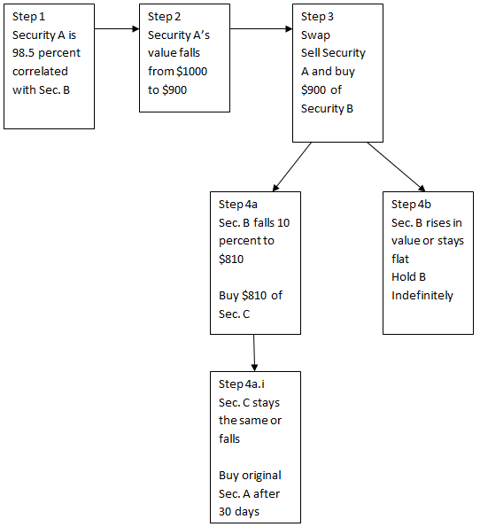

For example, swapping from SPDR S&P 500 (SPY) to iShares S&P 500 (IVV) would probably not be permitted as both securities follow the same index and are constructed almost identically. However, the IRS does not care at all about the correlation of two assets. As a result, you can swap between two securities that are highly correlated but follow different indexes. For example, iShares Dow Jones Industrial (DIA) is 98-99 percent correlated to the S&P 500, meaning it will provide a virtually identical return in short run, but because it follows a different index, the IRS will most likely allow the swap. Please consult a tax attorney and CPA before making a decision on the taxability of a tax loss harvest transaction.

Note: It is theoretically possible to use a tax swap for individual stocks in the same industry, such as Coke (KO) and Pepsi (PEP), but it is not advisable because company-specific risks can make correlations change drastically, especially around earnings releases.

Why tax loss harvest?

Tax loss harvesting allows you to maintain an investment in a particular asset class while simultaneously booking a tax loss. When done correctly, tax loss harvesting costs nothing other than trading commissions and gives you a tangible tax savings that you get back. It is one of the few truly free lunches. Short-term tax losses (less than one year) can be used to offset $3,000 in income and offset any other short- or long-term gains you generate. Long-term tax losses can offset other long-term gains. In falling markets, tax loss harvesting allows you to bank losses that you can use in the future to eliminate gains that you develop as the market rises.

A tax loss's value will vary according to your tax rate. To calculate the value of a short-term tax loss, multiply the dollar value of the tax loss by your tax rate. For example, if you are in the 25 percent tax bracket and the tax loss is $200, you would receive a benefit of $50 ($200 times 25 percent, or $50). Long-term capital gains are taxed at 15 percent, so simply multiply the tax loss by 15 percent.

How to tax loss harvest or tax swap

The first step in tax loss harvesting is identifying three or more swap candidates that are highly correlated to your security. Why three or more? When the market is falling you may be able to initiate multiple tax swaps, so you need to prepare for that eventuality. Thus, when the security falls, you are in a position to swap. Put the most correlated security as your first swap candidate, the second most correlated as your second swap, etc.

If you have access to a Bloomberg terminal, you can simply pull each security's correlation to one another. People outside of finance can calculate correlation by taking the returns of both securities from Yahoo Finance's historical prices data, converting the prices to price changes, and then using the correl function in Excel to calculate correlation. An even easier method is to simply Google the tax loss swap you want to complete and see if it is recommended by others.

Establish a threshold for tax loss harvesting. I usually use a 5 percent loss as a good minimum, but on smaller positions where commissions are high as a percentage of the transaction, you may want to use a higher threshold, such as 10 percent. Once you have identified a threshold and multiple swap candidates, sell the security that you want to take a loss on and buy the swap security. After thirty days, if the security continues to fall or stays at the same level, sell the security and swap back into the original security. If the security falls more than 5 percent below your purchase price at any point, you can swap into your second candidate, but it will restart the thirty-day clock. If the security rises, maintain your position in the security indefinitely.

Steps:

- Identify three tax swap candidates that are 98-99 percent correlated.

- One of your securities falls more than 5 percent below your purchase price

- Sell the security and buy the first swap candidate.

- Swap security goes down more than 5 percent in less than thirty days. If it does, sell the first swap security and buy the second swap security. If the second swap security continues to fall 5 percent below your purchase price, swap the second security for the third, or if thirty days have passed, purchase the original security.

- Thirty days have passed and the swap security has risen in price. Hold the security indefinitely.

- Multiply the dollar value of each loss by your tax rate to get the value of the tax loss.

Tax loss harvesting

0 comments:

Post a Comment