Alex McAdams for Nerd Wallet writes: Among the long list of perennial debates (coffee or tea? boxers or briefs? Mac or PC?), perhaps none is more likely to elicit blank stares and confused looks than the question “What’s the best way to file my taxes?”. The enormous complexity of the tax system and the constantly changing rules and regulations surrounding tax make it difficult to even know where to start. As a result, it’s easy to make a mistake when figuring out the best way to file your taxes.

We get it, and we’re here to help.

Just in time for deferred tax season (October 15 is coming up faster than you expect!), here’s NerdWallet’s definitive guide to preparing your taxes. In this 5 part series, we’ll walk you through the different options and highlight NerdWallet’s picks for the best way to file your taxes. Along the way, we’ll also offer some tips and tricks to make the process easier, faster and less migraine-inducing.

The Contenders

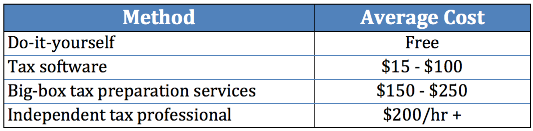

First off, it’s important to understand what your options are when it comes to filing taxes. Despite the apparent myriad of choices, there are really only four basic ways to get your taxes prepared (click the links below for more details on each approach). In order of increasing cost, they are:

Do-it-yourself is exactly what it sounds like: sitting down with a pencil and paper to hammer out the numbers the old-fashioned way. Slide-rule optional.

Tax software like TurboTax helps guide you through the process with easy prompts and automated forms. You can buy it at office retail stores, or just download it directly.

Big-box tax preparers are chains that handle upwards of thousands of tax returns each year in a given location. The biggest names are H&R Block, Jackson Hewitt and Liberty Tax.

Independent tax professionals tend to be much smaller operations, working with a limited number of clients. They tend to gain clients through word-of-mouth referrals and are often run by a single tax professional.

Pro-Tip: We’re talking about options for how you can prepare your taxes and calculate what you owe. When it comes to actually submitting your taxes to the IRS, there are only two options: electronic or on paper. According to the IRS, over 80% of people filed their returns electronically in 2012. That makes sense: e-filing is cheaper, faster and results in a more timely refund. Even if you prepare physical copies of your returns, it almost always makes sense to submit them electronically.

How to Assess the Complexity of Your Tax Situation

The most important factor in choosing how you should prepare your taxes is how complex your tax situation is. Note that complexity is NOT determined by the size of your paycheck. “How do you make your money?” and “Do you qualify for special deductions?” are much more important questions than “How much do you make?”.

For the vast majority of people, a couple of quick questions can determine whether you tax situation is complex:

- Do you own a home?

- Do you have lots (>$10,000) of investment transactions from the past year?

- Are you self-employed?

- Are you itemizing your deductions?

- Has your life situation recently changed? (marriage, divorce, grandma moving into your basement, etc)

If you answered “No” to all of these questions, then your tax situation is likely straightforward. While going over all the details with a fine-toothed comb could yield additional savings, the impact is likely to be marginal. If, on the other hand, you answered yes to these questions, a more detailed inspection could be in order. Not only can it dig up bigger savings, but it can also help make sure you have your bases covered in case you get audited.

How You Should File: the Quick Answer

While there’s no perfect solution for everyone, tax software or hiring an independent tax professional is the best option for most people. Deciding between these two comes down to how complex your tax situation is:

- If you don’t have a complex tax situation (i.e. you answered “no” to the questions above), then tax software will likely cover all your needs.

- If you answered yes or are looking for in-depth tax guidance (like estate planning), then a professional will likely be your best bet.

Generally speaking, you’ll want to avoid the do-it-yourself approach and big-box tax preparation services. Unless you fit some very specific circumstances, these approaches are far from ideal. They tend to lack the benefits of other options and carry significant drawbacks of their own.

Of course, the devil is often in the details. Check out our full guide to the different tax preparation methods below to learn more about the best way to prepare your taxes and find the one that best fits your situation. We’ll also highlight tips and tricks for getting the biggest refund and making taxes easier and faster.

Other Links:

0 comments:

Post a Comment