Intuit operates in four segments; with its small business group the company offers financial, employee, and payment management solutions; in the tax segment it mainly offers consumer tax solutions and has an army of professional accountants to handle small to large commercial tax issues for corporations; in the financial solution segment it offers both mobile and online banking solutions to a range of customers; and in the other businesses segment it has various local and global business.

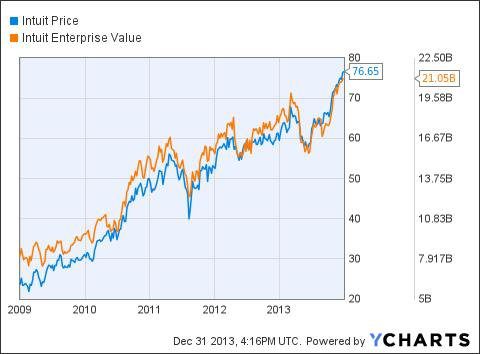

Intuit (NASDAQ:INTU) has built its business with a strong financial health that offers investors resilient profitability, steady cash flow, and management efficiency. Over the last 12 months, Intuit’s stock price has climbed from US$ 55.54 per share on January 2, 2013 and is currently trading at US$ 76.64, as of December 31, 2013; representing a gain of 38 percent. During the same period, this company has increased its market capitalization from below US$ 16 billion to over US$ 21 billion.

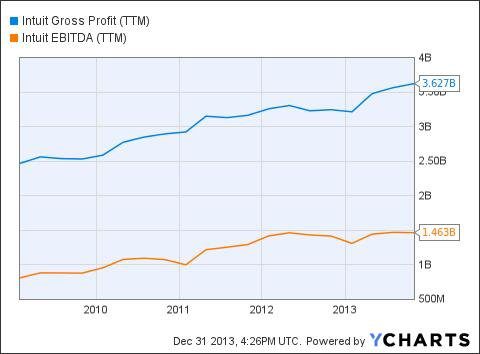

As the company continues to remain profitable with a large sum of free cash flow, it had the financial might to buy up competitors. During 2013, its board approved the acquisitions of Elastic Intelligence Inc., Good April, and Level Up Analytics Inc. This month, it bought popular document sharing site for small businesses, DocStoc. These strategic acquisitions indicate that management is expecting to grab more market share that will eventually lead to revenue growth. However, Intuit has also walked the talk with steady growth in gross profit margin since 2010!

As a growing company with a lot of acquisitions in recent months, currently Intuit (NASDAQ:INTU) is trading with a forward P/E ratio of 24 and an earnings-per-share (EPS) of 2.72. It also issued regular dividends to investors, unlike most other technology based growth companies we see in the media these days. Growth investors should consider taking a look at Intuit stocks as it has an enormous upside potential based on solid growth prospective.

0 comments:

Post a Comment