I started by placing a phone call to their advisor information line. I was told that the mutual funds were not actually mutual funds at all, but variable annuities that were designed to closely track the underlying mutual funds. In fact, I was told that there was no ticker symbol that they could give me to track the actual product my clients were invested in. Now I was really intrigued. A little more digging and I discovered that variable annuities that track underlying mutual funds contain a thin layer of insurance protection -- and a fat layer of extra fees. How much in fees is anyone's guess, it is not easily discoverable information. The disadvantages of the 457 plan compared to the 401k are numerous and beyond the scope of this article (however if there appears to be interest I will write an article specifically geared towards that audience). What this exchange opened up to me was a need to take a closer look at fees.

Most of the audience of Seeking Alpha I would imagine are stock traders. As stock traders with relatively high numbers of round trip trades we quickly realize the value of lower commissions in our trading. However, lower is not necessarily better. Early on in my trading career I tested using a broker that offered near $0 commissions on market orders. While watching a Level 2 quote screen I would execute a "buy at market" order from my discount broker and my fill would be 0.25 above the Ask. On a 100 share lot, that's $25, well above the commission charged by the discount brokers that allow direct routing. So much for zero commission trading.

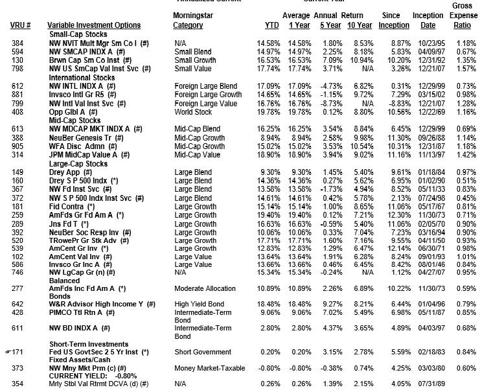

For mutual funds and ETF's we now have a fantastic tool created by FINRA, called the Fund Analyzer. Found here:apps.finra.org/fundanalyzer/1/fa.aspx. Using this tool I took another look at one of my clients statements from his 457 plan. This is a typical statement that shows the funds available, the transaction page shows total gains and losses with no mention of fees.

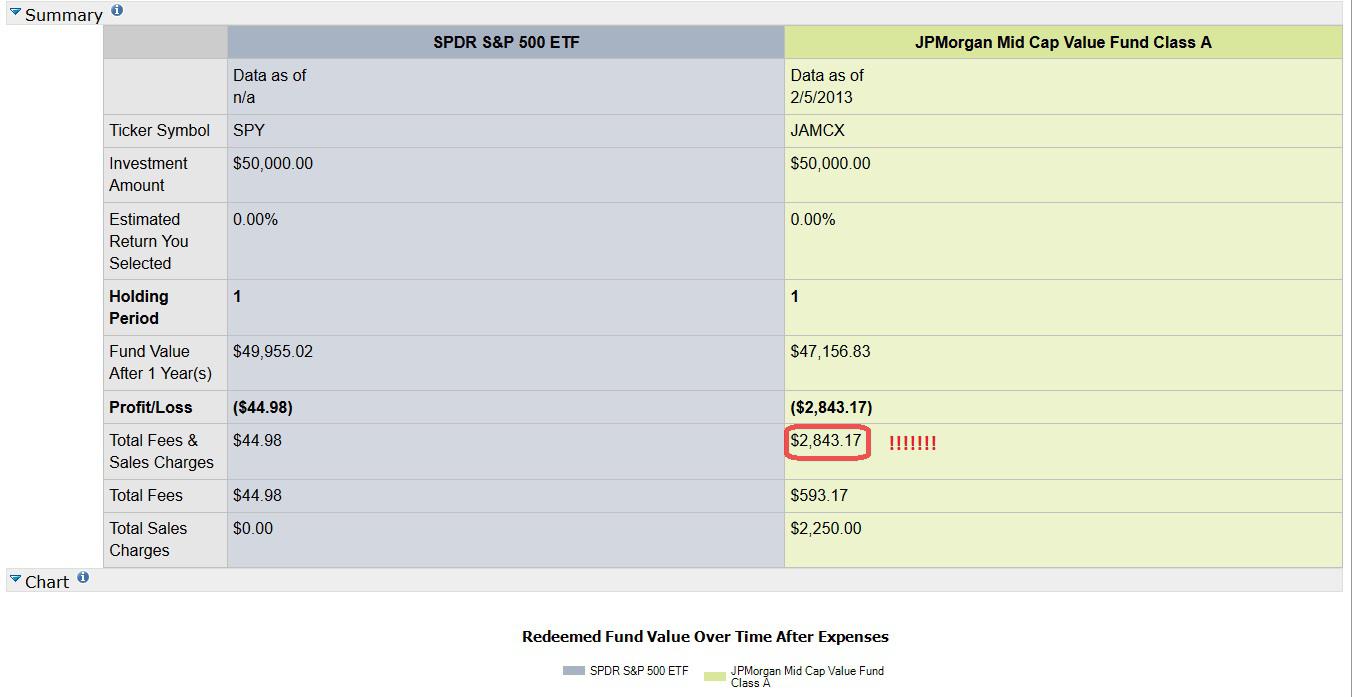

Nothing to indicate the potential minefield of fees we have just wandered into. Let's take some of these funds and type their tickers into FINRA's mutual fund analyzer. For comparison I will include the S&P 500 Spyder ETF (SPY), all assumptions will be equal with a 0% return and an investment of $49,000 (to highlight only the fees portion).

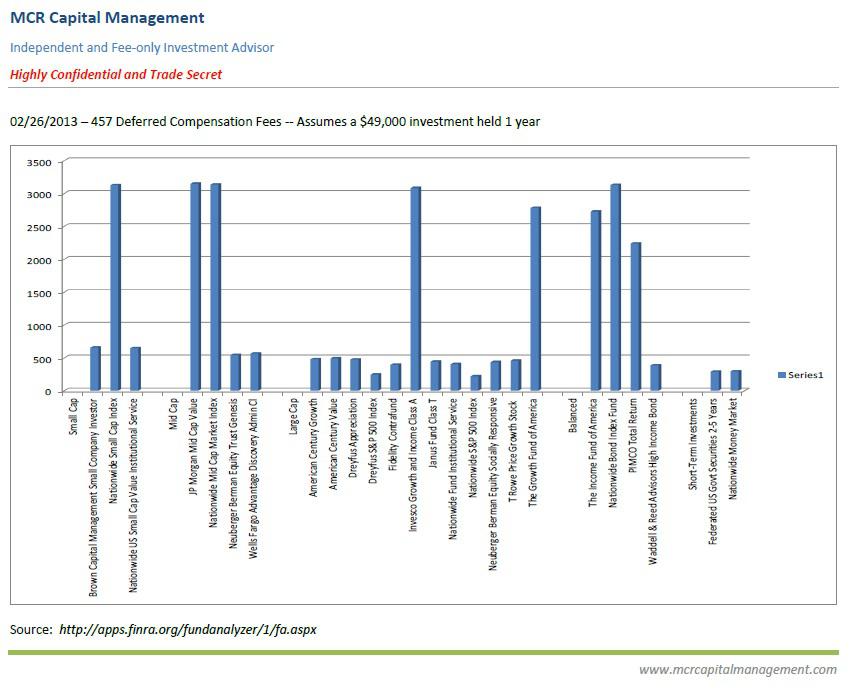

I then added the rest of the tickers and created this spreadsheet for my clients involved in this plan.

You can see that there are more than a few "fee land mines" in this client's retirement plan.

With volatile and uncertain markets sure to remain in the foreseeable future avoiding excessive fees is going to be key to all of us reaching our retirement goals.

0 comments:

Post a Comment