- Municipal bonds continue their recovery from a dismal performance in 2013.

- Leveraged muni bond closed-end-funds offer opportunities for high, tax-exempt yields at discounts to their net asset values.

- The four muni bond CEFs discussed here have shared in the muni bond recovery but their market prices have not kept pace.

- These funds present attractive entry points for today's muni fund buyer.

Continuing the theme of Municipal Bond Closed-End Funds, I want to expand a bit on my previous look, and present three more attractive opportunities for the investor looking for yield in the tax-exempt arena. Following yesterday's lead from my article on BlackRock Investment Quality Municipal Trust (BKN), I'm looking for yields better than 5.8% (preferably over 6%), a solid discount to NAV that appears out of line with recent price moves for the fund, and portfolio quality that an investor with some reasonable risk tolerance will find appropriate.

After a dismal performance in 2013, municipal bonds have been moving up since the beginning of 2014. The Barclays Municipal Trust Index is up 4.22% YTD. Muni bond ETFs are up - 2.09% (MUNI), 3.72% (MUB) and 6.23% (PZA).

As Seeking Alpha CEF guru, Doug Albo, has pointed out, market price is often a trailing indicator for CEFs. Accordingly, an investor can sometimes find bargains by tracking recent movements in NAV that are running ahead of movements in the market price. Doug Albo applies this approach to equity funds, and it may not translate cleanly to fixed income CEFs where premium and discount changes tend to be more closely tied to distribution yield. Regardless of the differences, I think one can identify potential for price increases and, perhaps more to the point, attractive entry points by looking closely at recent moves in the premium/discount among categories of funds beyond equity.

Yesterday's pick, BKN, led the pack for this criterion. It also has, in my view, solid credit quality and a reasonable yield. Today's added choices may not measure up in all areas, but some exceed BKN's appeal in one or more. All are, in my view, worth a hard look by an income investor looking for some tax relief for 2014.

The Funds

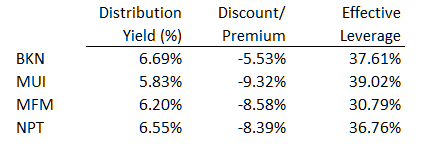

In addition to BKN, I offer for your research three closed-end, tax-exempt, municipal bond funds. One each from BlackRock, MFS and Nuveen: BlackRock Muni Intermediate Duration Fund (MUI), MFS Municipal Income (MFM) and Nuveen Premium Income Muni 4 (NPT). Summary data for the 4 CEFs are in the table:

BKN is rated 4-stars by Morningstar, each of the others get a 3-star rating.

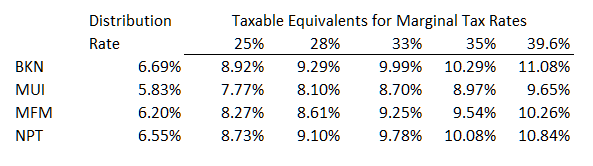

Every site I've ever looked at that discusses tax-exempt bond yields lists taxable-equivalent yields. This is invariably based on the highest marginal tax bracket. Because few of us reach that income level, I've calculated equivalent yields across the spectrum of marginal tax rates in this table.

Recent Performance

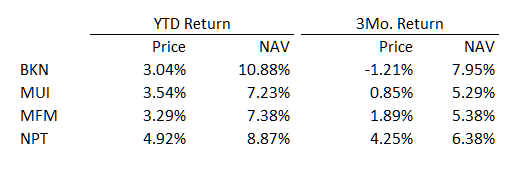

Each of the four funds is up year to date. At the same time, the price for each lags its NAV on YTD total return:

To put these values in perspective, for the 100 national municipal bond funds returned by the cefconnect.com screener the median return YTD is 8.22% (market) and 8.71% (NAV). Thus, while all 4 funds are well behind the pack in return on market price, BKN and NPT are beating on NAV, with BKN beating by a substantial margin.

Discounts Are Attractive Relative to Recent History

The Z-statistic (also called Z-score or Standard Score depending on the context) is a statistical measure of variation of a value from its mean value. For a CEF, the Z-statistic can be used as an indicator of how a fund's current discount/premium varies from its average discount/premium. For ease of discussion here, I'll consider funds with a discount only. For such funds, the Z-statistic is calculated by subtracting average discount from the current discount and dividing the result by the standard deviation of the discount:

Z-statistic = (Current Discount - Average Discount)/Standard Deviation of Discount

A negative Z-statistic indicates the current discount is lower than the average discount. The magnitude of the Z-statistic indicates how much lower. If normally distributed, the mean value for the Z-statistic is zero and its distance from zero indicates the probability of the Z-statistic. A Z-statistic of -1 would be expected to occur less than 15.9% of the time and -2 is expected less than 2.28% of the time.

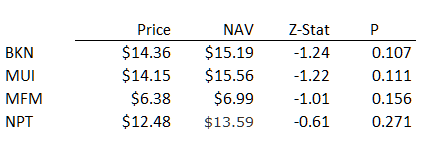

Z-statistics for the 4 funds based on one-year discount histories are tabulated below. I've also included P values which indicate the probability of the fund's current Z-statistic.

As the table shows, current divergence of discount from mean discount would be expected at present levels as infrequently as 11% of the time for BKN and MUI, 16% of the time for MFM, and 27% of the time for NPT. I submit that it is, therefore, not unreasonable to expect a reversion to the means going forward. If one considers that muni bonds will continue to recover, these funds will likely see their market prices move higher at rates greater than the broader muni bond fund universe. Even without that movement, there is little likelihood of a near-term erosion of the discount.

Portfolio Characteristics

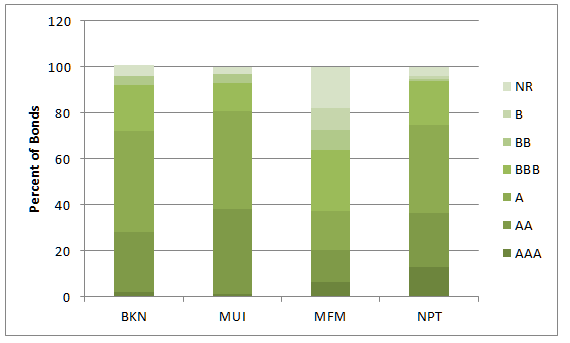

This chart shows the credit quality for the bonds comprising the 4 funds:

From the chart, I would say that NPT has a more attractive distribution overall, although Morningstar lists its weighted average credit rating as BBB, the same as BKN and MUI. MFM is listed as having a BB+ weighted average credit rating.

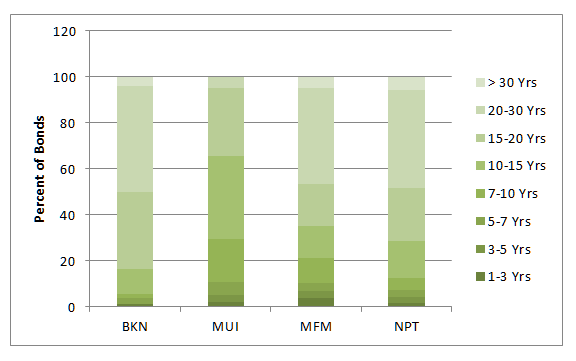

This chart depicts bond maturity breakdown for the funds:

Note that BKN has the longest maturity portfolio of the set and MUI has the shortest.

Summary

For a more detailed look at BKN, one might check out my previous report found here.

All four funds listed are paying out attractive tax-exempt yields at or near median values for comparable closed-end funds. They present attractive value for a new buyer seeking opportunities in tax-exempt municipal bond funds because their current market prices have failed to keep pace with the recent run-ups in NAVs.

There is an assortment of funds here to choose among depending on how an investor chooses to position muni bonds in an overall portfolio. BKN has the highest yield and the most extreme Z-score, but it also has the greatest interest rate sensitivity due to the long maturity of its portfolio. NPT offers a strong yield as well, coupled with a somewhat more attractive credit quality than the other funds, and less interest rate sensitivity than BKN. While its relative discount is favorable, its Z-score is the closest to zero for the set. MUI with the shortest duration affords lowest yield. Along with its BlackRock sibling, it appears to be attractively priced relative to its NAV and average discount status.

0 comments:

Post a Comment