Xero does a great job of showing you how much sales tax you have collected, but our new TaxJar/Xero integration takes that one step farther. TaxJar helps you slice and dice what you owe to each state and when. We even break this down by tax jurisdiction for those pesky destination-based states that require an extremely granular sales tax return.

While sales tax and accounting may not be “simple” anytime soon, combining these two small business finance management services together gets you as close as possible to automating your small business accounting and sales tax compliance.

How Xero and TaxJar Work Together for Your Business

Not convinced? Here’s a quick rundown of how it works so you can see how much simpler your business life will be.

When Xero pulls your ecommerce order history, TaxJar will automatically look up the sales tax collected through each state, city, and beyond. In no time flat you’ll know how much you owe to each state. On top of that, you also know when you need to pay these amounts. This is incredibly helpful for sellers with sales tax nexus in multiple states, considering how varied the due dates can be across the nation.

TaxJar will even create “bills” within your Xero account to let you know how much sales tax you have due, and when. No more dealing with calendar alerts, spreadsheets or tax tables to ensure you pay your sales tax on time!

Filing sales tax with a state’s taxing authority isn’t the whole story, though. You also need to keep accurate track of these numbers so you better grow your business. After all, it’s part of the reason you signed up with Xero in the first place. Keeping good records of your finances frees you to make your business truly thrive.

So that’s why we made sure to also focus on improved accuracy of your Xero ledger. Instead of trying to remember the totals or using guesswork, TaxJar now updates Xero with all the latest sales tax totals. Now you really know how well your business has been doing, and you can adjust accordingly.

Ease of Use

As mentioned, sales tax is never really going to be “simple.” In fact, states are going out of their way to make things tougher and tougher to make what they deem a more fair playing ground in business. Basically states want tax revenues from eCommerce, and they keep trying new and novel ways to collect it.

But this is where companies like Xero and TaxJar shine, especially when they work together. As complicated as online sales tax is, we’re determined to make it that much easier. That’s why we’re glad to be working with partners like Xero who know that running a business takes a lot of work and are just as determined as we are to streamline the process for everyone.

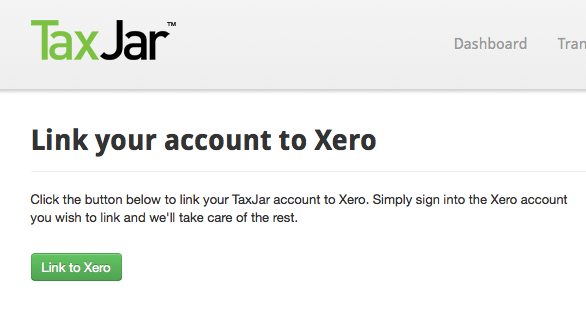

So the next time you think about sales tax and are stressing about the filing frequency or how to figure out all the tons of districts and states and their various sales tax rates, just pull up your Xero account and link your account with TaxJar. We promise to reduce your stress level as much as we can.

Confused about sales tax? Our Sales Tax 101 for Xero Users will answer your questions and get your Xero/TaxJar integration set up as quick as you can enjoy a peanut butter and jelly sandwich!

0 comments:

Post a Comment