Red Rock Wealth (Investment Management) writes: Tax time is a real pain for most people, and your investments don’t make things any easier. There are different rates and treatments for stocks, bonds, commodities, mutual funds, exchange traded funds (ETFs), exchange traded notes (ETNs), long term gains, short term gains – it goes on and on.

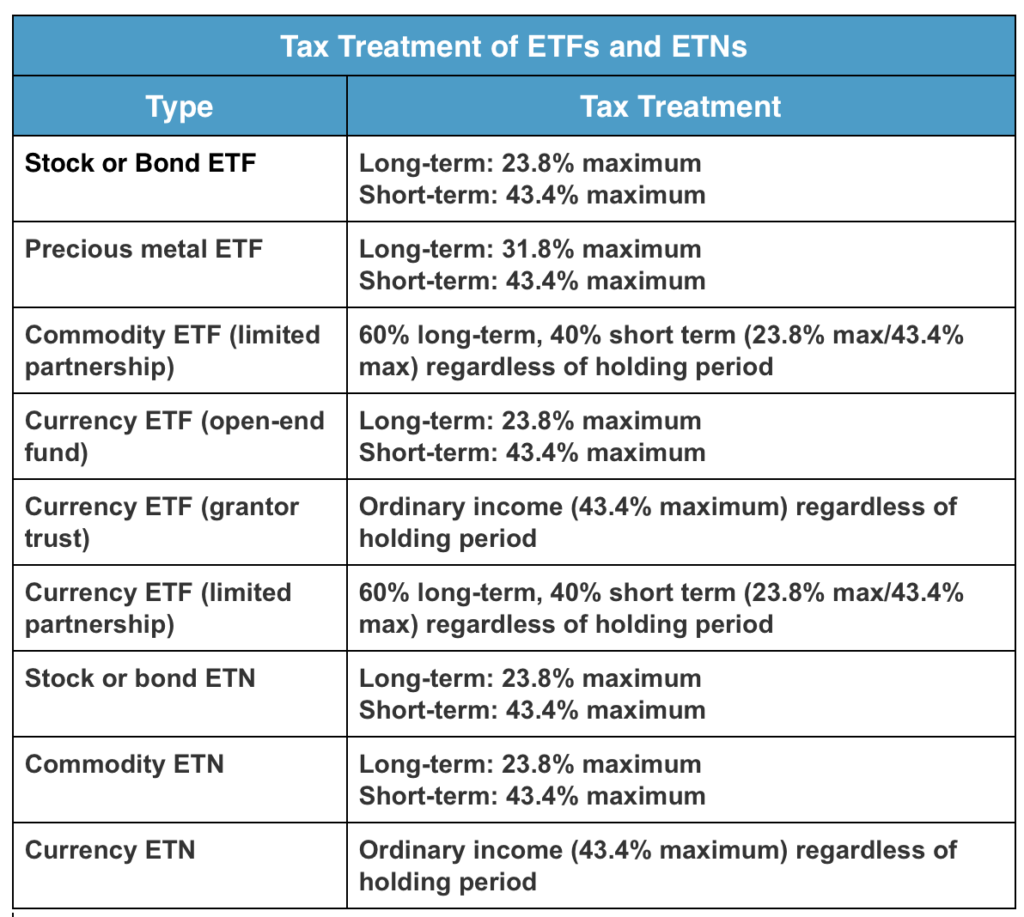

ETFs and ETNs are similar, but they tend to be taxed differently based on the underlying investments they hold. For example, stock and bond ETFs are treated the same as the stocks and bonds held within the fund. Stock ETFs are fairly tax efficient because they don’t distribute large amounts of capital gains. Bond ETFs usually pass interest payments to their fund holders monthly. Dividends and interest payments from ETFs are reported annually on your 1099, while earnings are taxed the same as the underlying stocks or bonds held.

ETFs which invest in commodities such as gold or oil are a different animal. Since they can’t buy the commodities themselves to hold, they attempt to do this by purchasing futures contracts. Shareholder income from commodity ETFs are reported annually on a K-1.

Some investors tend to be skeptical about K-1s due to their complexity or long filing times, but they accomplish the same goal as the 1099. The most interesting part about commodity ETFs is they are not taxed differently based on how long the investment is held. Usually, investments held for longer than 12 months are taxed at long term gains rates (currently a max of 23.8%). Inversely, investments held for under 12 months are taxed at short term gains rates (currently a max of 43.4%). Commodity ETFs are always taxed at 60% long term and 40% short term rates regardless the time frame the investment has been held.

ETNs and ETFs are inherently different in the fact that ETNs are actually bonds backed by the credit of the issuer. To a shareholder, this ultimately means that for whatever reason the issuer cannot repay, they are at risk for the loss. That being said, see below for a quick cheat sheet of different ETF and ETN tax rates and treatments.

0 comments:

Post a Comment