Tax-Expatraition writes: This admonition might sound a bit silly, considering we are talking about a “Tax Organizer”; which is often (but not always) provided by the tax return preparer to their clients simply to collect and organize information. It’s a communication between the taxpayer and the tax return preparer.

Tax Organizers come in all shapes, flavors and colors and have no real legal significance in and of themselves. They ask a range of questions and request  various information from their taxpayer clients. They are meant to help taxpayers coordinate their information to provide the better organized information to the office of the tax return preparer in finalizing and preparing the tax return.

various information from their taxpayer clients. They are meant to help taxpayers coordinate their information to provide the better organized information to the office of the tax return preparer in finalizing and preparing the tax return.

various information from their taxpayer clients. They are meant to help taxpayers coordinate their information to provide the better organized information to the office of the tax return preparer in finalizing and preparing the tax return.

various information from their taxpayer clients. They are meant to help taxpayers coordinate their information to provide the better organized information to the office of the tax return preparer in finalizing and preparing the tax return.

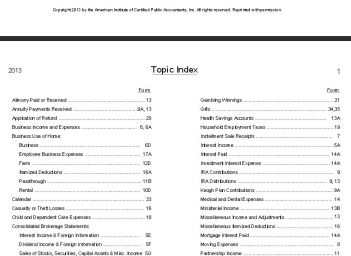

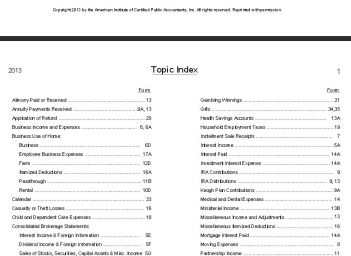

The AICPA has a sample Tax Organizer that is 95 pages in length. Most taxpayers quickly lose patience with detailed Tax Organizers and feel they are doing the work the tax return preparer is supposed to do in the first place. Some taxpayers simply do not complete these Tax Organizers, or do so summarily, with only partial information provided.

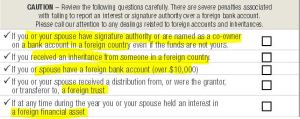

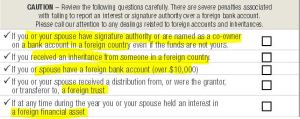

In years past, Tax Organizers often did not ask any questions or information about foreign bank accounts or foreign financial accounts. There are still plenty of Tax Organizers that are being used, which do not expressly raise this question.

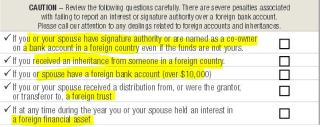

The first set of questions in the image at the beginning of the post, is from a Tax Organizer that asks a series of questions  regarding foreign accounts. This becomes important due to the law of Title 31 regarding foreign accounts. Of course, for the USC and LPR residing outside the U.S., their accounts in their home country of residence are necessarily “foreign accounts” as defined under the law, even if they are in the country where the person resides (which does not sound “foreign”). See, *Nuances of FBAR – Foreign Bank Account Report Filings – for USCs and LPRs living outside the U.S.

regarding foreign accounts. This becomes important due to the law of Title 31 regarding foreign accounts. Of course, for the USC and LPR residing outside the U.S., their accounts in their home country of residence are necessarily “foreign accounts” as defined under the law, even if they are in the country where the person resides (which does not sound “foreign”). See, *Nuances of FBAR – Foreign Bank Account Report Filings – for USCs and LPRs living outside the U.S.

regarding foreign accounts. This becomes important due to the law of Title 31 regarding foreign accounts. Of course, for the USC and LPR residing outside the U.S., their accounts in their home country of residence are necessarily “foreign accounts” as defined under the law, even if they are in the country where the person resides (which does not sound “foreign”). See, *Nuances of FBAR – Foreign Bank Account Report Filings – for USCs and LPRs living outside the U.S.

regarding foreign accounts. This becomes important due to the law of Title 31 regarding foreign accounts. Of course, for the USC and LPR residing outside the U.S., their accounts in their home country of residence are necessarily “foreign accounts” as defined under the law, even if they are in the country where the person resides (which does not sound “foreign”). See, *Nuances of FBAR – Foreign Bank Account Report Filings – for USCs and LPRs living outside the U.S.

The admonition in this post is because the government has made Tax Organizers a very big deal in cases where they have asserted the 50% civil willfulness penalty (including for multiple years in Zwerner). The government argued vociferously that since the taxpayers checked the box “No” on the Tax Organizer regarding foreign accounts, in both the Williams (very bad facts – due to admitted tax criminal conduct) and the Zwerner cases, this indicated the taxpayers had either “constructive knowledge” or were “willfully blind” as to the requirements they had under the law to file FBARs.

Of course, filling out an incomplete Tax Organizer with your tax return preparer is not a crime; unless the individual knows the information is false and will be provided to the IRS by their accountant. For a summary of the crime of filing a “false document”, see What could be the focal point of IRS Criminal Investigations of Former U.S. Citizens and Lawful Permanent Residents?

The “takeaway” from these two cases and how Tax Organizers are used by accountants, is that the individual is probably better off simply not using at all any Tax Organizer. This way, how it was completed (or not) cannot be construed and used against the individual as somehow showing willfulness under the FBAR penalty.

0 comments:

Post a Comment