Berrylane for Seeking Alpha writes: Summary

- Even as Salesforce.com has grown dramatically in the past few years and plowed resources into Service, Marketing and Platform offerings, it still reports profit and loss on a consolidated basis.

- Newer product offerings originate in acquisitions of young companies costing $4.5 billion in cash, stock and debt since 2010. These companies have vastly different risk/reward characteristics from the legacy business.

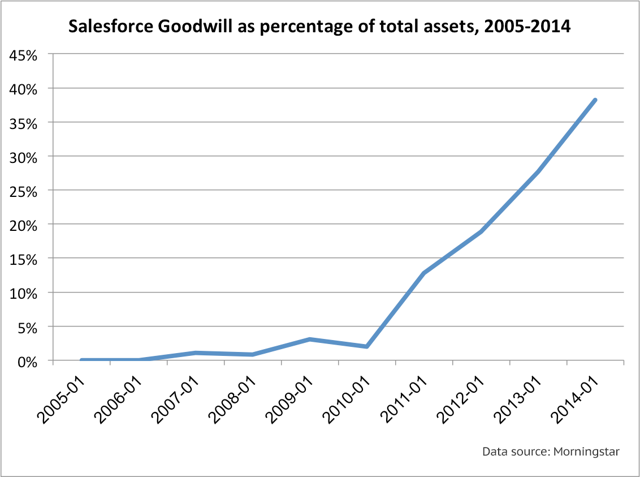

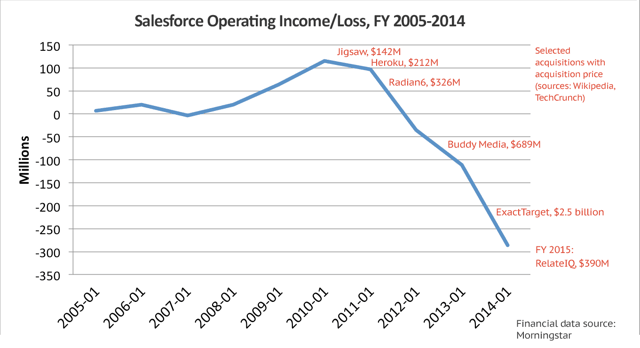

- During the acquisition spree, operating profit has plummeted and Goodwill has ballooned to nearly 40% of assets. The company's future depends on successful integration of these acquisitions.

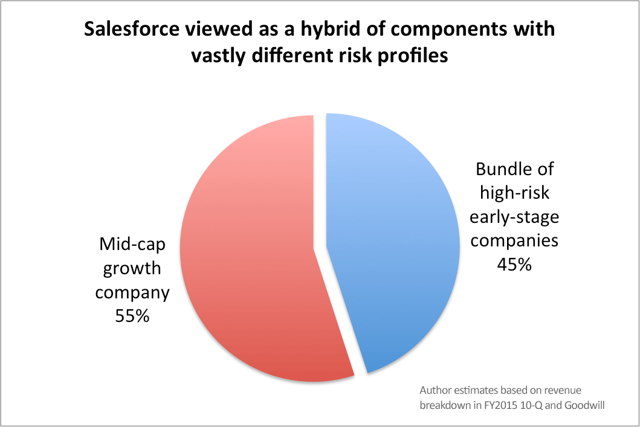

- Salesforce can be seen as a hybrid of a mid-cap company and a basket of speculative early-stage tech companies. Accounting principles call for disclosure of the profitability of each component.

Introduction: Salesforce ain't what it used to be

Salesforce.com (NYSE:CRM) has changed dramatically in four years, going from 4,000 employees in 2010 to over 13,000 as of January 2014. Through acquisitions of at least 21 companies since 2010 with a combined price tag of at least $4.5 billion, Salesforce has added two major product areas to its core CRM product: Service Cloud and Marketing Cloud. It has also deepened its commitment to the Platform offering and made related acquisitions. At the time of acquisition, many of these companies were innovative, young and growing fast but not necessarily profitable (for example, Buddy Mediahad a net loss of $20.6 million in the first half of 2012 and ExactTarget had a net loss of $11.6 million in Q1 2013).

The newer product lines now represent fully half of the company's revenue in Q1 2015 (see "Revenue by Cloud Service Offering" under Item 2 of the 10-Q). Given the significant shift in product offerings and investment of company resources, it is reasonable for an investor to ask: what cash flow and profit or loss are these new revenue streams yielding?

The SEC and Salesforce exchange letters about revenue sources and segment performance

In a comment letter to Salesforce in May 2013, the SEC raised questions about performance of the company's four main product offerings among other issues. Salesforce responded in June 2013:

We respectfully advise the Staff that we do not believe the individual performance of our four core service offerings, Sales Cloud, Service Cloud, Marketing Cloud and the Salesforce Platform, are key variables to understanding and evaluating our historical results and the future prospects of our business.

The SEC was apparently not satisfied because on July 30, 2013 it replied:

Please explain to us why the individual performance of each of your four core service offerings is not key to understanding and evaluating your historical results and the future prospects of your business, or material to an understanding of your business. For example, your response states that you will disclose that the "majority" of your total revenue is derived from subscriptions to your Sales Cloud, and that you expect this trend to decline as you become more successful in selling your other service offerings. Your proposed disclosure does not appear to provide any insight into how successfully you sold non-Sales Cloud service offerings during the periods presented. In addition, please tell us the percentage of your total revenues attributable to each of your four core service offerings during the periods presented...

Salesforce responded on August 23:

We respectfully advise the Staff that we do not manage the Company based on revenue by core service offering. As evidence of this, we do not forecast or report revenue by service offering as part of any standard weekly, monthly or quarterly information package to either our board of directors or executive management committee, which includes our CEO... Therefore, we do not believe that revenue by core service offering provides insight as to how our management evaluates the performance of the Company.Additionally...we have not invested in financial systems and controls that are capable of systematically reporting revenue by individual core service offering. Therefore we cannot derive the information consistently across quarters or years....[S]hould the Company implement systems and controls that can track and manage its operations based on cloud-specific revenue, we will consider providing appropriate disclosure of such trends based on the circumstances at such time.

A week later the SEC shot back:

In future filings, please quantify the "majority" of your total revenue derived from subscriptions to your Sales Cloud.

In September Salesforce acquiesced on reporting revenue by product offering(emphasis added):

As we discussed with the [SEC] Staff, we currently intend to implement financial reporting systems that will enable us to quantify our cloud-specific revenue before the end of fiscal 2015 (which ends January 31, 2015). Once such information is available, we will provide appropriate disclosures of cloud-specific revenue and related trends on a going forward basis.

Salesforce reported this information in the first quarter of FY 2015 (10-Q) (percentage column added):

Product line

|

Revenue in millions

|

% of total revenue

|

Sales Cloud

|

$576.6

|

50%

|

Service Cloud

|

$294.8

|

26%

|

ExactTarget Marketing Cloud

|

$111.0

|

10%

|

Salesforce1 Platform and Other

|

$164.9

|

14%

|

$1,147.3

|

100%

|

However the company stopped short of reporting profit and loss for these offerings, providing this explanation:

We operate as one operating segment. Operating segments are defined as components of an enterprise for which separate financial information is evaluated regularly by the chief operating decision maker, who in our case is the chief executive officer, in deciding how to allocate resources and assess performance.

(For deep background, that paragraph draws on the language of Financial Accounting Standard 131, "Disclosures about Segments of an Enterprise and Related Information.")

Next the company makes a nuanced claim: while it has "offerings" in multiple market segments, it evaluates financials on a consolidated basis (emphasis added):

Over the past few years, we have completed several acquisitions. These acquisitions have allowed us to expand our offerings, presence and reach in various market segments of the enterprise cloud computing market. While we have offerings in multiple enterprise cloud computing market segments, our business operates in one operating segment because our chief operating decision makerevaluates our financial information and resources and assesses the performance of these resources on a consolidated basis. Since we operate as one operating segment, all required financial segment information can be found in the condensed consolidated financial statements.

Let's review where we are after this intricate exchange with the SEC:

- Salesforce acknowledges that it has offerings for different enterprise cloud computing segments.

- Salesforce now breaks out revenue separately for each of these offerings.

- The newer offerings--Service Cloud, Marketing Cloud and to some extent Platform--originate in acquisitions of different companies.

- Salesforce declines to show profit and loss for its four main product offerings by claiming it does not regularly report on these metrics internally.

How well does this meet the needs of investors? Let's look at a principle laid out in one of FASB's broad Concepts Statements (Concepts Statement No. 8, Conceptual Framework for Financial Reporting) (emphasis added):

OB16. Information about a reporting entity's financial performance helps users to understand the return that the entity has produced on its economic resources. Information about the return the entity has produced provides an indication of how well management has discharged its responsibilities to make efficient and effective use of the reporting entity's resources. Information about the variability and components of that return also is important, especially in assessing the uncertainty of future cash flows...

Key terms to keep in mind are "efficient and effective use of...resources," "components of that return" and "uncertainty of future cash flows." I'll turn now to a discussion of the vastly different risk profiles of various components of Salesforce's business, and explain why the above accounting principle calls for disclosure of profitability for each of those components.

Salesforce is a combination of a mid-cap tech company and a basket of high-risk, unprofitable early-stage companies

We can think of Salesforce as a portfolio of three "asset classes." One is the Sales Cloud--the mature CRM product that leads its category in market share. This is the cash-generating foundation of the portfolio; I'll call itasset class A. If this were the only asset class, consolidated financial statements would be adequate to give a clear picture of its profitability and future prospects.

A second asset class is acquired young companies with significant revenues or "anchor" status in product offerings, such as ExactTarget, Buddy Media and Radian6. I'll call this class B1.

Finally there is a longer list of acquired small companies or startups such as Assist.ly and DimDim acquired for $50 million or less. Typically these have been brought in to acquire specific technologies, features or key individuals who can strengthen existing offerings. I'll call these class B2. Salesforce has organized these companies' offerings as shown below, with class B1 in bold (assignments partly based on author's judgment, acknowledging that a company may not fit neatly into one offering):

Product offering

|

Acquired companies and price if known

|

Sales Cloud

|

Legacy product + Jigsaw ($142M), Rypple, ThinkFuse, BlueTail, Prior Knowledge, EdgeSpring, RelateIQ ($390M)

|

Service Cloud

|

Activa, Assist.ly ($50M), GoInstant ($70M)

|

Marketing Cloud

|

Radian6 ($326M), Buddy Media ($689M), ExactTarget($2.5 billion)

|

Platform and other

|

Existing infrastructure + Heroku ($212M), DimDim ($31M), ManyMoon (~$30M), Model Metrics, Stypi, EntropySoft

|

Acquisitions in multiple or unknown product line(s)

|

ChoicePass, clipboard.com ($12M)

|

Total of known acquisition costs since 2010

|

~$4.5 billion

|

In asset class B1, ExactTarget and Buddy Media were known to be losing money at the time of acquisition. AllThingsD reported that Rypple was cash flow-positive but did not report numbers. Jigsaw reported profitability on a revenue run rate that I estimate at $20 million -- so profit was likely to be negligible. As a recent graduate of Y Combinator, Heroku was likely not profitable.

I do not have financial information on the companies in class B2; but in the typical growth trajectory of a tech startup, the first few years see an expanding user base and revenue growth while profitability takes a few more years (if achieved at all). More likely than not, classes B1 and B2 were not making a meaningful profit at the time they were acquired by Salesforce.

As mentioned above, Sales cloud now represents about 50% of revenues. We can also count some Platform revenue as class A since it is more established than Service and Marketing Clouds, bringing us to roughly 55% in class A. For the other 45% of its business, Salesforce is effectively acting as a giant incubator and integrator of small, early-stage tech companies. It is attempting to convert these into cash flow generators by combining them into the four main offerings shown in the above table.

Goodwill on the Balance Sheet reveals the resources Salesforce has deployed to develop new offerings. Goodwill has ballooned to nearly 40% of total assets as of the end of FY 2014:

During the intensive period of acquisitions from FY2011-2014, Operating Income dropped precipitously:

(And in the first quarter of this fiscal year, operating loss was $55 million vs. $45 million in the prior year quarter.)

Let's revisit the FASB Concept quoted above (emphasis added):

Information about the return the entity has produced provides an indication of how well management has discharged its responsibilities to make efficient and effective use of the reporting entity's resources. Information about the variability and components of that return also is important, especially in assessing the uncertainty of future cash flows...

The Goodwill chart makes it clear that Salesforce has directed significant resources towards emerging offerings in the Service Cloud, Marketing Cloud and to some extent Platform. These products are based on acquisitions of early-stage companies that were purchased at high multiples and are, by and large, probably not profitable for reasons stated above. As a result, future cash flows of Service Cloud, Marketing Cloud and Platform are highly uncertain. This is precisely the time when investors need to understand the performance of these newer components of Salesforce's business (asset classes B1 and B2) compared to the more established Sales cloud component (asset class A).

Seeing this simple table in SEC filings would go a long way towards fulfilling the FASB principle above and allowing investors to assess the risk-reward profile of each of Salesforce's product offerings:

Product line

|

Revenue ($millions)

|

Expenses

|

Operating cash flow

|

Net gain/loss

|

Sales Cloud

|

$576.6

| |||

Service Cloud

|

294.8

| |||

ExactTarget Marketing Cloud

|

111.0

| |||

Salesforce1 Platform and Other

|

164.9

|

With this data, investors could track Salesforce's progress in incubating and integrating acquired companies into its scheme of four main product offerings. They could better understand the current cash flows and future prospects of these new offerings. They could assess whether the $3.5 billion in Goodwill on the balance sheet, representing nearly 40% of assets, remains an accurate reflection of the current value of past acquisitions.

Inadequate reporting creates an inefficiency

As discussed above, from an investment point of view Salesforce is a hybrid of approximately 55% established CRM and platform products and 45% speculative products adapted from early-stage, higher-risk companies that by and large would have been unprofitable at the time of acquisition. Even though Salesforce strives to be seen as an integrated company, from an investment risk/reward perspective one could see it this way:

Through the dramatic changes of the last four years, the company's reporting has not meaningfully changed to reflect a diversified set of offerings. By reporting accounting on a consolidated basis (with the exception of revenue), Salesforce is failing to disclose material information: specifically, its progress in bringing acquisitions to profitability in the context of its four main product offerings.

I believe Salesforce is massively understating the risks inherent in its strategy of acquisition, diversification and growth, and therefore not providing adequate information to its investors. Over ten years the stock has been propelled by customer acquisition, technical innovation and revenue growth among other factors. Dramatic recent changes to the company's strategy and finances, combined with the lack of information about vastly different risk profiles across components of the business, create an inefficiency that points to an investment opportunity on the short side.

_____________________________________________________________

_____________________________________________________________

salesforce.com, inc. CEO Sells $3,199,200 in Stock (CRM)

salesforce.com, inc. (NYSE:CRM) CEO Marc Benioff sold 60,000 shares of the company’s stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $53.32, for a total value of $3,199,200.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

Marc Benioff sold 60,000 shares of the company’s stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $53.32, for a total value of $3,199,200.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

Several analysts have recently commented on the stock . Analysts at Morgan Stanley reiterated a “positive” rating on shares of salesforce.com, inc. in a research note on Thursday, June 19th. Separately, analysts at Credit Suisse reiterated an “outperform” rating on shares of salesforce.com, inc. in a research note on Thursday, May 29th. They now have a $75.00 price target on the stock, down previously from $80.00. Finally, analysts at Pivotal Research reiterated a “buy” rating on shares of salesforce.com, inc. in a research note on Thursday, May 22nd. They now have a $73.00 price target on the stock, down previously from $74.00. One research analyst has rated the stock with a sell rating, four have issued a hold rating, twenty-six have assigned a buy rating and two have assigned a strong buy rating to the company. The stock currently has an average rating of “Buy” and a consensus price target of $67.24.

. Analysts at Morgan Stanley reiterated a “positive” rating on shares of salesforce.com, inc. in a research note on Thursday, June 19th. Separately, analysts at Credit Suisse reiterated an “outperform” rating on shares of salesforce.com, inc. in a research note on Thursday, May 29th. They now have a $75.00 price target on the stock, down previously from $80.00. Finally, analysts at Pivotal Research reiterated a “buy” rating on shares of salesforce.com, inc. in a research note on Thursday, May 22nd. They now have a $73.00 price target on the stock, down previously from $74.00. One research analyst has rated the stock with a sell rating, four have issued a hold rating, twenty-six have assigned a buy rating and two have assigned a strong buy rating to the company. The stock currently has an average rating of “Buy” and a consensus price target of $67.24.

salesforce.com , inc. (NYSE:CRM) traded up 0.22% on Friday, hitting $53.63. The stock had a trading volume of 4,697,019 shares. salesforce.com, inc. has a 52-week low of $42.11 and a 52-week high of $67.00. The stock has a 50-day moving average of $54.7 and a 200-day moving average of $56.23. The company’s market cap is $32.929 billion.

, inc. (NYSE:CRM) traded up 0.22% on Friday, hitting $53.63. The stock had a trading volume of 4,697,019 shares. salesforce.com, inc. has a 52-week low of $42.11 and a 52-week high of $67.00. The stock has a 50-day moving average of $54.7 and a 200-day moving average of $56.23. The company’s market cap is $32.929 billion.

salesforce.com, inc. (NYSE:CRM ) last issued its quarterly earnings data on Tuesday, May 20th. The company reported $0.11 earnings per share for the quarter, beating the analysts’ consensus estimate of $0.10 by $0.01. The company had revenue of $1.23 billion for the quarter, compared to the consensus estimate of $1.21 billion. During the same quarter last year, the company posted $0.10 earnings per share. salesforce.com, inc.’s revenue was up 37.7% compared to the same quarter last year. On average, analysts predict that salesforce.com, inc. will post $0.51 earnings per share for the current fiscal year.

) last issued its quarterly earnings data on Tuesday, May 20th. The company reported $0.11 earnings per share for the quarter, beating the analysts’ consensus estimate of $0.10 by $0.01. The company had revenue of $1.23 billion for the quarter, compared to the consensus estimate of $1.21 billion. During the same quarter last year, the company posted $0.10 earnings per share. salesforce.com, inc.’s revenue was up 37.7% compared to the same quarter last year. On average, analysts predict that salesforce.com, inc. will post $0.51 earnings per share for the current fiscal year.

salesforce.com, inc. is a provider of enterprise cloud computing and social enterprise solutions. The Company provides a customer and collaboration relationship management (NYSE:CRM), applications through the Internet or cloud.

and social enterprise solutions. The Company provides a customer and collaboration relationship management (NYSE:CRM), applications through the Internet or cloud.

0 comments:

Post a Comment