Summary

- Our proprietary model screens all stocks on the S&P 500 and uses regression analysis to identify outliers.

- We only look for stocks that are several standard deviations from the mean in their valuation.

- The model is based on a mean-reversion assumption for extreme outliers.

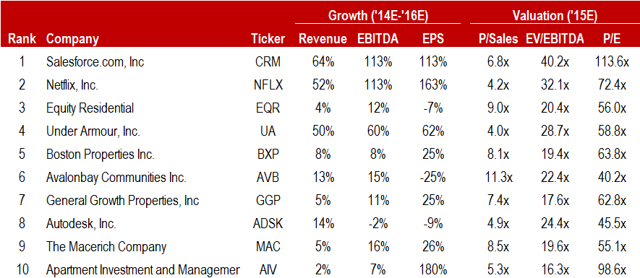

- We have identified the 10 most overvalued companies (growth adjusted) on the S&P 500.

Introduction

Apus Investments' Quant Model ("AIQ Model") uses a proprietary system to identify stocks that are extreme outliers in their valuation relative to the mean of index constituents. The model is currently focused on the S&P 500 Index and uses several criteria to rank stocks:

- 3 year forward growth rates for revenue, EBITDA, and EPS

- Trading multiples for P/Sales, EV/EBITDA, P/E and P/BV

- Cash flow margins and ability to generate cash

- Leverage metrics and balance sheet strength

After taking into account each stock's current valuation (adjusted for growth rates and leverage ratios) the model uses regression analysis to determine fair value of each company relative to the index constitutions.

Sector specialists will be quick to point that each sector has its own metrics and nuances that a generalist approach does not take into consideration. We agree with this point wholeheartedly, but that is not the purpose of the quant model. The purpose of the AIQ Model is to identify stocks that are such extreme outliers in their valuation (adjusted for growth) that we expect to see some sort of mean reversion regardless of certain qualitative issues or sector nuances.

Top 10 Short Ideas

Based on our most recent screen of the S&P 500 and applying our proprietary system, the below companies represent the top 10 most overvalued (growth adjusted) stocks. We believe all of these stocks are significant enough outliers from the mean of constituents to justify a case for mean reversion.

Source: Author's analysis using Capital IQ consensus estimates.

Salesforce.com (NYSE:CRM) trades at 40.2x 2015E EBITDA and 113.6x 2015E EPS with Revenue growth of 64% and EPS growth of 113% from 2014 - 2016E.

salesforce.com, inc. provides enterprise cloud computing solutions to various businesses and industries worldwide. The company offers social and mobile cloud apps and platform services.

0 comments:

Post a Comment