Gary Gordon for ETF Trends writes: A leading non-partisan tax policy researcher, The Tax Foundation,

estimates that your first 111 days belong to the U.S. government. When

the estimate includes the effect of federal borrowing, the date moves to

May 6. In other words, you work for Uncle Sam in your first 125 days of

a given year, while the remaining 240 belong to you.

The effect of federal borrowing cannot be understated. Right now, you

work an extra 14 days to pay the interest on the country’s debt. On the

other hand, the Federal Reserve’s zero-interest-rate policy coupled

with quantitative easing (”QE”) has kept the borrowing costs for the

U.S. exceptionally low. If rates returned to “normal,” the current 6.4%

of tax dollars going toward interest on sovereign debt would likely jump

to 12.5%. Instead of working until May 6 to reach “Tax Freedom Day,” you may need to wait until June approaches.

Keep in mind, I haven’t mentioned the probability that tax rates for

families are likely to climb. Consider Congressional Budget Office (CBO)

data that shows the trend of an increasing burden on the top 20%

earners, not just the much-maligned 1%. The Wall Street Journal, citing

the CBO data, explained that increased taxation of a couple with two

children making more than $150,000 has jumped from 65% in 1980 to more

than 90% by 2010.

Think increases in taxes will only hit the top 20% of income earning

families? Then you must not be paying attention. Due to a lack of savings

by “Boomers” and “Gen Xers,” as well as an increasingly aging

population and new entitlements, the U.S. will need to collect as much

as 25% more tax revenue above the average percentage (17.4%) of gross

domestic product (GDP). Yet half of Americans effectively contribute

zero dollars to the present tax system. Indeed, one does not need to be

psychic to foresee the onerous tax hikes ahead.

Granted, there are scores of legitimate ways to reduce a tax

albatross. One family might look to shift some W-2 earnings to 1099

income such that the side business activity offers deductible expenses.

Another family might move from a high-tax state to a lower-tax state.

Still, are there ways that a market-based investor can reduce the number

of days that Uncle Sam has commandeered?

The short answer is, “Yes.” Unfortunately, most people’s imagination rarely moves beyond tax

deferral in an employer-sponsored plan. Tax deferral is remarkably

beneficial in compounding the growth of a portfolio. On the other hand,

pushing one’s tax obligation out into the future is not the same as

shrinking it or eliminating it.

Enter the exchange-traded index fund. An ETF that tracks an

established index does not distribute significant capital gains the way a

traditional mutual fund might. For one thing, an index does not change

very much, if at all. Without the need to change what the ETF holds, the

lack of trading activity means there are less distributions to

shareholders for tax consequences. Similarly, outflows force the sale of

securities in mutual funds; the redemption process for an ETF is

different than the process for a mutual fund whereby the ETF structure

enhances tax efficiency.

According to a 2012 study at Morningstar, the 5-year average

distribution for a large-cap stock blend mutual fund was nearly 2%.

ETFs? 0%. For one who might have $200,000 in large stock mutual fund

exposure, that’d be four thousand dollars in capital gains distributions

annually. Five years of holding the large cap fund would cost $600 per

year at a 15% capital gains rate for a total of $3000. Simply selecting

iShares S&P 500 (IVV) in one’s brokerage account would eliminate the

levy.

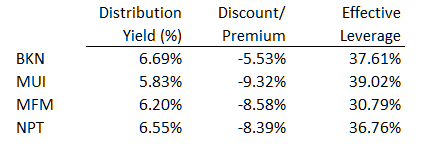

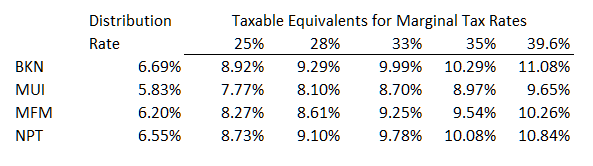

Outside of the stock arena, distaste for capital gains distributions

morphs into disdain for the taxation of interest income. Those who find

themselves in a very high marginal tax bracket might do well to skip

straight to the no-tax world of municipal bonds. It is true that the

rapid rise in interest rates that followed the Fed’s tapering

announcement in May of 2013 served to punish munis mercilessly. SPDR

Nuveen Muni Bond (TFI) logged -3.9% last year.

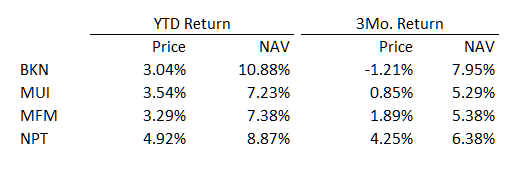

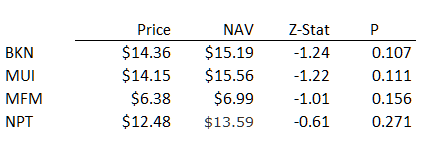

However, last year’s muni bashing created opportunity for those who

wish to pursue income free from federal taxation. TFI quickly recovered a

technical uptrend, already garnering 4.5% year-to-date. For an investor

in the 35% tax bracket, the taxable bond equivalent yield is 4.0% — a

return that simply cannot be matched by intermediate-term investment

grade bond funds. Longer-term munis in Market Vectors Long (MLN) have

also been winners.

Obviously, investing in anything for tax benefits alone is likely to

bite in unexpected and undesirable ways. Nevertheless, one can consider

the favorable spreads that munis offer the high marginal tax bracket

investor. A fund that I like for taxable as well as non-taxable accounts

is PIMCO Short-Term High Yield (HYS). It may offer a 4.3% yield with

relatively low risk. Now consider Market Vectors Short-Term High Yield

Muni (SHYD) with a projected 3.9% yield net of fees. In a 35% marginal

bracket, a 6.0% taxable equivalent yield makes SHYD an attractive

prospect.

Founded by Daisuke

Sasaki and Ryu Yokoji in July 2012, freee aims to make bookkeeping and

accounting quick and easy. While the idea seems simple, no one seems to

have created an easy-to-use piece of accounting software for Japan.

For many years, Yayoi has been dominating the accounting software space

with over 60 percent market share in Japan. Sasaki says that Yayoi

follows the dual-entry bookkeeping method, which could prove to be

difficult and unnecessary for many small businesses. It functions okay

but it lacks invoicing or bank account integration. It is at best an

upgraded Excel spreadsheet.

On the other hand, freee’s offer is so much more compelling. It is built

on the cloud and is accessible via any web browser. Accounting entries

are highly automated. For example, if a payment was made to Softbank,

freee automatically turns it into a journal entry and classifies the

expense as a telco billing. All the accountant has to do is to approve

the bills.

Freee also helps small businesses generate tax reports in a few clicks

for tax submissions to authorities. Automation is made possible because

freee is integrated with over 1,600 banks in Japan.

(See: MergePay is Mint for business, making bookkeeping easier)

“Bank account integration has been around for many years but we are the

first to use it for business,” says Sasaki. “We want small and medium

businesses (SMBs) to just care about their expenses and invoices and

leave the accounting job to the software.”

freee-mobile

Business owners can also access freee on mobile.

Sasaki, a former Googler who was in charge of SMBs, realized that

technology literacy in small businesses in Japan is really low. Many of

them still use faxes along with pen and paper when doing their accounts.

“Something is wrong about Japan’s SMB market and I really want to solve

the problem. There are no tech products to help a SMB that is affordable

in the market,” adds Sasaki.

Since its official launch in March 2013, freee is now used by over

67,000 SMBs. Sasaki declined to reveal the number of paid users. Freee

charges individual self-employees US$10 a month, and $20 for corporates.

Rocky start

When the company was founded, Sasaki faced two problems. First, his team

was so passionate about the product that they cared too much about its

look and feel.

“We discussed a lot how the product should look like. Maybe too much. In

the first two months, we made no progress. We decided to stop and make

decisions fast and things started to move.”

The team was coding 15 hours a day, rushing for their launch. But when

the prototype was ready, Saski faced the second hurdle – skepticism from

the market.

“We showed our product to some potential users before launch. But they

looked at it with the traditional accounting mindset and thought we can

never disrupt the accounting industry,” he says.

freee-team

Despite the naysayers, freee launched in March last year to good

feedback. Sasaki says that happy freee users brought in more users. A

customer was so impressed with Sasaki’s accounting software that he even

wrote a book about tax filing using freee.

What we learned was that even though the initial feedback was not

good, it is important to just launch and see what the real customers are

saying. We are fortunate because we have early adopters who help to

give good reviews on the internet and other people followed.

(See: Despite the naysayers, Pixta became Japan’s biggest stock photo

marketplace)

Sasaki has also been pretty creative in distributing his accounting

software. He sold coupons on Amazon because, as he puts it, “people

actually search for accounting software on Amazon.” As credit card

spending is automatically tracked and recorded on freee, more owners are

happy to spend, knowing that freee will track the expenses. This in

turn makes the credit card companies more willing to promote freee for

free.

Other distribution methods include partnering with point-of-sales (POS)

services like Square and any retail iPads powered by POS software. Freee

also gets cozy with tax advisors, and has so far partnered with 300 of

them. “If they say that freee is good, then word will spread and it’s

good for business,” says Sasaki. Freee also offers its API so it is easy

for any application and POS to integrate with it.

We want one million SMBs to use our product and we aim to create a

network of SMBs who can easily make transactions within the freee

network. We also want to globalize our product. Right now, freee is only

in Japan. But once our product is more stable, we hope to enter other

Asia markets, hopefully starting next year.

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Founded by Daisuke

Sasaki and Ryu Yokoji in July 2012, freee aims to make bookkeeping and

accounting quick and easy. While the idea seems simple, no one seems to

have created an easy-to-use piece of accounting software for Japan.

For many years, Yayoi has been dominating the accounting software space

with over 60 percent market share in Japan. Sasaki says that Yayoi

follows the dual-entry bookkeeping method, which could prove to be

difficult and unnecessary for many small businesses. It functions okay

but it lacks invoicing or bank account integration. It is at best an

upgraded Excel spreadsheet.

On the other hand, freee’s offer is so much more compelling. It is built

on the cloud and is accessible via any web browser. Accounting entries

are highly automated. For example, if a payment was made to Softbank,

freee automatically turns it into a journal entry and classifies the

expense as a telco billing. All the accountant has to do is to approve

the bills.

Freee also helps small businesses generate tax reports in a few clicks

for tax submissions to authorities. Automation is made possible because

freee is integrated with over 1,600 banks in Japan.

(See: MergePay is Mint for business, making bookkeeping easier)

“Bank account integration has been around for many years but we are the

first to use it for business,” says Sasaki. “We want small and medium

businesses (SMBs) to just care about their expenses and invoices and

leave the accounting job to the software.”

freee-mobile

Business owners can also access freee on mobile.

Sasaki, a former Googler who was in charge of SMBs, realized that

technology literacy in small businesses in Japan is really low. Many of

them still use faxes along with pen and paper when doing their accounts.

“Something is wrong about Japan’s SMB market and I really want to solve

the problem. There are no tech products to help a SMB that is affordable

in the market,” adds Sasaki.

Since its official launch in March 2013, freee is now used by over

67,000 SMBs. Sasaki declined to reveal the number of paid users. Freee

charges individual self-employees US$10 a month, and $20 for corporates.

Rocky start

When the company was founded, Sasaki faced two problems. First, his team

was so passionate about the product that they cared too much about its

look and feel.

“We discussed a lot how the product should look like. Maybe too much. In

the first two months, we made no progress. We decided to stop and make

decisions fast and things started to move.”

The team was coding 15 hours a day, rushing for their launch. But when

the prototype was ready, Saski faced the second hurdle – skepticism from

the market.

“We showed our product to some potential users before launch. But they

looked at it with the traditional accounting mindset and thought we can

never disrupt the accounting industry,” he says.

freee-team

Despite the naysayers, freee launched in March last year to good

feedback. Sasaki says that happy freee users brought in more users. A

customer was so impressed with Sasaki’s accounting software that he even

wrote a book about tax filing using freee.

What we learned was that even though the initial feedback was not

good, it is important to just launch and see what the real customers are

saying. We are fortunate because we have early adopters who help to

give good reviews on the internet and other people followed.

(See: Despite the naysayers, Pixta became Japan’s biggest stock photo

marketplace)

Sasaki has also been pretty creative in distributing his accounting

software. He sold coupons on Amazon because, as he puts it, “people

actually search for accounting software on Amazon.” As credit card

spending is automatically tracked and recorded on freee, more owners are

happy to spend, knowing that freee will track the expenses. This in

turn makes the credit card companies more willing to promote freee for

free.

Other distribution methods include partnering with point-of-sales (POS)

services like Square and any retail iPads powered by POS software. Freee

also gets cozy with tax advisors, and has so far partnered with 300 of

them. “If they say that freee is good, then word will spread and it’s

good for business,” says Sasaki. Freee also offers its API so it is easy

for any application and POS to integrate with it.

We want one million SMBs to use our product and we aim to create a

network of SMBs who can easily make transactions within the freee

network. We also want to globalize our product. Right now, freee is only

in Japan. But once our product is more stable, we hope to enter other

Asia markets, hopefully starting next year.

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Founded by Daisuke

Sasaki and Ryu Yokoji in July 2012, freee aims to make bookkeeping and

accounting quick and easy. While the idea seems simple, no one seems to

have created an easy-to-use piece of accounting software for Japan.

For many years, Yayoi has been dominating the accounting software space

with over 60 percent market share in Japan. Sasaki says that Yayoi

follows the dual-entry bookkeeping method, which could prove to be

difficult and unnecessary for many small businesses. It functions okay

but it lacks invoicing or bank account integration. It is at best an

upgraded Excel spreadsheet.

On the other hand, freee’s offer is so much more compelling. It is built

on the cloud and is accessible via any web browser. Accounting entries

are highly automated. For example, if a payment was made to Softbank,

freee automatically turns it into a journal entry and classifies the

expense as a telco billing. All the accountant has to do is to approve

the bills.

Freee also helps small businesses generate tax reports in a few clicks

for tax submissions to authorities. Automation is made possible because

freee is integrated with over 1,600 banks in Japan.

(See: MergePay is Mint for business, making bookkeeping easier)

“Bank account integration has been around for many years but we are the

first to use it for business,” says Sasaki. “We want small and medium

businesses (SMBs) to just care about their expenses and invoices and

leave the accounting job to the software.”

freee-mobile

Business owners can also access freee on mobile.

Sasaki, a former Googler who was in charge of SMBs, realized that

technology literacy in small businesses in Japan is really low. Many of

them still use faxes along with pen and paper when doing their accounts.

“Something is wrong about Japan’s SMB market and I really want to solve

the problem. There are no tech products to help a SMB that is affordable

in the market,” adds Sasaki.

Since its official launch in March 2013, freee is now used by over

67,000 SMBs. Sasaki declined to reveal the number of paid users. Freee

charges individual self-employees US$10 a month, and $20 for corporates.

Rocky start

When the company was founded, Sasaki faced two problems. First, his team

was so passionate about the product that they cared too much about its

look and feel.

“We discussed a lot how the product should look like. Maybe too much. In

the first two months, we made no progress. We decided to stop and make

decisions fast and things started to move.”

The team was coding 15 hours a day, rushing for their launch. But when

the prototype was ready, Saski faced the second hurdle – skepticism from

the market.

“We showed our product to some potential users before launch. But they

looked at it with the traditional accounting mindset and thought we can

never disrupt the accounting industry,” he says.

freee-team

Despite the naysayers, freee launched in March last year to good

feedback. Sasaki says that happy freee users brought in more users. A

customer was so impressed with Sasaki’s accounting software that he even

wrote a book about tax filing using freee.

What we learned was that even though the initial feedback was not

good, it is important to just launch and see what the real customers are

saying. We are fortunate because we have early adopters who help to

give good reviews on the internet and other people followed.

(See: Despite the naysayers, Pixta became Japan’s biggest stock photo

marketplace)

Sasaki has also been pretty creative in distributing his accounting

software. He sold coupons on Amazon because, as he puts it, “people

actually search for accounting software on Amazon.” As credit card

spending is automatically tracked and recorded on freee, more owners are

happy to spend, knowing that freee will track the expenses. This in

turn makes the credit card companies more willing to promote freee for

free.

Other distribution methods include partnering with point-of-sales (POS)

services like Square and any retail iPads powered by POS software. Freee

also gets cozy with tax advisors, and has so far partnered with 300 of

them. “If they say that freee is good, then word will spread and it’s

good for business,” says Sasaki. Freee also offers its API so it is easy

for any application and POS to integrate with it.

We want one million SMBs to use our product and we aim to create a

network of SMBs who can easily make transactions within the freee

network. We also want to globalize our product. Right now, freee is only

in Japan. But once our product is more stable, we hope to enter other

Asia markets, hopefully starting next year.

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Founded by Daisuke

Sasaki and Ryu Yokoji in July 2012, freee aims to make bookkeeping and

accounting quick and easy. While the idea seems simple, no one seems to

have created an easy-to-use piece of accounting software for Japan.

For many years, Yayoi has been dominating the accounting software space

with over 60 percent market share in Japan. Sasaki says that Yayoi

follows the dual-entry bookkeeping method, which could prove to be

difficult and unnecessary for many small businesses. It functions okay

but it lacks invoicing or bank account integration. It is at best an

upgraded Excel spreadsheet.

On the other hand, freee’s offer is so much more compelling. It is built

on the cloud and is accessible via any web browser. Accounting entries

are highly automated. For example, if a payment was made to Softbank,

freee automatically turns it into a journal entry and classifies the

expense as a telco billing. All the accountant has to do is to approve

the bills.

Freee also helps small businesses generate tax reports in a few clicks

for tax submissions to authorities. Automation is made possible because

freee is integrated with over 1,600 banks in Japan.

(See: MergePay is Mint for business, making bookkeeping easier)

“Bank account integration has been around for many years but we are the

first to use it for business,” says Sasaki. “We want small and medium

businesses (SMBs) to just care about their expenses and invoices and

leave the accounting job to the software.”

freee-mobile

Business owners can also access freee on mobile.

Sasaki, a former Googler who was in charge of SMBs, realized that

technology literacy in small businesses in Japan is really low. Many of

them still use faxes along with pen and paper when doing their accounts.

“Something is wrong about Japan’s SMB market and I really want to solve

the problem. There are no tech products to help a SMB that is affordable

in the market,” adds Sasaki.

Since its official launch in March 2013, freee is now used by over

67,000 SMBs. Sasaki declined to reveal the number of paid users. Freee

charges individual self-employees US$10 a month, and $20 for corporates.

Rocky start

When the company was founded, Sasaki faced two problems. First, his team

was so passionate about the product that they cared too much about its

look and feel.

“We discussed a lot how the product should look like. Maybe too much. In

the first two months, we made no progress. We decided to stop and make

decisions fast and things started to move.”

The team was coding 15 hours a day, rushing for their launch. But when

the prototype was ready, Saski faced the second hurdle – skepticism from

the market.

“We showed our product to some potential users before launch. But they

looked at it with the traditional accounting mindset and thought we can

never disrupt the accounting industry,” he says.

freee-team

Despite the naysayers, freee launched in March last year to good

feedback. Sasaki says that happy freee users brought in more users. A

customer was so impressed with Sasaki’s accounting software that he even

wrote a book about tax filing using freee.

What we learned was that even though the initial feedback was not

good, it is important to just launch and see what the real customers are

saying. We are fortunate because we have early adopters who help to

give good reviews on the internet and other people followed.

(See: Despite the naysayers, Pixta became Japan’s biggest stock photo

marketplace)

Sasaki has also been pretty creative in distributing his accounting

software. He sold coupons on Amazon because, as he puts it, “people

actually search for accounting software on Amazon.” As credit card

spending is automatically tracked and recorded on freee, more owners are

happy to spend, knowing that freee will track the expenses. This in

turn makes the credit card companies more willing to promote freee for

free.

Other distribution methods include partnering with point-of-sales (POS)

services like Square and any retail iPads powered by POS software. Freee

also gets cozy with tax advisors, and has so far partnered with 300 of

them. “If they say that freee is good, then word will spread and it’s

good for business,” says Sasaki. Freee also offers its API so it is easy

for any application and POS to integrate with it.

We want one million SMBs to use our product and we aim to create a

network of SMBs who can easily make transactions within the freee

network. We also want to globalize our product. Right now, freee is only

in Japan. But once our product is more stable, we hope to enter other

Asia markets, hopefully starting next year.

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/

Read more: This Japanese entrepreneur is freeing small businesses from their accounting nightmares http://www.techinasia.com/daisuke-sasaki-ryu-yokoji-freee-bookkeeping-accounting-software/