How about some comedy?

Sunday, April 20, 2014

Connecting LivePlan to Xero

JoAnne Catlin for LivePlan writes: If you need help setting up the connection between Xero and LivePlan, please contact us, and we'll be happy to walk you through the process. You can reach us by email at help@paloalto.com or by phone at 888-498-6136 or +1 541 683 6162.

The LivePlan Scoreboard is integrated with Xero, which makes it easy to import the actuals data from your Xero organization into the LivePlan Scoreboard. This means you won't have to enter your actual numbers into LivePlan manually, your results will stay continually updated, and you'll be able to quickly compare your actuals to your LivePlan forecast.

The LivePlan Scoreboard is integrated with Xero, which makes it easy to import the actuals data from your Xero organization into the LivePlan Scoreboard. This means you won't have to enter your actual numbers into LivePlan manually, your results will stay continually updated, and you'll be able to quickly compare your actuals to your LivePlan forecast.

Getting set up with Xero

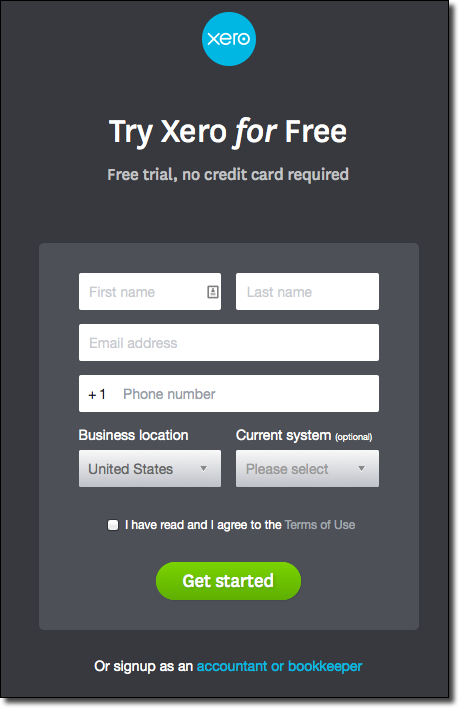

- If you don't have a Xero account yet, you'll need to sign up for one (there is a free trial option):

- Next, you'll need to set up a Xero organization for your business. For help doing this, refer to the Xero Business Help Center.

- Once you have a Xero account and organization set up, you can connect LivePlan to Xero.

Connecting LivePlan to Xero:

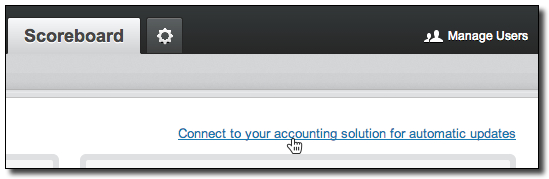

- Log in to your LivePlan account.

- On the Scoreboard overview, click Connect to your accounting solution for automatic updates:

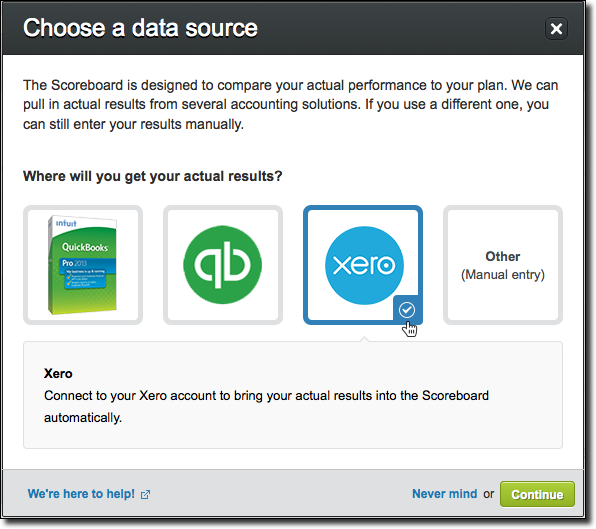

- In the Choose a data source overlay, choose the Xero option, and then click Continue:

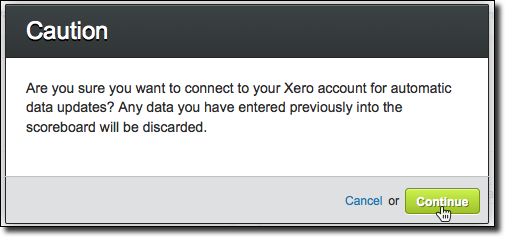

- If you have used manual entry to enter any data into the Scoreboard prior to connecting, an overlay will appear to warn you that the data will be discarded when you connect to Xero. Click Continue:

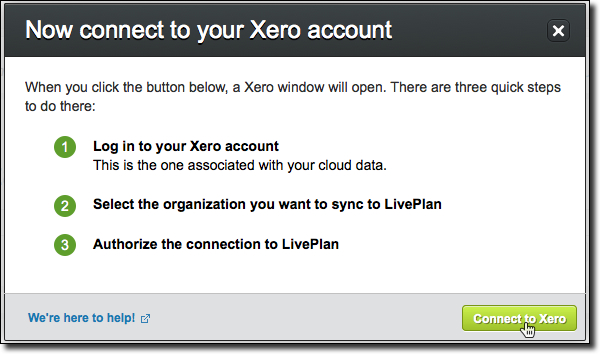

- The next overlay outlines the steps you need to take to connect to Xero. Click Connect to Xero:

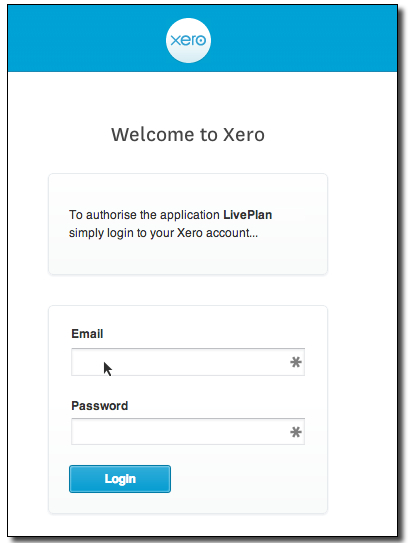

- In the Xero overlay that appears, enter the username and password for your Xero account, and then click Login:

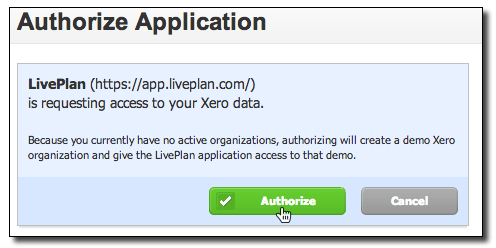

- In the overlay that asks you to authorize LivePlan to connect to your Xero account, click Authorize:

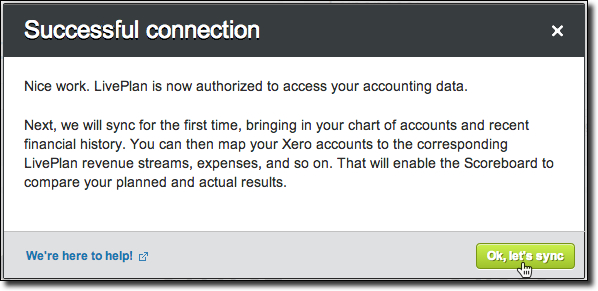

- Once the connection is successful, the next step is to bring the data from Xero into the Scoreboard. Click OK, let's sync:

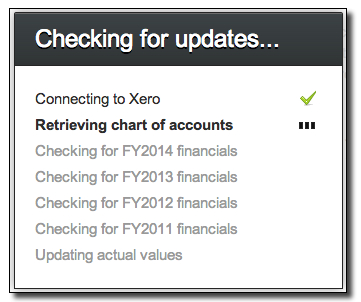

- LivePlan will pull in your Xero data for the current year and up to three fiscal years in the past. You'll see the following overlay during this process:

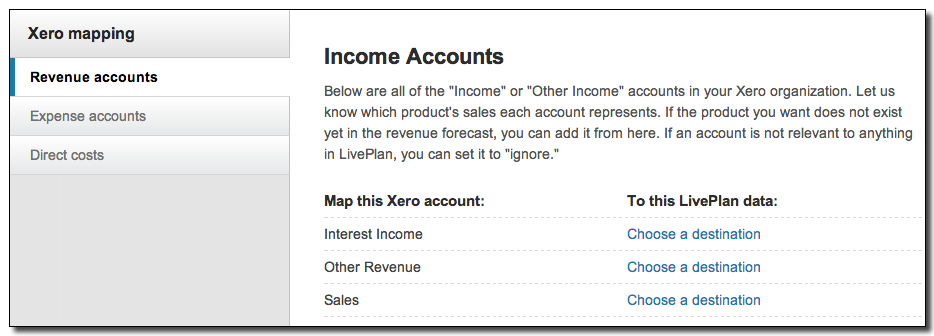

- Once LivePlan and Xero are connected, the Xero mapping view will appear:

- Now, move on to Mapping Xero accounts to LivePlan data.

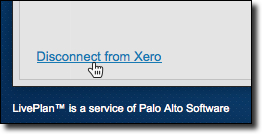

To disconnect from Xero:

Once you're connected to Xero, your Scoreboard will remain that way until you disconnect it from Xero. As long as the connection is intact, LivePlan will automatically sync the data between LivePlan and Xero on a nightly basis.

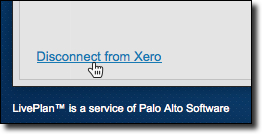

If at some point you want to disconnect LivePlan from Xero, click the Disconnect from Xero link the bottom of either the Scoreboard overview or the mapping view:

Why don't Wealthfront or Betterment offer index funds based 401k plans for small businesses?

We came across a discussion where someone asked, "Why don't Wealthfront or Betterment offer index funds based 401k plans for small businesses?"

___________

Katherine from Betterment here. Thanks for your question about 401(k) plans; it's

something we’re looking into. Offering our services in a 401(k) plan is a sensible idea.

We believe Betterment is the next generation of the target date fund, found in the

vast majority of employer-sponsored retirement plans. Right now we’re focused on

growing what we believe is the most efficient individual investment service. To create

a Betterment 401(k) option requires extensive operational and regulatory manpower -

our resources are currently dedicated to making Betterment the best product it can be.

Please check back with us for updates as we continue to expand our product offering.

Thanks,

Katherine

Katherine Buck.

-

Who is Betterment?

With a decade of experience in finance and as a CFA charterholder, Betterment CEO Jon sought an investment service that would deliver the best possible results and save him time and money. A service to build wealth, yes, but more importantly give him the peace of mind and the time to pursue his career and enjoy other things in life.

But every product he found was time-consuming and thoughtless. Whatever technical innovation he found seemed to benefit traders, but left his professional peers and sophisticated investors no better off than they were two decades ago.

Jon saw an opportunity to make investment management better through the thoughtful application of technology, which could optimize any portfolio, whether $10,000 or $10 million. He assembled an expert team of engineers, quants, and designers, and together they re-imagined what an investing product should be: efficient, accessible, and delightful.

At Betterment, we are creating a world where investing better is accessible to everyone. We have built a financial utility that provides the obvious, smart answer to "What should I do with my money?"

Subscribe to:

Comments (Atom)