Allyson Kazmucha for imore.com writes: FROM FINANCIAL CALCULATORS TO BETTER DOCUMENT HANDLING, THESE ARE THE IPHONE AND IPADS APPS EVERY ACCOUNTANT OR CPA NEEDS!

Looking for the best iPhone apps or best iPad apps for accounts or CPAs? Maybe you need help getting through a barrage of client meetings, or a better system scanning signed copies of documents and storing and retrieving files when on the go. Maybe you need help managing all the passwords for all the different systems and people you cover? Well, the App Store has a ton of apps to help your mobile improve efficiency and overall workflow. But which apps are the absolute best for accountants and CPAs?

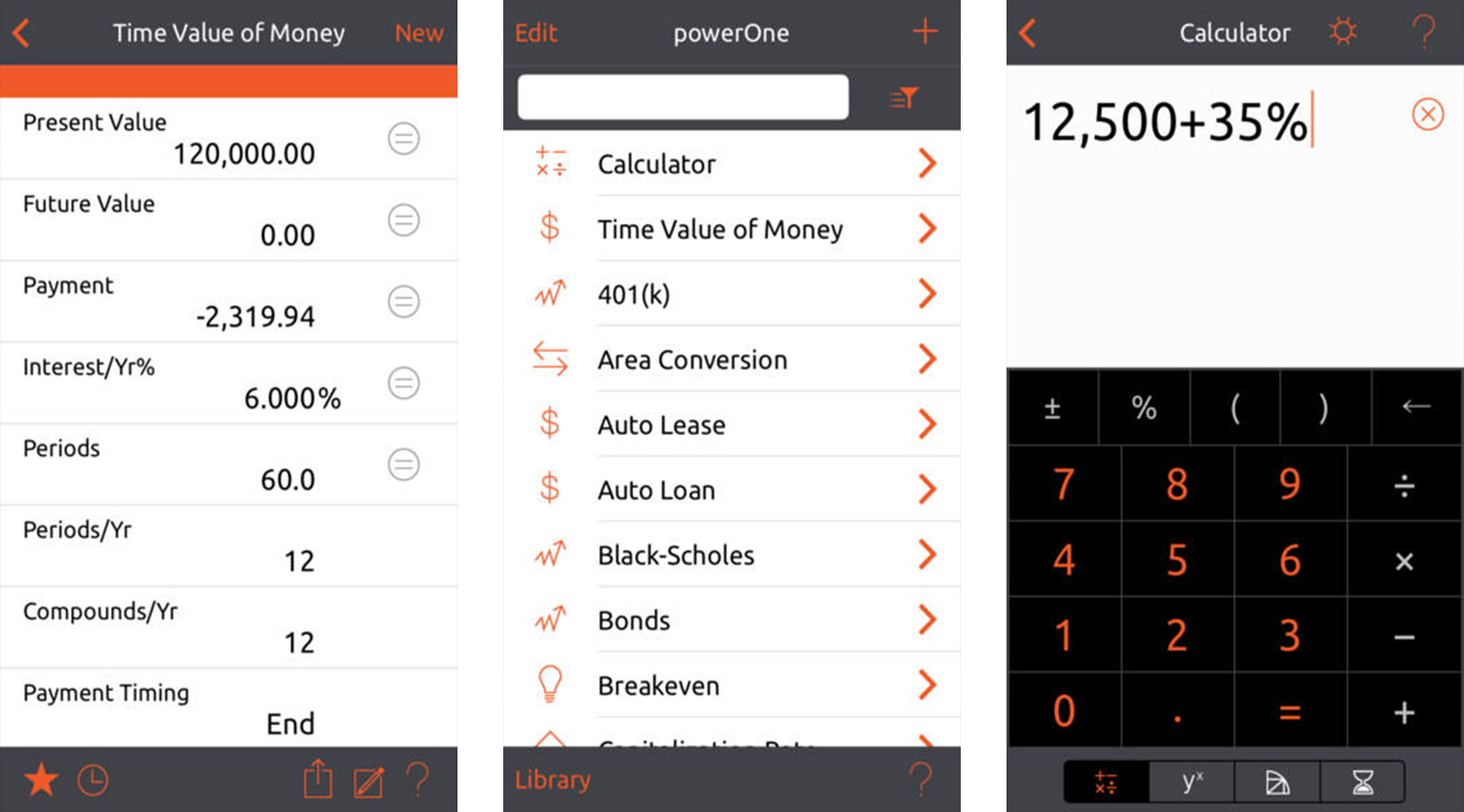

powerOne Finance Pro Calculator

powerOne is a financial calculator that is designed to be used on both the iPhone and iPad. The financial edition of powerOne features many commonly used calculations such as 401k calculations, auto loans and leases, bonds, breakevens, currency conversion, cash flows — NPR, NFV, IRR, and more. If you're calculating an amortization or a loan, powerOne can even show graphs to help visualize information, which is always helpful when explaining something to a client. powerOne also offers many other calculators for professionals including a general business calculator.

If you want a powerful and easy to use financial calculator wherever you go, get powerOne.

- $4.99 - Download Now

See also:

- powerOne Business Calculator - Free - Download Now

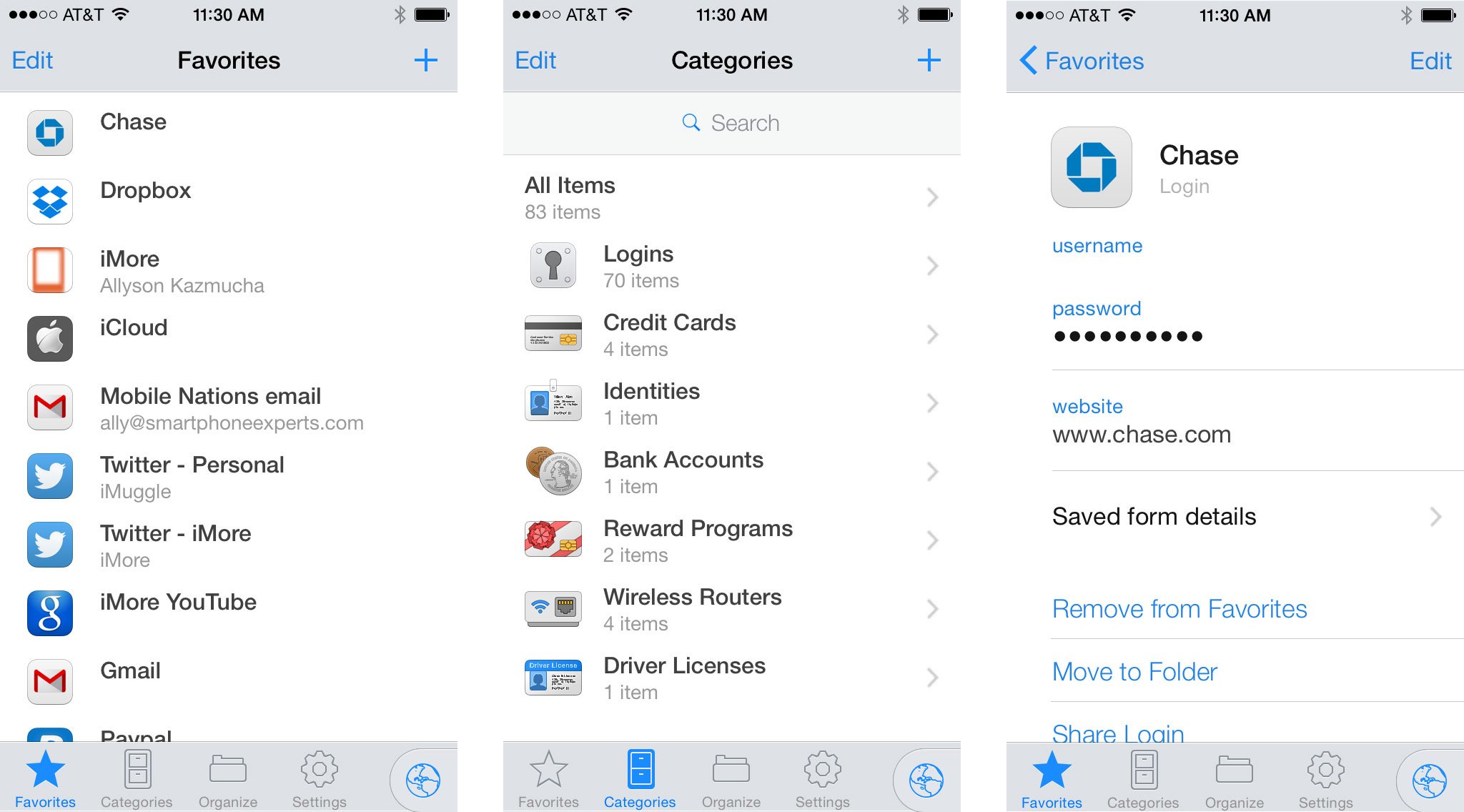

1Password

Accountants typically have a lot of passwords to remember. Everything from client Quickbooks logins to document storage portals to internal systems, it's enough to make anyone's head spin. 1Password is a safe and secure place to store them all without worrying about whether or not they're going to fall in the wrong hands. You only need to remember one master password. 1Password can also help you generate strong passwords so you can rest easy knowing your sensitive information is as secure as possible.

If you need a better way to efficiently manage passwords and keep files secure with strong ones, you need 1Password.

- $8.99 - Download Now

See also:

- 1Password for Mac - $49.99 - Download Now

- 1Password for Windows - $49.99 - Download Now

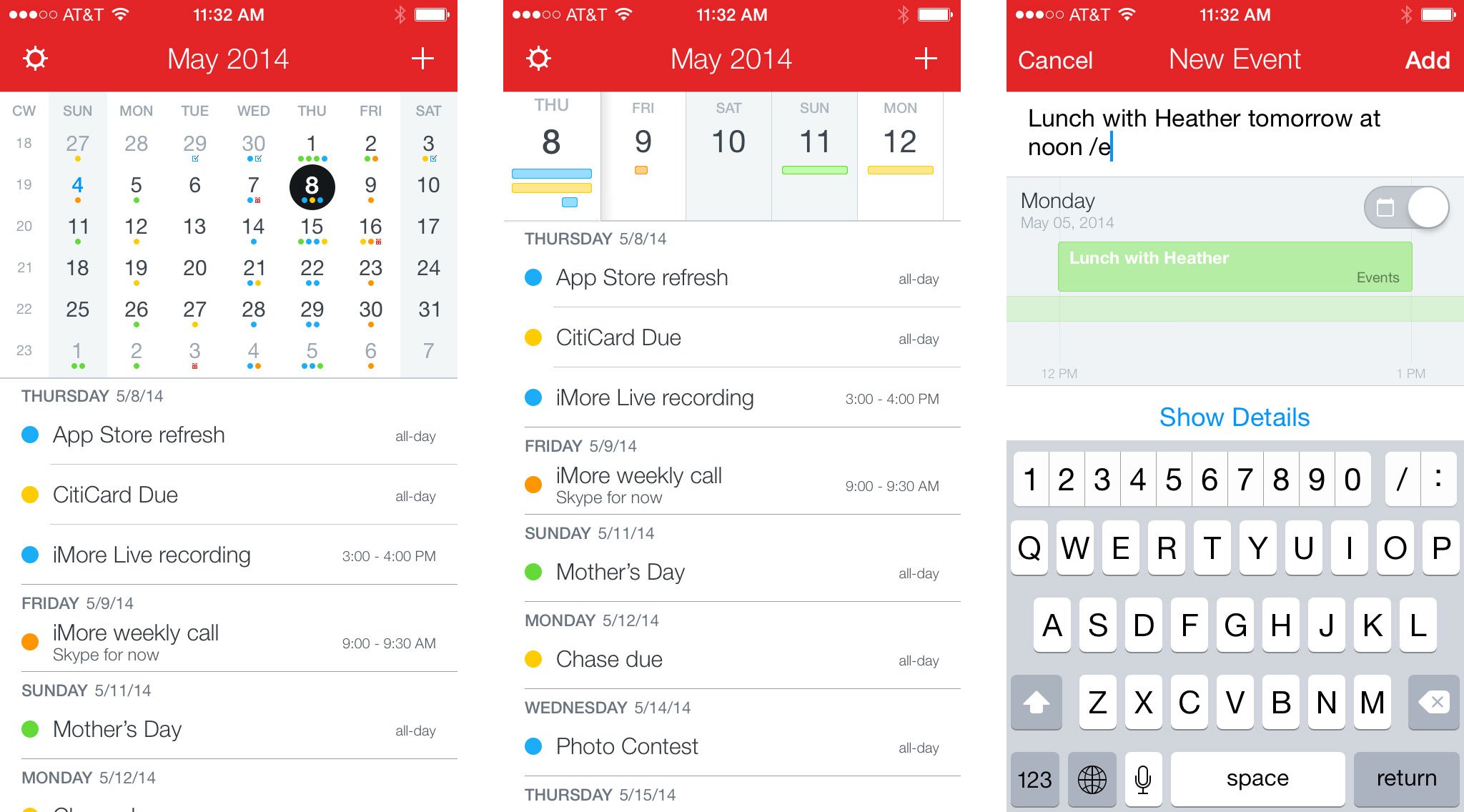

Fantastical 2

When it comes to scheduling appointments and entering events into your calendar, there is no better calendar app for iOS than Fantastical 2. Not only is the interface and layout worlds better than the built-in Calendar app, it combines all your reminders into one app. From natural language support to a personalized keyboard that makes event creation a snap, Fantastical really is worth its weight in gold. Since it pulls everything from your existing calendar, it supports every account type the built-in app supports. Fantastical will even keep built-in apps in case you ever need to use them.

When it comes to managing your appointments, tasks, and events, look no further than Fantastical 2.

- iPhone - $4.99 - Download Now

- iPad - $9.99 - Download Now

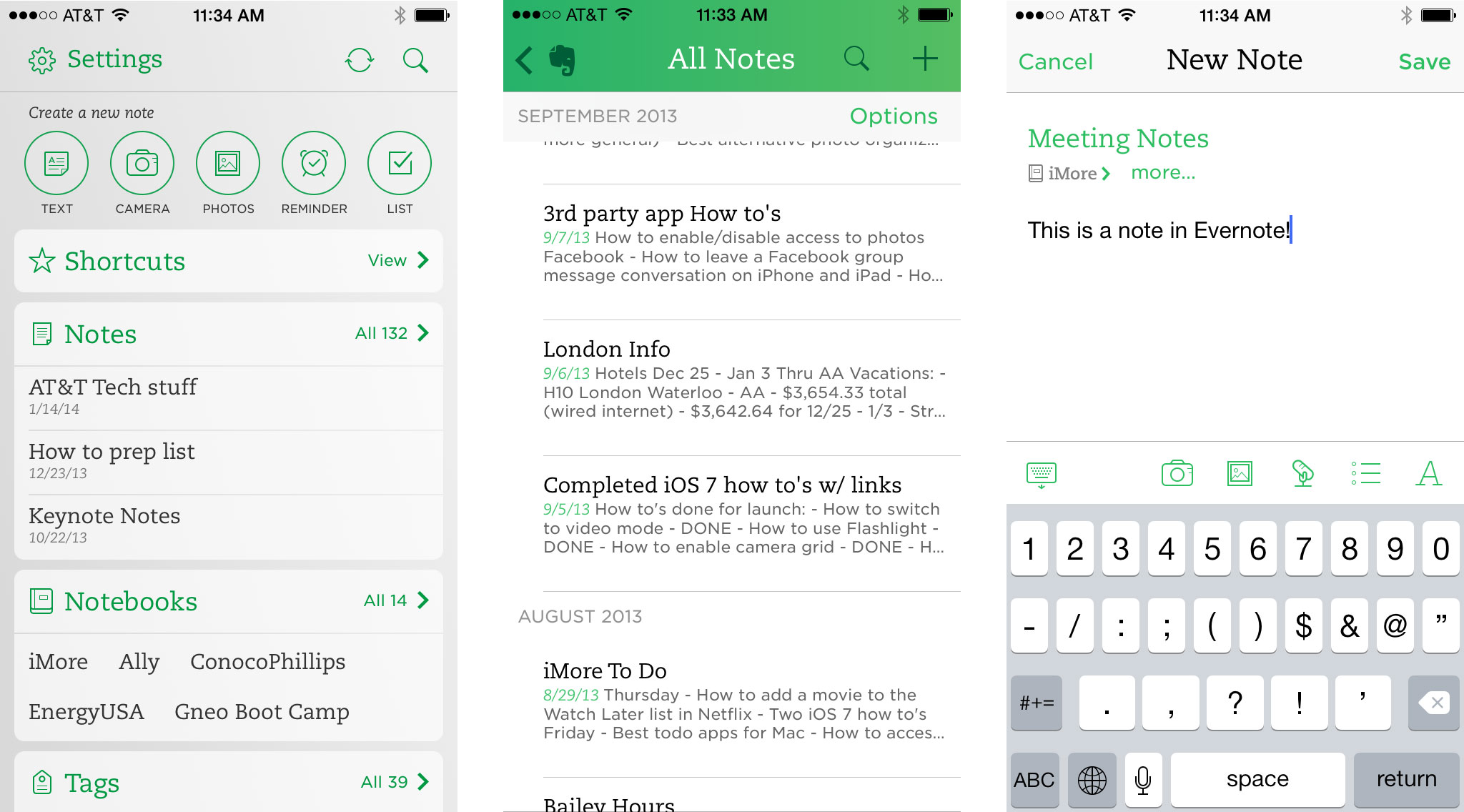

Evernote

Every accountant and CPA needs a way to quickly take and manage notes when in client meetings. Evernote is available for virtually every platform imaginable, including iPhone and iPad, and can seamlessly sync notes between them. Create multiple notebooks to manage different projects or clients effortlessly. Add tags to quickly search for specific notes and more. You can also create checklists for yourself within Evernote as well as add photos, voice notes, and more as attachments.

For meeting notes and organizing your thoughts, check out Evernote.

- Free - Download Now

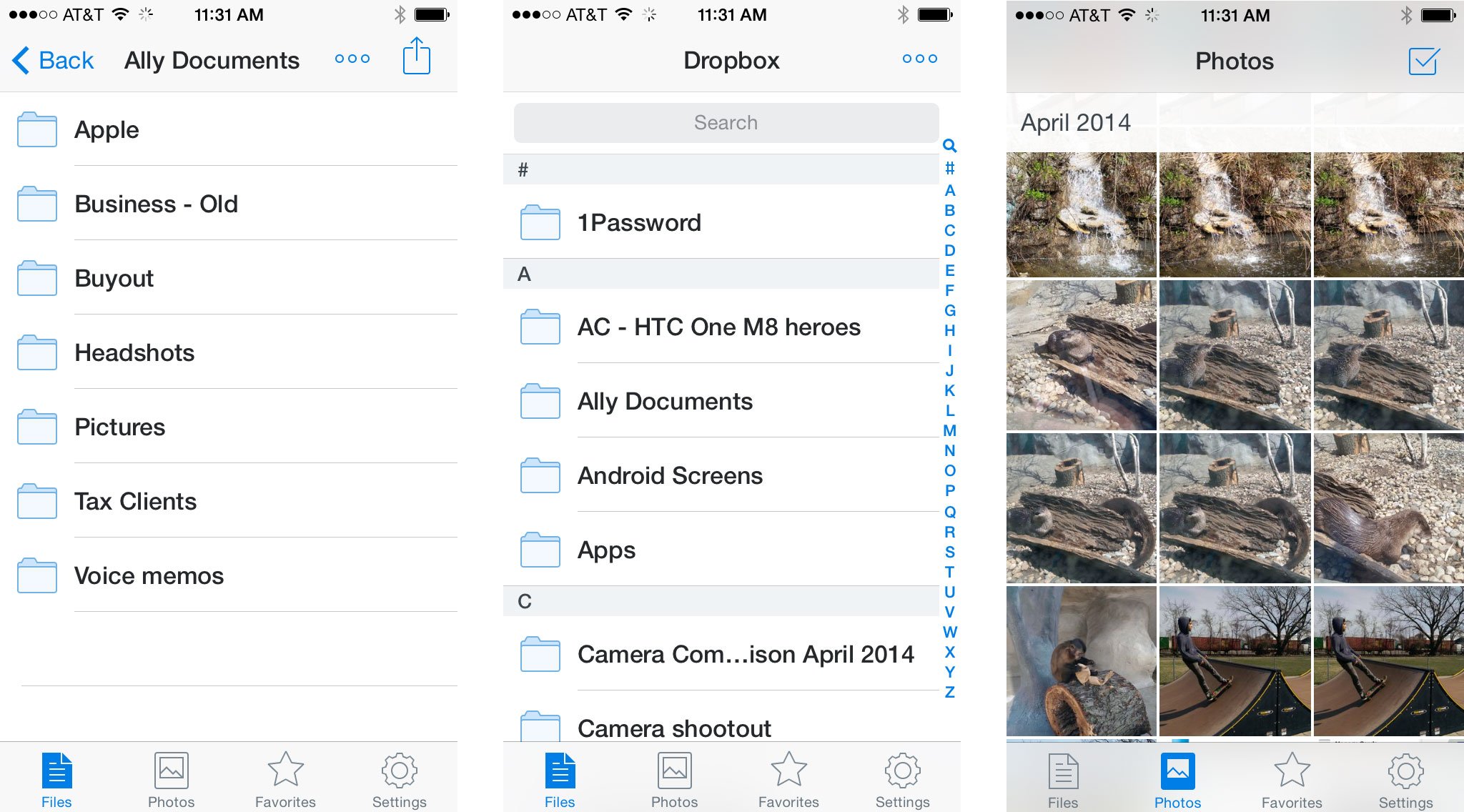

Dropbox

The barrage of paperwork that comes your way may seem endless but there can be a method to the madness, with Dropbox. Create folders for clients, sort your files within it, and then access them from virtually anywhere, including right on your iPhone or iPad. Almost every App Store app that deals with documents supports saving to Dropbox. You can open documents in external apps on your iPhone or iPad right inside Dropbox too. This makes for an almost seamless file management system. Until Apple gives us a better way to manage files, apps like Dropbox will have to do.

To help you manage the endless stream of documents and paperwork, there is Dropbox.

- Free - Download Now

See also:

- Dropbox for Mac and PC - Free - Download Now

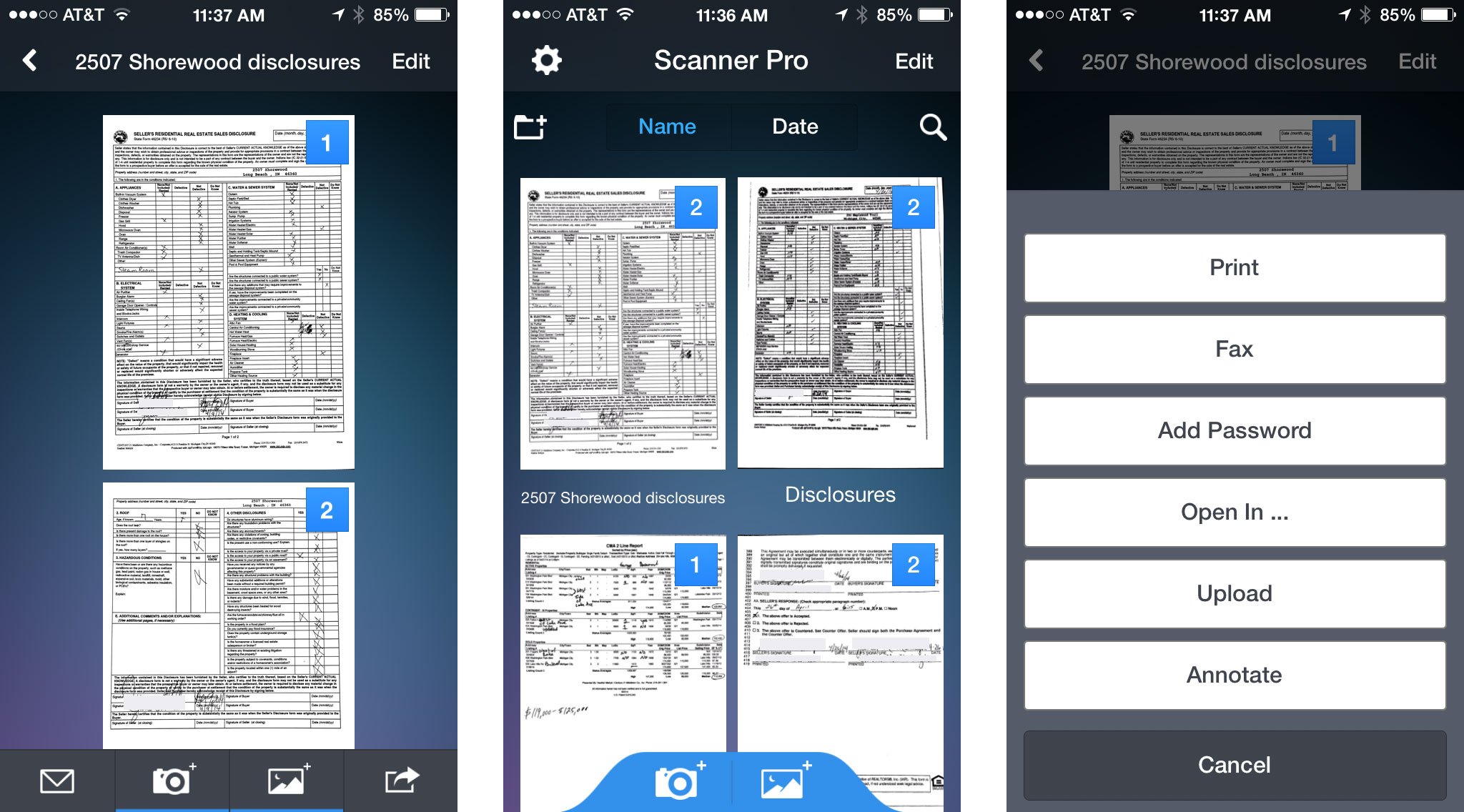

Scanner Pro

A lot of paperwork requires client signatures and other handwritten information to be filled in. Scanner Pro lets you easily take photos of signed documents on your iPhone or iPad. You can then upload them to Dropbox, email them, or share them any other way you could think possible. If you have a newer iPhone or iPad, the images Scanner Pro creates aren't just readable, they're higher quality than most desktop scanners are.

If you need the ability to scan and send documents from virtually anywhere, get Scanner Pro.

- $6.99 - Download Now