for Hubstaff writes: If you’re an entrepreneur, you know that having good accounting is a must for your business. You just have to handle all of those financial transactions, invoices, taxes and get the accounting in order. As it turns out, up until recently, you had to use complicated software in order to do your own accounting.

And then cloud accounting solutions changed everything

Ever since cloud accounting became popular, business owners were relieved to find that they can skip the complicated old accounting software.Cloud accounting solutions are web-based and place heavy emphasis in simplifying your workflow.

Up until recently, there were only two major choices when it comes to cloud accounting software providers, Sage and Quickbooks.

Which cloud accounting application should I choose?

There is great difficulty in choosing just the right provider, considering that there are dozens of them out there. So how can you tellwhich one is best for your business? The unfortunately simple answer: you go out there and try a few and see which one suits you best. There’s just a large part of the selection process that relies on personal preferences, and there is simply no substitute for testing.

To make the testing process easier for you, we will review the top 5 cloud accounting software applications that currently dominate the market. Pick 2 or 3 of these to test and find your match.

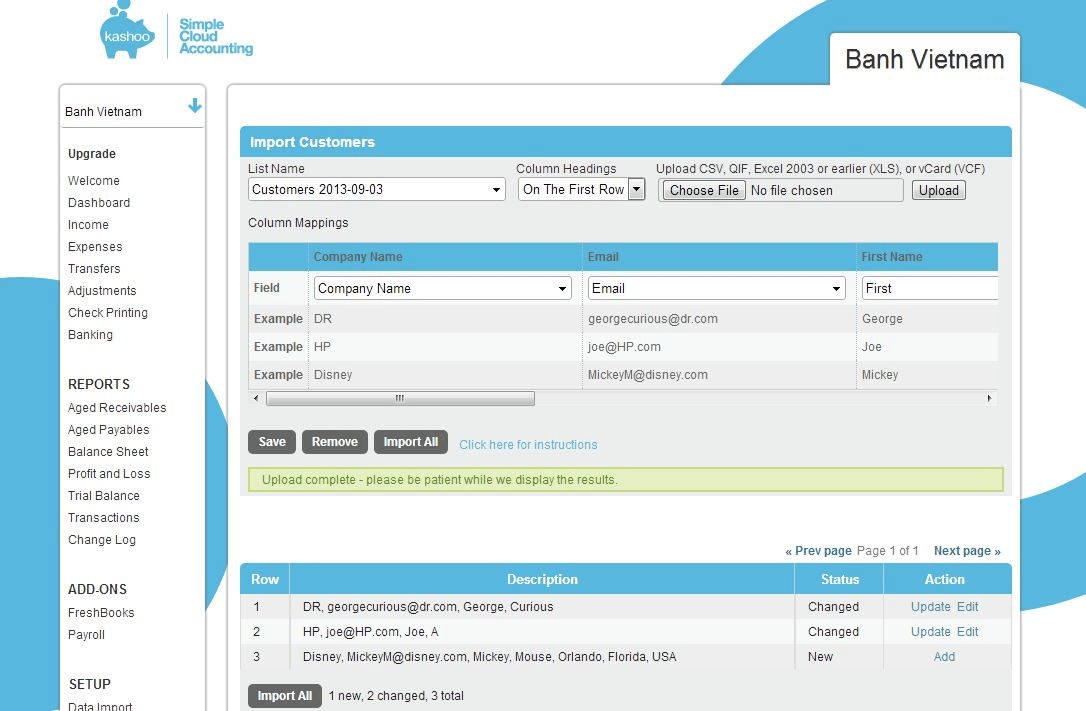

1) Kashoo

Kashoo is rather simple to use; therefore, it is great for beginners. It is especially popular among iPad users since its iPad app is fully featured. With Kashoo, you will be able to automatically import your bank information and the multi-currency facilities should really impress you.

Besides getting access to financial statements, invoices, checks and reports, you also get to use their multi-tax rate feature, which also allows you to download transaction information from any bank, which even includes credit card transactions.

While you don’t get to track complex projects, you do have a lot of other advantages with Kashoo, such as quick entry and simple invoicing. Find out how your business is doing right away with the help of instant financial reports. Unfortunately, they don’t have any iPhone or Android apps right now.

You can try Kashoo for free for one month and then continue paying $20 a month in order to continue using it.

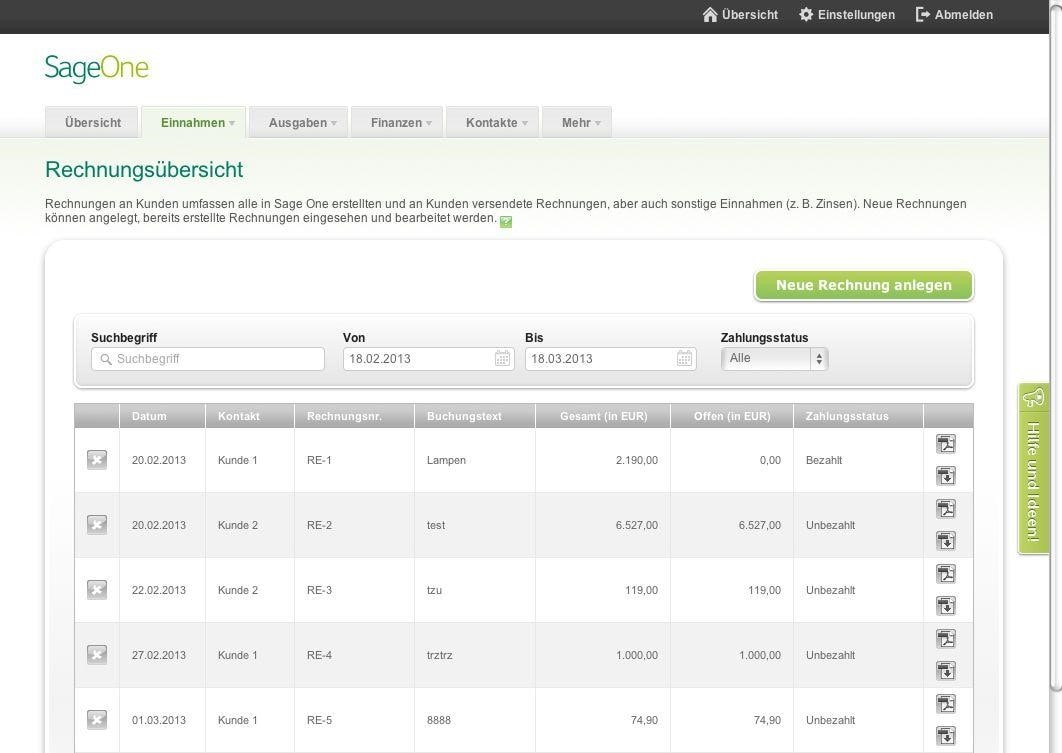

2) Sage One

The best thing about this service is probably the fact that one doesn’t need any accounting knowledge in order to use it. It features a very simple accounting system and is therefore perfectly suited for small businesses or freelancers.

Another great advantage of Sage One is that you get to create and manage tasks. It also lets you track projects and collaborate with teams and customers.

While it is great for small businesses, startups and freelancers, it will not suit larger companies that have a greater number of employees. There is also no support for foreign currency transactions or stock control.

It starts at $9 a month depending on the features and benefits that you need. You can try it for free without having to use a credit card.

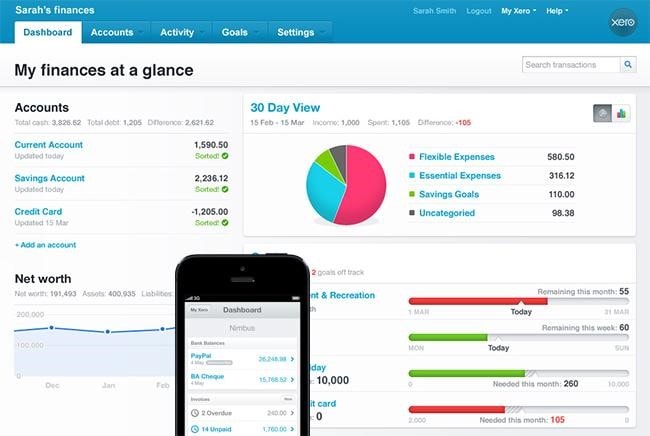

3) Xero (Hubstaff uses Xero and we love it)

Are you a small business owner that wants to save on time spent in accounting? Then this is the accounting solution for you, since it can manage simple accounting tasks such as invoices, general ledgers, customer payments and much more.

It records your bank account information daily, so you don’t have to it manually.

Xero lets you use multiple currencies and tax rates, integrate various business applications and enjoy its beautiful interface.

While Xero does provide some of the most basic accounting tools, it does not provide more advanced tools such as time tracking. You will need to add other tools to your workflow in order to turn this into a complete business application.

You can try Xero for free; when the trial ends, you can choose a monthly plan, starting from 20$ a month.

4) FreshBooks

FreshBooks is a great accounting tool for small businesses since it can be used for managing expenditures, invoicing, time tracking and other basic accounting calculations. The interface is very simple and easy to use, which makes it perfect for small business owners and freelancers.

Online invoicing is probably the best part about FreshBooks, since it is easy to use and features basic accounting tools. Since it’s not considered a full accounting solution, you are able to add on products that bring it closer to a full accounting solution.

The reason why FreshBooks isn’t suited for big companies is the fact that it cannot cope with a large inventory. Another con is that you cannot distribute payments across multiple invoices with FreshBooks.

You can use the product for free for as long as you want; the payment packages start at 20$ a month.

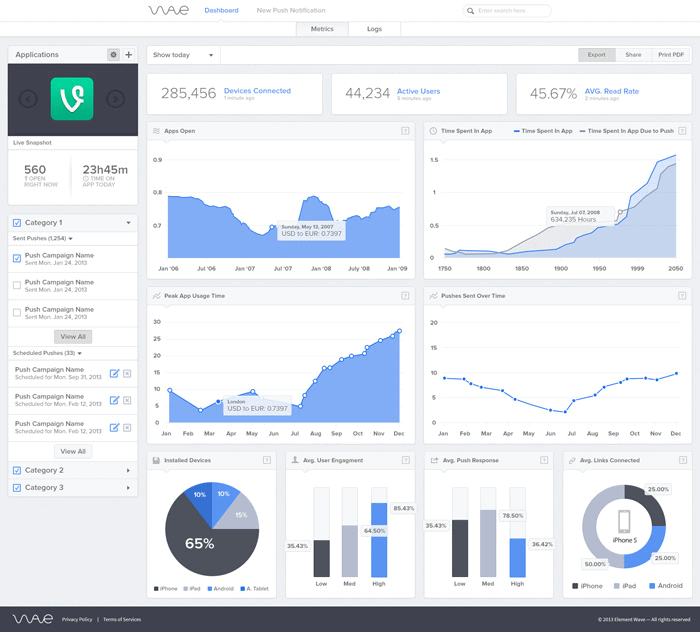

5) Wave

Wave accounting is a free cloud based accounting software solution which automatically backs up your data. For a fee, Wave lets you handle credit card payments with the invoices. Besides accounting and invoicing, Wave features an affordable payroll solution as well.

This application is simple to use and anyone can learn to use it fairly quickly. Wave also saves you a lot of time when it comes to financial transactions since everything is automated. And unlike many other accounting applications, Wave supports multi-currency transactions.

Since Wave is free, some might find the ads that come up quite irritating. You cannot import your existing contact list into your account and there are limitations when it comes to invoice templates.

Making the final decision

Figure out what kind of software you need based on the type of business you run. As you can see, all of these applications are best suited for small businesses, freelancers and startups.

Ask yourself some questions:

- Are your projects complex or simple?

- Will you need multi-currency facilities?

- Is it important for you to access accounting info on all of your devices?

- Will you need to track projects and collaborate with teams/customers?

- Do you need additional features such as time tracking?

- Do you need to distribute payment across multiple invoices?

- What about credit card payments and a payroll?

In order to make the final choice, you need to rank the importance of these various features so that you can see which application suits you best. [end]

The author Dave Nevogt is the co-founder of Hubstaff and manages a team of 15+ contractors and developers on a daily basis.Dave has a deep understanding of what it takes to increase productivity and specializes in management of remote teams.You can get his free training on outsourcing and remote management.